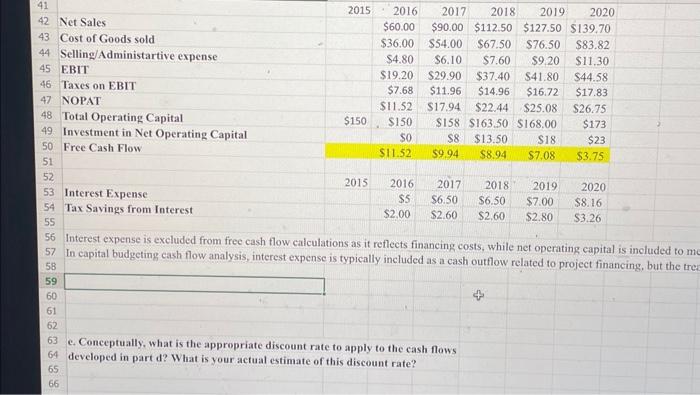

Question: Please help me answer part e Interest expense is excluded from free cash flow calculations as it reflects financing costs, while net operating capital is

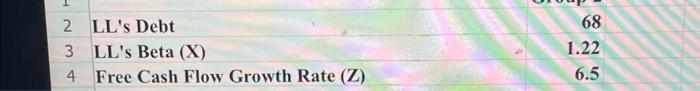

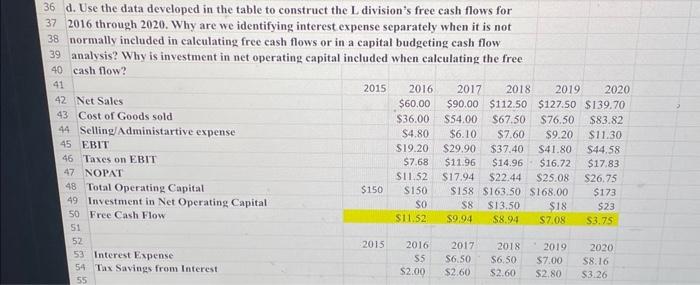

Interest expense is excluded from free cash flow calculations as it reflects financing costs, while net operating capital is included to n In capital budgeting cash flow analysis, interest expense is typically included as a cash outflow related to project financing, but the tre e. Conceptually, what is the appropriate discount rate to apply to the cash flows developed in part d? What is your actual estimate of this discount rate? 2 LL's Debt 68 3 LL's Beta (X) 1.22 4 Free Cash Flow Growth Rate (Z) 6.5 d. Use the data developed in the table to construct the L division's free cash flows for 2016 through 2020 . Why are we identifying interest expense separately when it is not normally included in calculating free cash flows or in a capital budgeting cash flow analysis? Why is investment in net operating capital included when calculating the free 40 cash flow? Interest expense is excluded from free cash flow calculations as it reflects financing costs, while net operating capital is included to n In capital budgeting cash flow analysis, interest expense is typically included as a cash outflow related to project financing, but the tre e. Conceptually, what is the appropriate discount rate to apply to the cash flows developed in part d? What is your actual estimate of this discount rate? 2 LL's Debt 68 3 LL's Beta (X) 1.22 4 Free Cash Flow Growth Rate (Z) 6.5 d. Use the data developed in the table to construct the L division's free cash flows for 2016 through 2020 . Why are we identifying interest expense separately when it is not normally included in calculating free cash flows or in a capital budgeting cash flow analysis? Why is investment in net operating capital included when calculating the free 40 cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts