Question: please help me answer the following 6 questions, please only answer if you can solve all 6. THANK YOU! will rate Omaha Company's capital structure

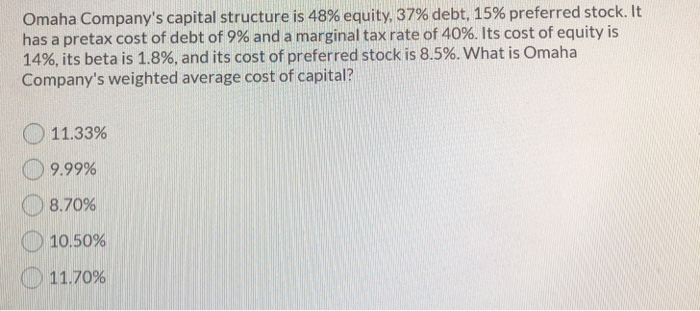

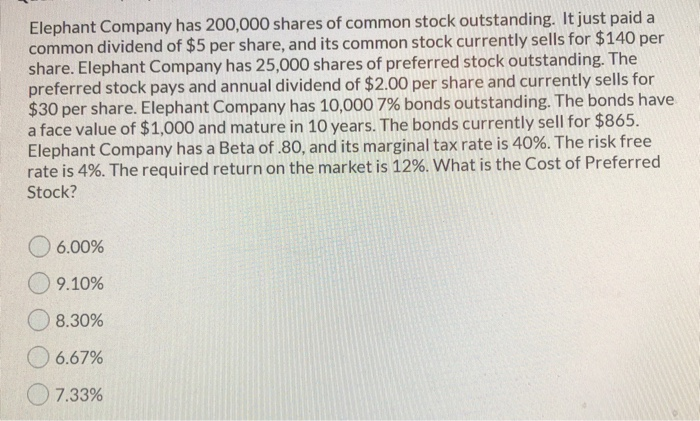

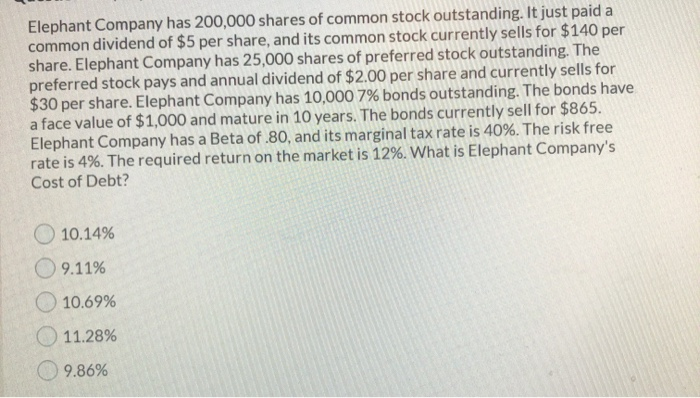

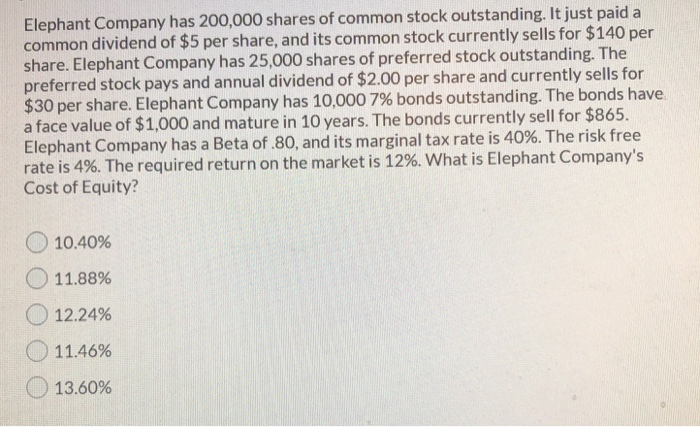

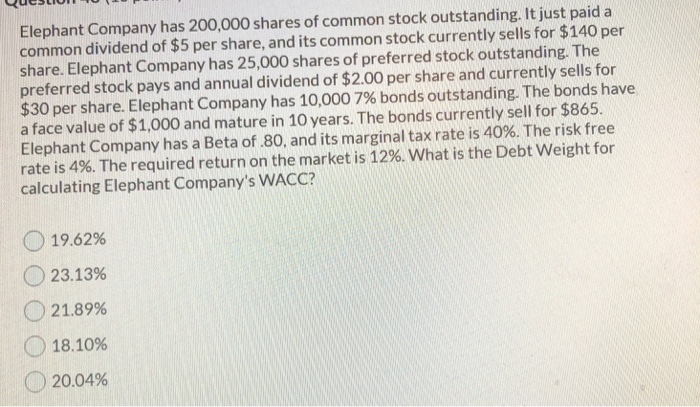

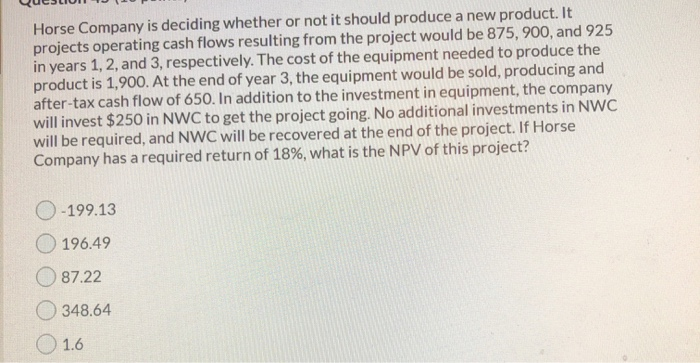

Omaha Company's capital structure is 48% equity, 37% debt, 15% preferred stock. It has a pretax cost of debt of 9% and a marginal tax rate of 40%. Its cost of equity is 14%, its beta is 1.8%, and its cost of preferred stock is 8.5%. What is Omaha Company's weighted average cost of capital? 11.33% 9.99% 8.70% 10.50% 11.70% Elephant Company has 200,000 shares of common stock outstanding. It just paid a common dividend of $5 per share, and its common stock currently sells for $140 per share. Elephant Company has 25,000 shares of preferred stock outstanding. The preferred stock pays and annual dividend of $2.00 per share and currently sells for $30 per share. Elephant Company has 10,000 7% bonds outstanding. The bonds have a face value of $1,000 and mature in 10 years. The bonds currently sell for $865. Elephant Company has a Beta of.80, and its marginal tax rate is 40%. The risk free rate is 4%. The required return on the market is 12%. What is the Cost of Preferred Stock? 06.00% O 9.10% 8.30% O 6.67% 7.33% Elephant Company has 200,000 shares of common stock outstanding. It just paid a common dividend of $5 per share, and its common stock currently sells for $140 per share. Elephant Company has 25,000 shares of preferred stock outstanding. The preferred stock pays and annual dividend of $2.00 per share and currently sells for $30 per share. Elephant Company has 10,000 7% bonds outstanding. The bonds have a face value of $1,000 and mature in 10 years. The bonds currently sell for $865. Elephant Company has a Beta of.80, and its marginal tax rate is 40%. The risk free rate is 4%. The required return on the market is 12%. What is Elephant Company's Cost of Debt? 10.14% 09.11% 10.69% 11.28% 9.86% Elephant Company has 200,000 shares of common stock outstanding. It just paid a common dividend of $5 per share, and its common stock currently sells for $140 per share. Elephant Company has 25,000 shares of preferred stock outstanding. The preferred stock pays and annual dividend of $2.00 per share and currently sells for $30 per share. Elephant Company has 10,000 7% bonds outstanding. The bonds have a face value of $1,000 and mature in 10 years. The bonds currently sell for $865. Elephant Company has a Beta of.80, and its marginal tax rate is 40%. The risk free rate is 4%. The required return on the market is 12%. What is Elephant Company's Cost of Equity? 10.40% O 11.88% O 12.24% 11.46% 13.60% Elephant Company has 200,000 shares of common stock outstanding. It just paid a common dividend of $5 per share, and its common stock currently sells for $140 per share. Elephant Company has 25,000 shares of preferred stock outstanding. The preferred stock pays and annual dividend of $2.00 per share and currently sells for $30 per share. Elephant Company has 10,000 7% bonds outstanding. The bonds have a face value of $1,000 and mature in 10 years. The bonds currently sell for $865. Elephant Company has a Beta of.80, and its marginal tax rate is 40%. The risk free rate is 4%. The required return on the market is 12%. What is the Debt Weight for calculating Elephant Company's WACC? 19.62% 23.13% 21.89% 18.10% 20.04% Horse Company is deciding whether or not it should produce a new product. It projects operating cash flows resulting from the project would be 875, 900, and 925 in years 1, 2, and 3, respectively. The cost of the equipment needed to produce the product is 1,900. At the end of year 3, the equipment would be sold, producing and after-tax cash flow of 650. In addition to the investment in equipment, the company will invest $250 in NWC to get the project going. No additional investments in NWC will be required, and NWC will be recovered at the end of the project. If Horse Company has a required return of 18%, what is the NPV of this project? 0-199.13 196.49 O 87.22 O 348.64 O 1.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts