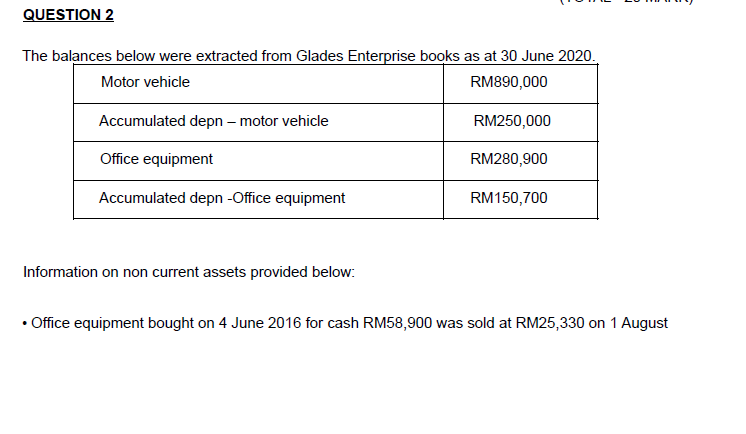

Question: Please help me answer i will give good rating QUESTION 2 The balances below were extracted from Glades Enterprise books as at 30 June 2020.

Please help me answer i will give good rating

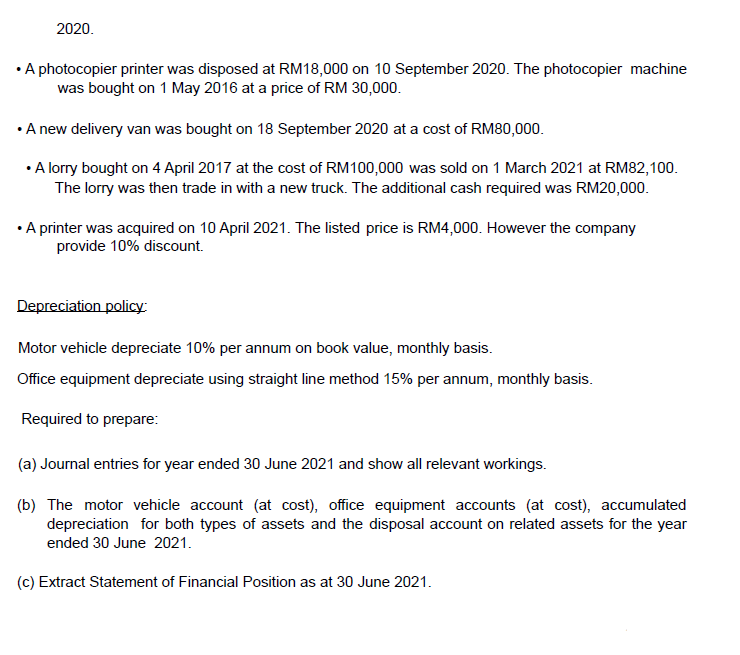

QUESTION 2 The balances below were extracted from Glades Enterprise books as at 30 June 2020. Motor vehicle RM890,000 Accumulated depn - motor vehicle RM250,000 Office equipment RM280,900 Accumulated depn-Office equipment RM150,700 Information on non current assets provided below: Office equipment bought on 4 June 2016 for cash RM58,900 was sold at RM25,330 on 1 August 2020. A photocopier printer was disposed at RM18,000 on 10 September 2020. The photocopier machine was bought on 1 May 2016 at a price of RM 30,000. A new delivery van was bought on 18 September 2020 at a cost of RM80,000. A lorry bought on 4 April 2017 at the cost of RM100,000 was sold on 1 March 2021 at RM82,100. The lorry was then trade in with a new truck. The additional cash required was RM20,000. A printer was acquired on 10 April 2021. The listed price is RM4,000. However the company provide 10% discount Depreciation policy Motor vehicle depreciate 10% per annum on book value, monthly basis. Office equipment depreciate using straight line method 15% per annum, monthly basis. Required to prepare: (a) Journal entries for year ended 30 June 2021 and show all relevant workings. (b) The motor vehicle account (at cost), office equipment accounts (at cost), accumulated depreciation for both types of assets and the disposal account on related assets for the year ended 30 June 2021. (c) Extract Statement of Financial Position as at 30 June 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts