Question: Please help me answer Please help me solve Question 10, Problem 8-22 Part 1 of 4 HW Score: 4.67%, 3.5 of 75 points O Points:

Please help me answer

Please help me solve

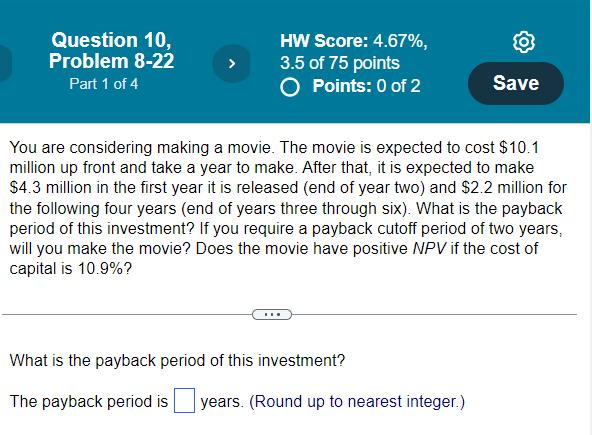

Question 10, Problem 8-22 Part 1 of 4 HW Score: 4.67%, 3.5 of 75 points O Points: 0 of 2 Save You are considering making a movie. The movie is expected to cost $10.1 million up front and take a year to make. After that, it is expected to make $4.3 million in the first year it is released (end of year two) and $2.2 million for the following four years (end of years three through six). What is the payback period of this investment? If you require a payback cutoff period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.9%? What is the payback period of this investment? The payback period is years. (Round up to nearest integer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts