Question: Please help me answer question 1,2,3, and 4. Case 8. Horniman Horticulture 1. Read and briefly summarize the case. 2. Based on the information presented

Please help me answer question 1,2,3, and 4.

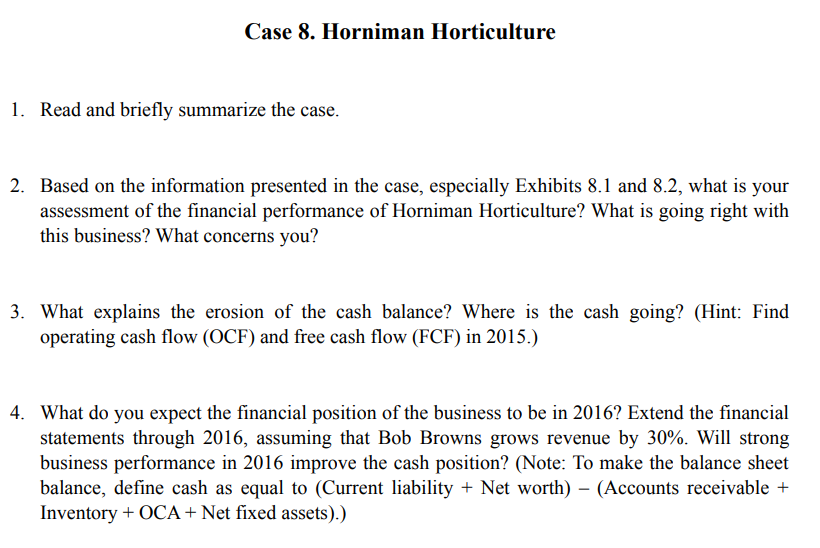

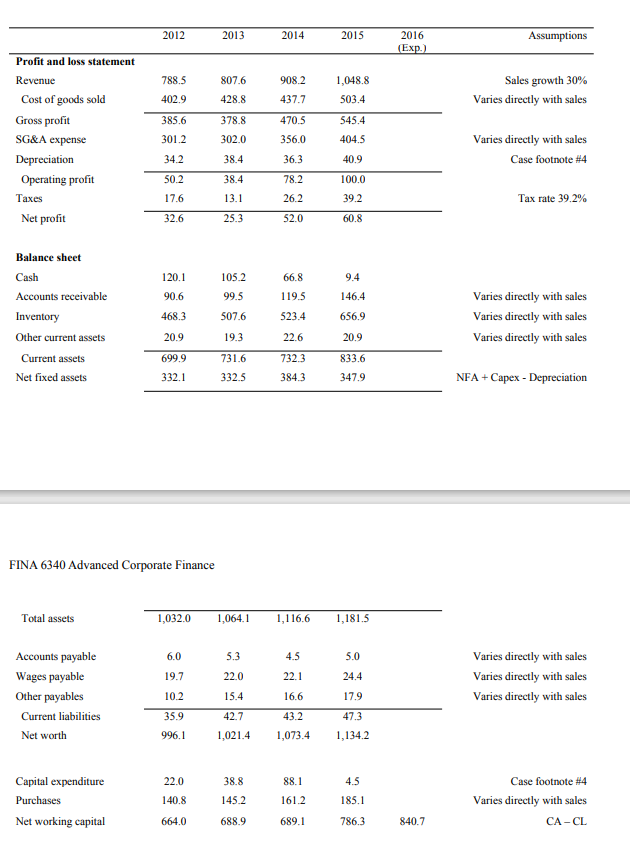

Case 8. Horniman Horticulture 1. Read and briefly summarize the case. 2. Based on the information presented in the case, especially Exhibits 8.1 and 8.2, what is your assessment of the financial performance of Horniman Horticulture? What is going right with this business? What concerns you? 3. What explains the erosion of the cash balance? Where is the cash going? (Hint: Find operating cash flow (OCF) and free cash flow (FCF) in 2015.) 4. What do you expect the financial position of the business to be in 2016? Extend the financial statements through 2016, assuming that Bob Browns grows revenue by 30%. Will strong business performance in 2016 improve the cash position? (Note: To make the balance sheet balance, define cash as equal to (Current liability + Net worth) - (Accounts receivable + Inventory + OCA + Net fixed assets).) 2012 2013 2014 2015 2016 (Exp.) Assumptions 788.5 908.2 807.6 428.8 1,048.8 503.4 Sales growth 30% Varies directly with sales 402.9 437.7 385.6 378.8 470.5 545.4 Profit and loss statement Revenue Cost of goods sold Gross profit SG&A expense Depreciation Operating profit Taxes Net profit 301.2 302.0 404.5 356.0 36.3 Varies directly with sales Case footnote #4 34.2 38.4 40.9 50.2 38.4 78.2 100.0 17.6 13.1 26.2 39.2 Tax rate 39.2% 32.6 25.3 52.0 60.8 Balance sheet Cash 120.1 105.2 66.8 9.4 90.6 99.5 119.5 146,4 468.3 507.6 523.4 656.9 Accounts receivable Inventory Other current assets Current assets Net fixed assets Varies directly with sales Varies directly with sales Varies directly with sales 20.9 19.3 22.6 20.9 732.3 833.6 699.9 332.1 731.6 3325 384.3 347.9 NFA + Capex - Depreciation FINA 6340 Advanced Corporate Finance Total assets 1,032.0 1,064.1 1,116.6 1,181.5 6.0 5.3 4.5 5.0 19.7 22.0 22.1 24.4 Accounts payable Wages payable Other payables Current liabilities Net worth Varies directly with sales Varies directly with sales Varies directly with sales 10.2 15.4 16.6 17.9 35.9 42.7 43.2 47.3 996.1 1,021.4 1,073.4 1,134.2 22.0 38.8 88.1 4.5 Capital expenditure Purchases Net working capital 140.8 145.2 161.2 185.1 Case footnote #4 Varies directly with sales CA-CL 664.0 688.9 689.1 786.3 840.7 Case 8. Horniman Horticulture 1. Read and briefly summarize the case. 2. Based on the information presented in the case, especially Exhibits 8.1 and 8.2, what is your assessment of the financial performance of Horniman Horticulture? What is going right with this business? What concerns you? 3. What explains the erosion of the cash balance? Where is the cash going? (Hint: Find operating cash flow (OCF) and free cash flow (FCF) in 2015.) 4. What do you expect the financial position of the business to be in 2016? Extend the financial statements through 2016, assuming that Bob Browns grows revenue by 30%. Will strong business performance in 2016 improve the cash position? (Note: To make the balance sheet balance, define cash as equal to (Current liability + Net worth) - (Accounts receivable + Inventory + OCA + Net fixed assets).) 2012 2013 2014 2015 2016 (Exp.) Assumptions 788.5 908.2 807.6 428.8 1,048.8 503.4 Sales growth 30% Varies directly with sales 402.9 437.7 385.6 378.8 470.5 545.4 Profit and loss statement Revenue Cost of goods sold Gross profit SG&A expense Depreciation Operating profit Taxes Net profit 301.2 302.0 404.5 356.0 36.3 Varies directly with sales Case footnote #4 34.2 38.4 40.9 50.2 38.4 78.2 100.0 17.6 13.1 26.2 39.2 Tax rate 39.2% 32.6 25.3 52.0 60.8 Balance sheet Cash 120.1 105.2 66.8 9.4 90.6 99.5 119.5 146,4 468.3 507.6 523.4 656.9 Accounts receivable Inventory Other current assets Current assets Net fixed assets Varies directly with sales Varies directly with sales Varies directly with sales 20.9 19.3 22.6 20.9 732.3 833.6 699.9 332.1 731.6 3325 384.3 347.9 NFA + Capex - Depreciation FINA 6340 Advanced Corporate Finance Total assets 1,032.0 1,064.1 1,116.6 1,181.5 6.0 5.3 4.5 5.0 19.7 22.0 22.1 24.4 Accounts payable Wages payable Other payables Current liabilities Net worth Varies directly with sales Varies directly with sales Varies directly with sales 10.2 15.4 16.6 17.9 35.9 42.7 43.2 47.3 996.1 1,021.4 1,073.4 1,134.2 22.0 38.8 88.1 4.5 Capital expenditure Purchases Net working capital 140.8 145.2 161.2 185.1 Case footnote #4 Varies directly with sales CA-CL 664.0 688.9 689.1 786.3 840.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts