Question: please help me answer questions a-e (shown in the last photo) lenny Cochran, a graduate of the University of Tennessee with 4 years of experience

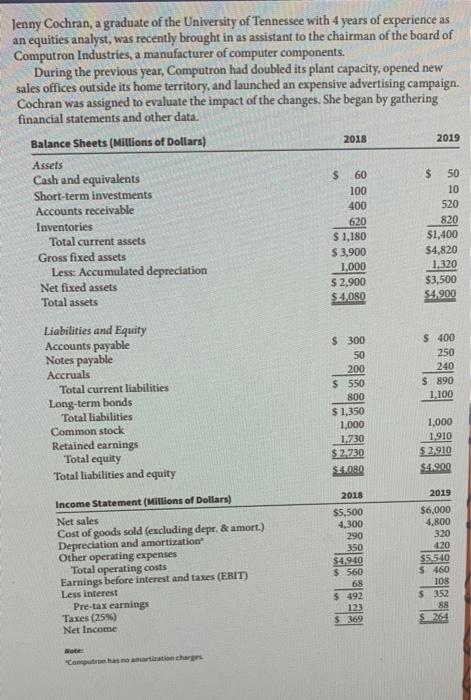

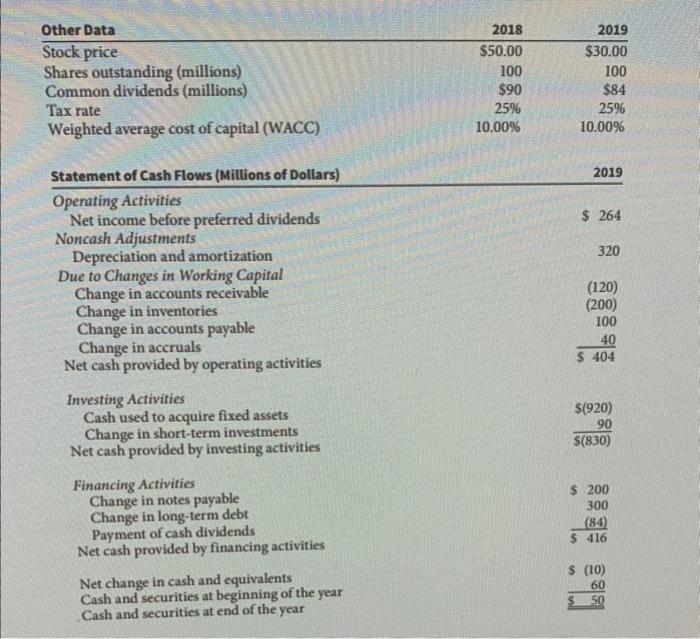

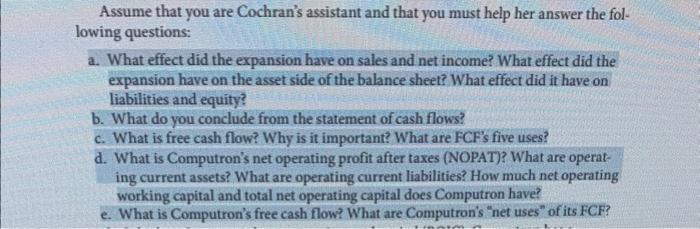

lenny Cochran, a graduate of the University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. Durino the orevious vear. Computron had doubled its plant capacity, opened new \begin{tabular}{lrr} Other Data & 2018 & 2019 \\ \hline Stock price & $50.00 & $30.00 \\ Shares outstanding (millions) & 100 & 100 \\ Common dividends (millions) & $90 & $84 \\ Tax rate & 25% & 25% \\ Weighted average cost of capital (WACC) & 10.00% & 10.00% \end{tabular} Statement of Cash Flows (Mitlions of Dollars) 2019 Operating Activities Net income before preferred dividends $264 Noncash Adjustments Depreciation and amortization 320 Due to Changes in Working Capital Change in accounts receivable (120) Change in inventories (200) Change in accounts payable Change in accruals Net cash provided by operating activities Investing Activities Cash used to acquire fixed assets Change in short-term investments Net cash provided by investing activities $(920)90(830) Financing Activities Change in notes payable Change in long-term debt Payment of cash dividends Net cash provided by financing activities Net change in cash and equivalents Cash and securities at beginning of the year Cash and securities at end of the year Assume that you are Cochran's assistant and that you must help her answer the following questions: a. What effect did the expansion have on sales and net income? What effect did the expansion have on the asset side of the balance sheet? What effect did it have on liabilities and equity? b. What do you conclude from the statement of cash flows? c. What is free cash flow? Why is it important? What are FCF's five uses? d. What is Computron's net operating profit after taxes (NOPAT)? What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computron have? e. What is Computron's free cash flow? What are Computron's "net uses" of its FCF? lenny Cochran, a graduate of the University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. Durino the orevious vear. Computron had doubled its plant capacity, opened new \begin{tabular}{lrr} Other Data & 2018 & 2019 \\ \hline Stock price & $50.00 & $30.00 \\ Shares outstanding (millions) & 100 & 100 \\ Common dividends (millions) & $90 & $84 \\ Tax rate & 25% & 25% \\ Weighted average cost of capital (WACC) & 10.00% & 10.00% \end{tabular} Statement of Cash Flows (Mitlions of Dollars) 2019 Operating Activities Net income before preferred dividends $264 Noncash Adjustments Depreciation and amortization 320 Due to Changes in Working Capital Change in accounts receivable (120) Change in inventories (200) Change in accounts payable Change in accruals Net cash provided by operating activities Investing Activities Cash used to acquire fixed assets Change in short-term investments Net cash provided by investing activities $(920)90(830) Financing Activities Change in notes payable Change in long-term debt Payment of cash dividends Net cash provided by financing activities Net change in cash and equivalents Cash and securities at beginning of the year Cash and securities at end of the year Assume that you are Cochran's assistant and that you must help her answer the following questions: a. What effect did the expansion have on sales and net income? What effect did the expansion have on the asset side of the balance sheet? What effect did it have on liabilities and equity? b. What do you conclude from the statement of cash flows? c. What is free cash flow? Why is it important? What are FCF's five uses? d. What is Computron's net operating profit after taxes (NOPAT)? What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computron have? e. What is Computron's free cash flow? What are Computron's "net uses" of its FCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts