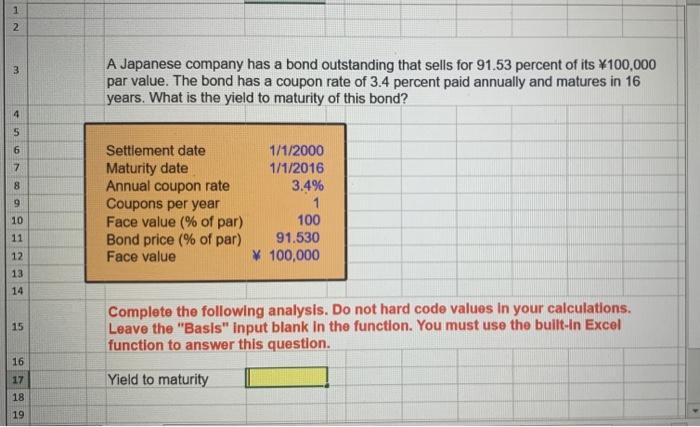

Question: please help me. answer needs to be in an excel formula. 1 m2 3 456 7 8 9 10 11 12 13 14 15 16

1 m2 3 456 7 8 9 10 11 12 13 14 15 16 199 17 18 A Japanese company has a bond outstanding that sells for 91.53 percent of its 100,000 par value. The bond has a coupon rate of 3.4 percent paid annually and matures in 16 years. What is the yield to maturity of this bond? 1/1/2000 Settlement date Maturity date 1/1/2016 Annual coupon rate 3.4% Coupons per year 1 Face value (% of par) 100 91.530 Bond price (% of par) Face value * 100,000 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. Yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts