Question: Please help me answer question E9-2(A,B,C). thank you F9-2 The inventory records of Maypen Corporation indicated the following at December 31. 2003: Units Cost per

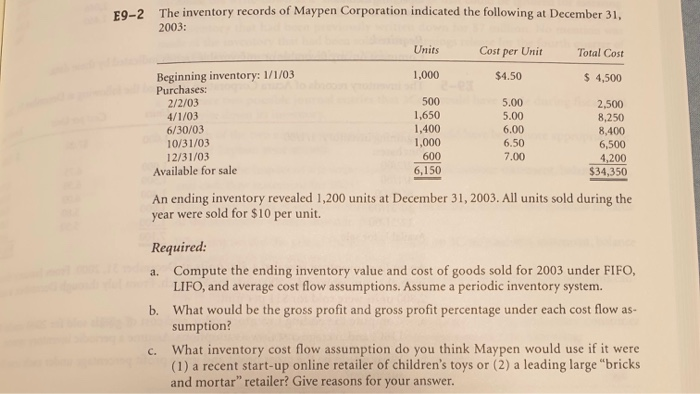

F9-2 The inventory records of Maypen Corporation indicated the following at December 31. 2003: Units Cost per Unit Total Cost 1,000 $4.50 $ 4,500 Beginning inventory: 1/1/03 Purchases: 2/2/03 4/1/03 6/30/03 10/31/03 12/31/03 Available for sale 500 1,650 1,400 1,000 5.00 5.00 6.00 6.50 7.00 2,500 8,250 8,400 6,500 4,200 600 6,150 $34,350 An ending inventory revealed 1,200 units at December 31, 2003. All units sold during the year were sold for $10 per unit. Required: a. Compute the ending inventory value and cost of goods sold for 2003 under FIFO, LIFO, and average cost flow assumptions. Assume a periodic inventory system. b. What would be the gross profit and gross profit percentage under each cost flow as- sumption? C. What inventory cost flow assumption do you think Maypen would use if it were (1) a recent start-up online retailer of children's toys or (2) a leading large "bricks and mortar" retailer? Give reasons for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts