Question: Please help me answer question 7.1 What is the difference between a bond equivalent yield and a money market yield? Little Prince (LP) has 100

Please help me answer question 7.1

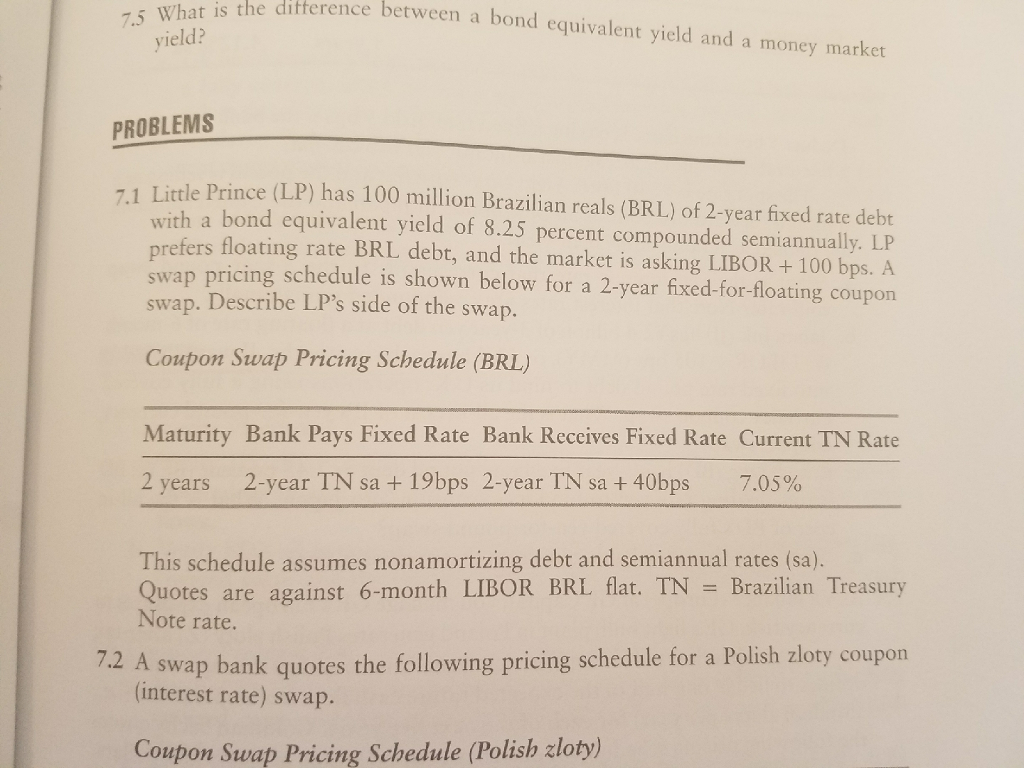

What is the difference between a bond equivalent yield and a money market yield? Little Prince (LP) has 100 million Brazilian (BRL) of 2-year fixed rate debt with a bond equivalent yield of 8.25 percent compounded semiannually. LP prefers floating rate BRL debt, and the market is asking LIBOR + 100 bps. A swap pricing schedule is shown below for a 2-year fixed-for-floating coupon swap. Describe LP's side of the swap. Coupon Swap Pricing Schedule (BRL) This schedule assumes debt and semiannual rates. Quotes are against 6-month LIBOR BRL flat. TN = Brazilian Treasury Note rate. A swap bank quotes the following pricing schedule for a Polish zloty coupon (interest rate) swap. Coupon Swap Pricing Schedule (Polish zloty)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts