Question: PLEASE HELP ME ANSWER QUESTION 5 THROUGH 8!! Thanks in advance!! The most recent financial statements for Williamson, Inc., are shown here (assuming no income

PLEASE HELP ME ANSWER QUESTION 5 THROUGH 8!! Thanks in advance!!

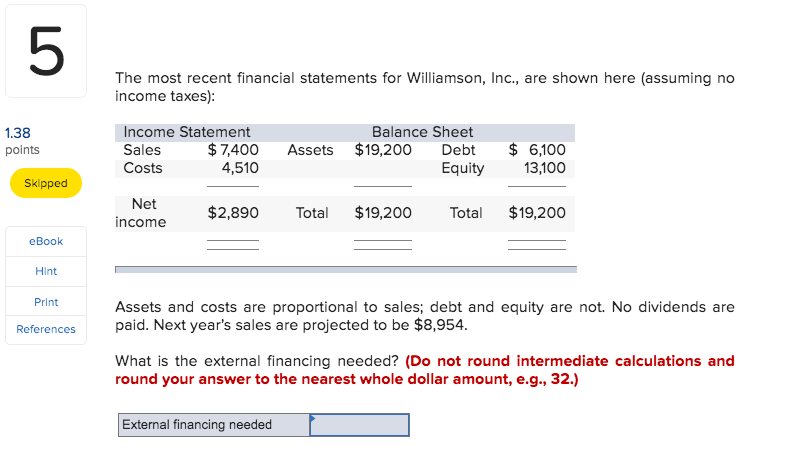

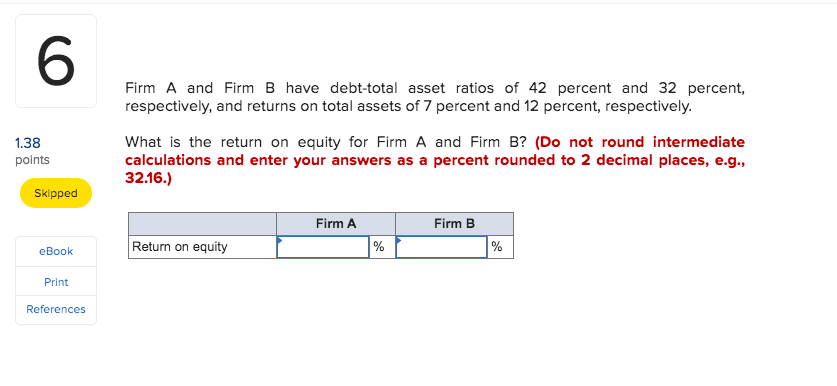

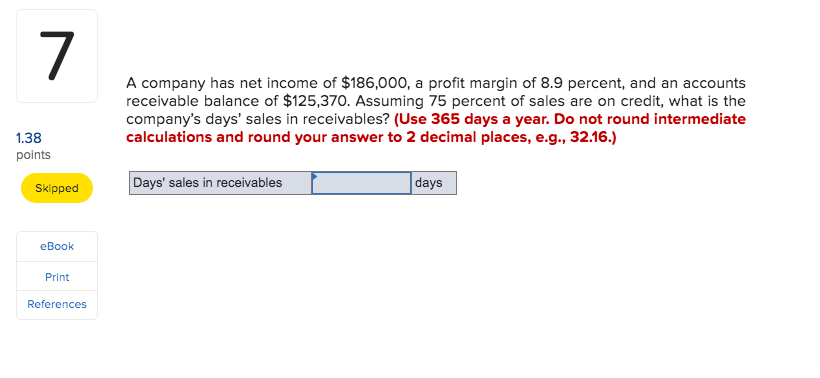

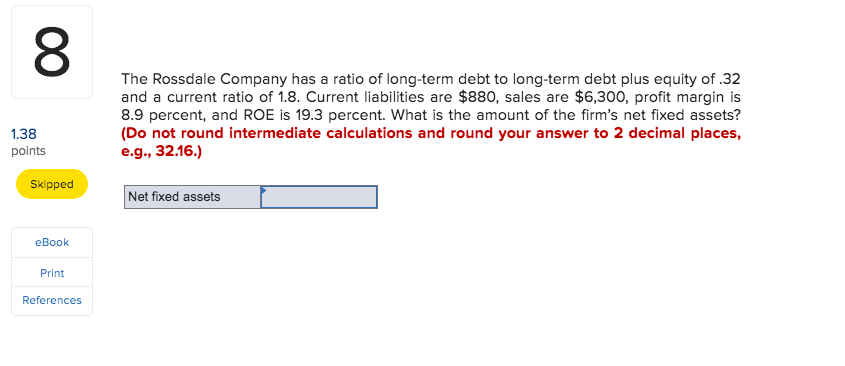

The most recent financial statements for Williamson, Inc., are shown here (assuming no income taxes): 1.38 points Income Statement Sales $ 7,400 Costs 4,510 Assets Balance Sheet $19,200 Debt Equity $ 6,100 13,100 Skipped Net income $2,890 Total $19,200 Total $19,200 eBook Hint Print Assets and costs are proportional to sales; debt and equity are not. No dividends are paid. Next year's sales are projected to be $8,954. References What is the external financing needed? (Do not round intermediate calculations and round your answer to the nearest whole dollar amount, e.g., 32.) External financing needed Firm A and Firm B have debt-total asset ratios of 42 percent and 32 percent, respectively, and returns on total assets of 7 percent and 12 percent, respectively. 1.38 points What is the return on equity for Firm A and Firm B? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Skipped Firm A Firm B eBook Return on equity Print References A company has net income of $186,000, a profit margin of 8.9 percent, and an accounts receivable balance of $125,370. Assuming 75 percent of sales are on credit, what is the company's days' sales in receivables? (Use 365 days a year. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 1.38 points Skipped days Days' sales in receivables eBook Print References The Rossdale Company has a ratio of long-term debt to long-term debt plus equity of .32 and a current ratio of 1.8. Current liabilities are $880, sales are $6,300, profit margin is 8.9 percent, and ROE is 19.3 percent. What is the amount of the firm's net fixed assets? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 1.38 points Skipped Net fixed assets eBook Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts