Question: Please help me answer question #1 and #3 with detail by answering and giving the ratios required and the inventory ratios. Principles of Finance Pl

Please help me answer question #1 and #3 with detail by answering and giving the ratios required and the inventory ratios.

Principles of Finance

Pl

Pl

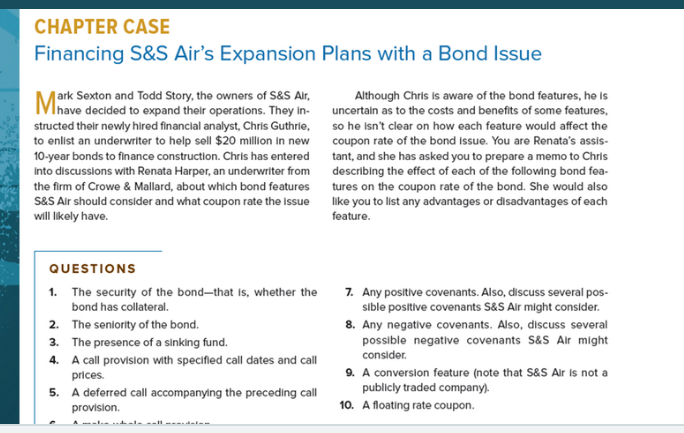

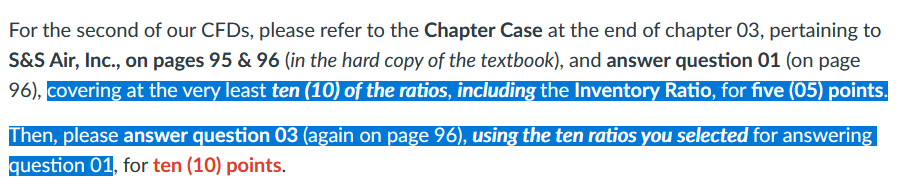

CHAPTER CASE Financing S&S Air's Expansion Plans with a Bond Issue to ark Sexton and Todd Story, the owners of S&S Air, Although Chris is aware of the bond features, he is structed their newly hired financial analyst, Chris Guthrie, so he isn't clear on how each feature would affect the to enlist an underwriter to help sell $20 million in new coupon rate of the bond issue. You are Renata's assis- 10-year bonds to finance construction. Chris has entered tant, and she has asked you to prepare a memo to Chris Into discussions with Renata Harper, an underwriter from describing the effect of each of the following bond fea- the firm of Crowe & Mallard, about which bond features tures on the coupon rate of the bond. She would also S&S Air should consider and what coupon rate the issue like you to list any advantages or disadvantages of each will likely have. feature. QUESTIONS 1. The security of the bondthat is, whether the bond has collateral. 2. The seniority of the bond. 3. The presence of a sinking fund. 4. A call provision with specified call dates and call prices. 5. A deferred call accompanying the preceding call provision 7. Any positive covenants. Also, discuss several pos- sible positive covenants S&S Air might consider. 8. Any negative covenants. Also, discuss several possible negative covenants S&S Air might consider 9. A conversion feature (note that S&S Air is not a publicly traded company). 10. A floating rate coupon. For the second of our CFDs, please refer to the Chapter Case at the end of chapter 03, pertaining to S&S Air, Inc., on pages 95 & 96 (in the hard copy of the textbook), and answer question 01 (on page 96), covering at the very least ten (10) of the ratios, including the Inventory Ratio, for five (05) points. Then, please answer question 03 (again on page 96), using the ten ratios you selected for answering question 01, for ten (10) points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts