Question: please help me answer part A2 and make sure the answer is correct please. thank you so much!! Wilson Blossom is a leading producer of

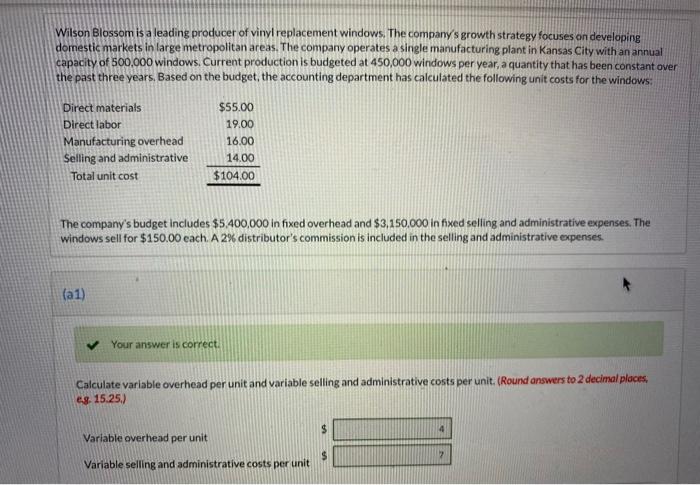

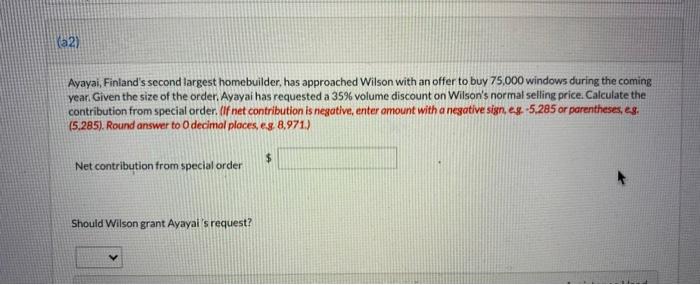

Wilson Blossom is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows Direct materials Direct labor Manufacturing overhead Selling and administrative Total unit cost $55.00 19.00 16.00 14.00 $104.00 The company's budget Includes $5,400,000 in fixed overhead and $3,150,000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. (21) Your answer is correct Calculate variable overhead per unit and variable selling and administrative costs per unit. (Round answers to 2 decimal places, es. 15.25.) Variable overhead per unit VA 2 Variable selling and administrative costs per unit (a2) Ayayai, Finland's second largest homebuilder, has approached Wilson with an offer to buy 75,000 windows during the coming year. Given the size of the order. Ayayai has requested a 35% volume discount on Wilson's normal selling price. Calculate the contribution from special order. (If net contribution is negative, enter amount with a negative sign, es -5,285 or parentheses, eg. (5.285). Round answer to O decimal places, eg 8,971.) $ Net contribution from special order Should Wilson grant Ayayal's request

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts