Question: PLEASE HELP ME ANSWER ALL! THEY ARE FORMED AS SUBQUESTIONS AND I CANNOT MOVE ON WITHOUT ANSWERING ALL!!! Which of the following should be the

PLEASE HELP ME ANSWER ALL! THEY ARE FORMED AS SUBQUESTIONS AND I CANNOT MOVE ON WITHOUT ANSWERING ALL!!!

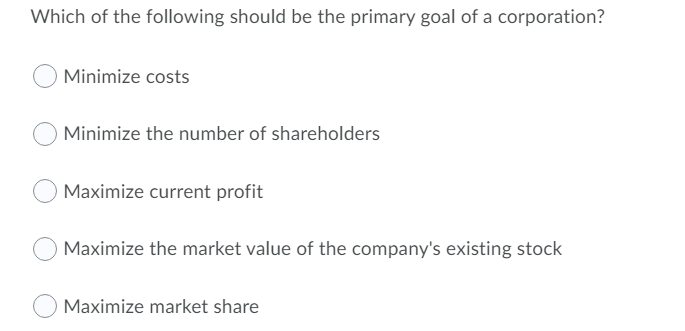

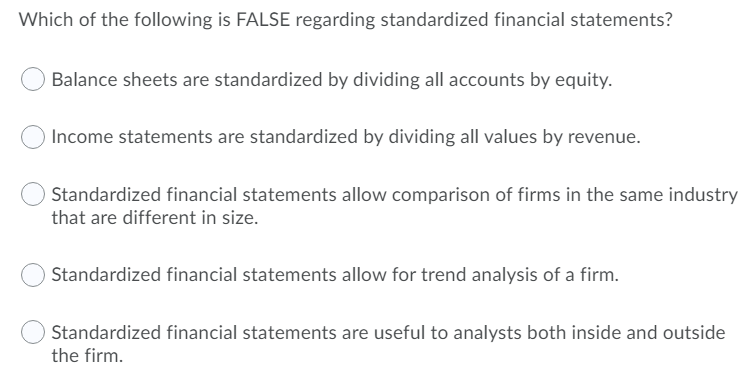

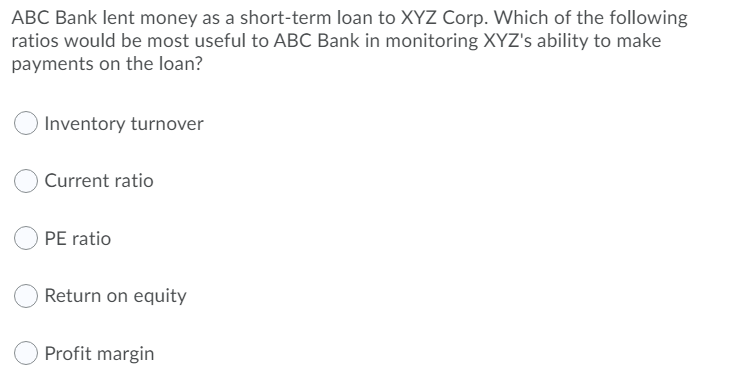

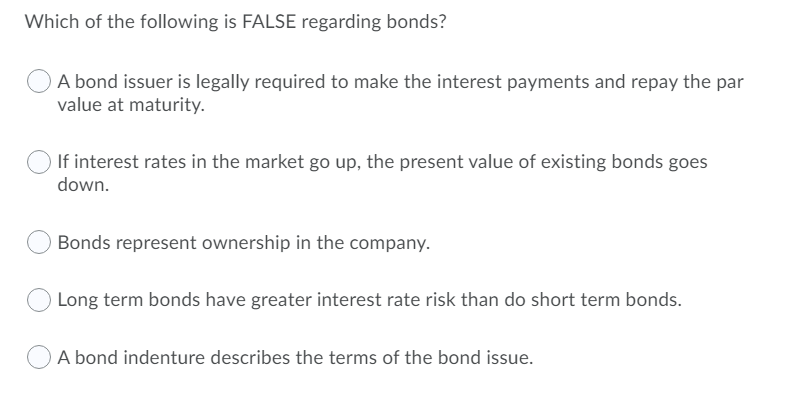

Which of the following should be the primary goal of a corporation? Minimize costs Minimize the number of shareholders Maximize current profit Maximize the market value of the company's existing stock Maximize market share Which of the following is FALSE regarding standardized financial statements? Balance sheets are standardized by dividing all accounts by equity. Income statements are standardized by dividing all values by revenue. Standardized financial statements allow comparison of firms in the same industry that are different in size. Standardized financial statements allow for trend analysis of a firm. Standardized financial statements are useful to analysts both inside and outside the firm. ABC Bank lent money as a short-term loan to XYZ Corp. Which of the following ratios would be most useful to ABC Bank in monitoring XYZ's ability to make payments on the loan? Inventory turnover Current ratio PE ratio Return on equity Profit margin Which of the following is FALSE regarding bonds? A bond issuer is legally required to make the interest payments and repay the par value at maturity. If interest rates in the market go up, the present value of existing bonds goes down. Bonds represent ownership in the company. Long term bonds have greater interest rate risk than do short term bonds. A bond indenture describes the terms of the bond issue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts