Question: Please help me answer it in 60mins, and I will vote up, thank you very much. If a country chooses to have a pure float

Please help me answer it in 60mins, and I will vote up, thank you very much.

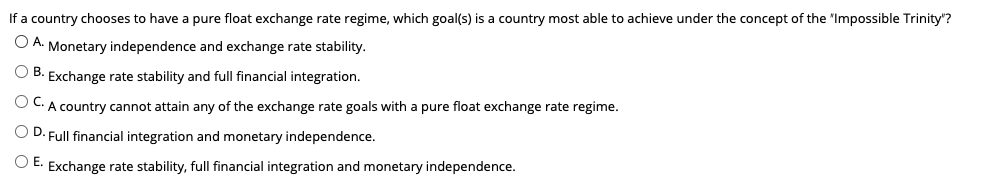

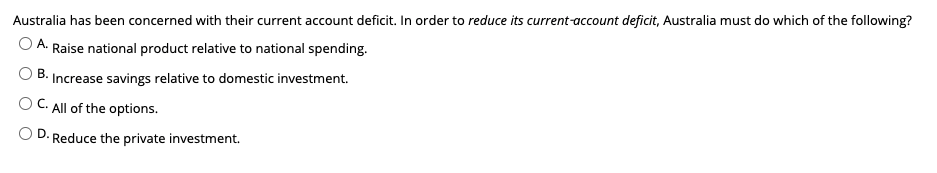

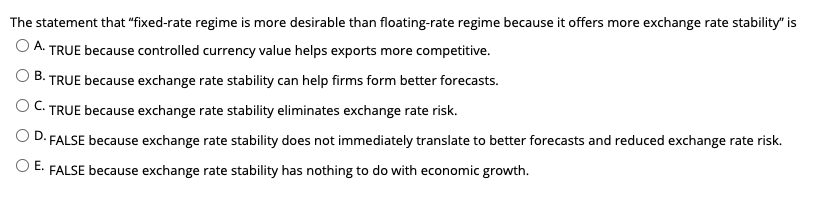

If a country chooses to have a pure float exchange rate regime, which goal(s) is a country most able to achieve under the concept of the "Impossible Trinity'? O A. Monetary independence and exchange rate stability. O B. Exchange rate stability and full financial integration. OC. A country cannot attain any of the exchange rate goals with a pure float exchange rate regime. OD. Full financial integration and monetary independence. O E. Exchange rate stability, full financial integration and monetary independence. Australia has been concerned with their current account deficit. In order to reduce its current account deficit, Australia must do which of the following? A. Raise national product relative to national spending. OB. Increase savings relative to domestic investment. OC. All of the options. D Reduce the private investment. The statement that "fixed-rate regime is more desirable than floating-rate regime because it offers more exchange rate stability" is O A. TRUE because controlled currency value helps exports more competitive. B. TRUE because exchange rate stability can help firms form better forecasts. OC. TRUE because exchange rate stability eliminates exchange rate risk. D. FALSE because exchange rate stability does not immediately translate to better forecasts and reduced exchange rate risk. OE. FALSE because exchange rate stability has nothing to do with economic growth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts