Question: Please help me answer the following problems given below. 2-35. On December 31, 2019, after recording depreciation for the year, an item of equipment with

Please help me answer the following problems given below.

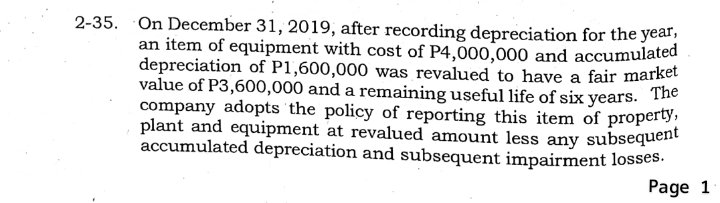

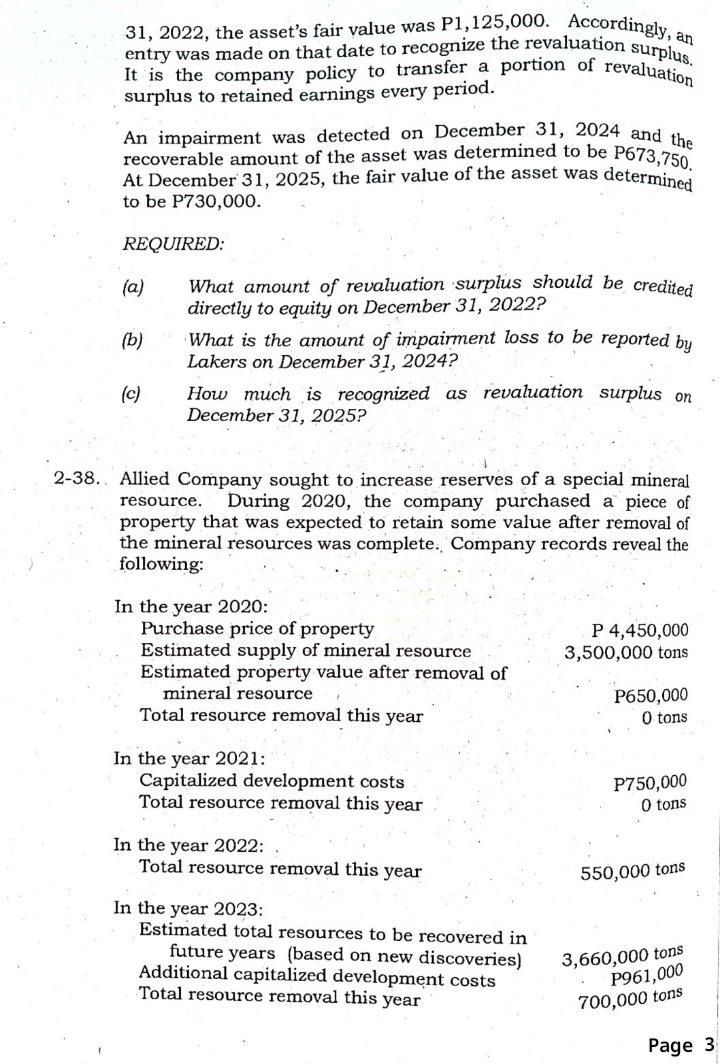

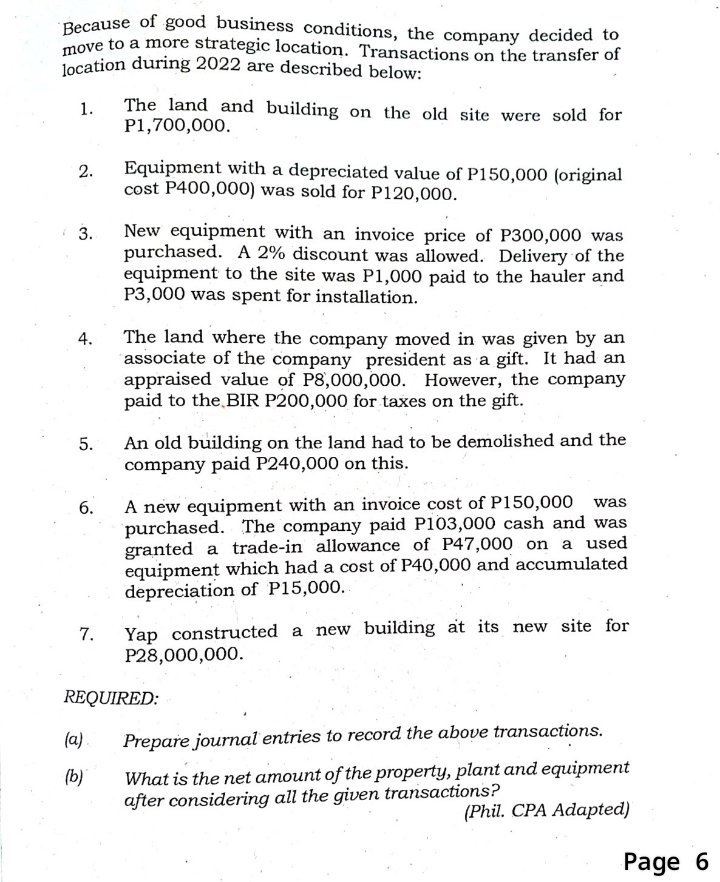

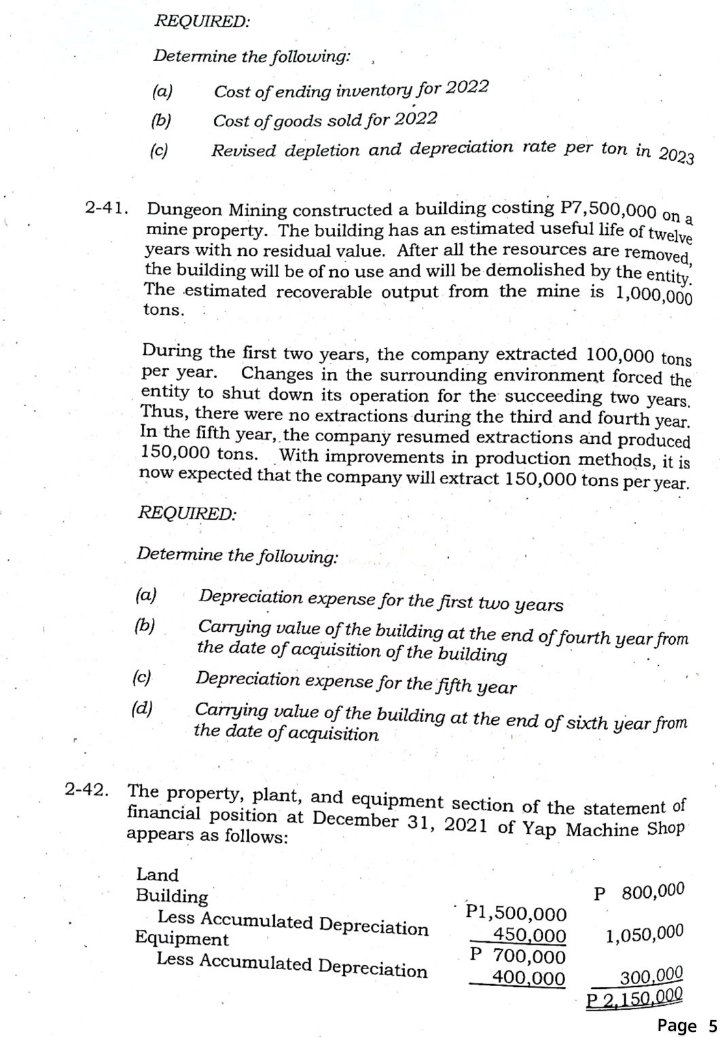

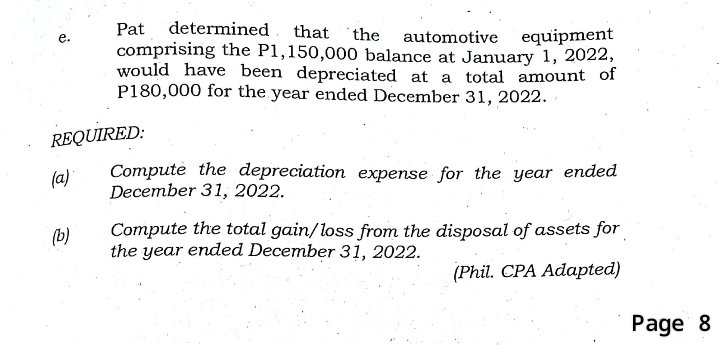

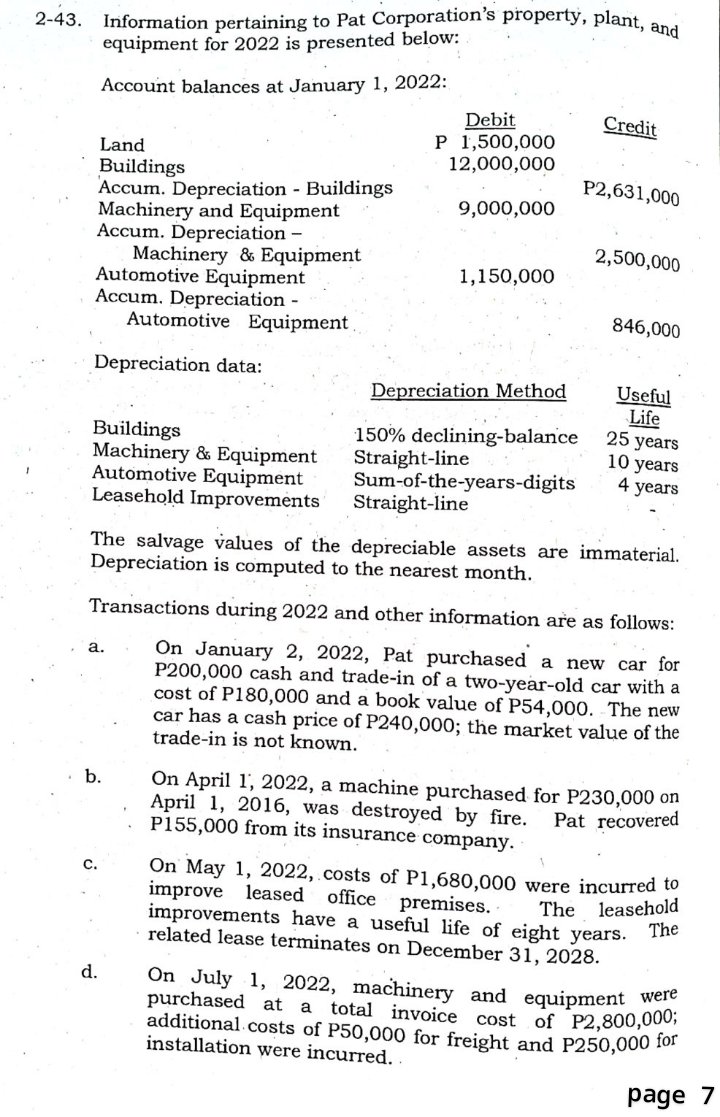

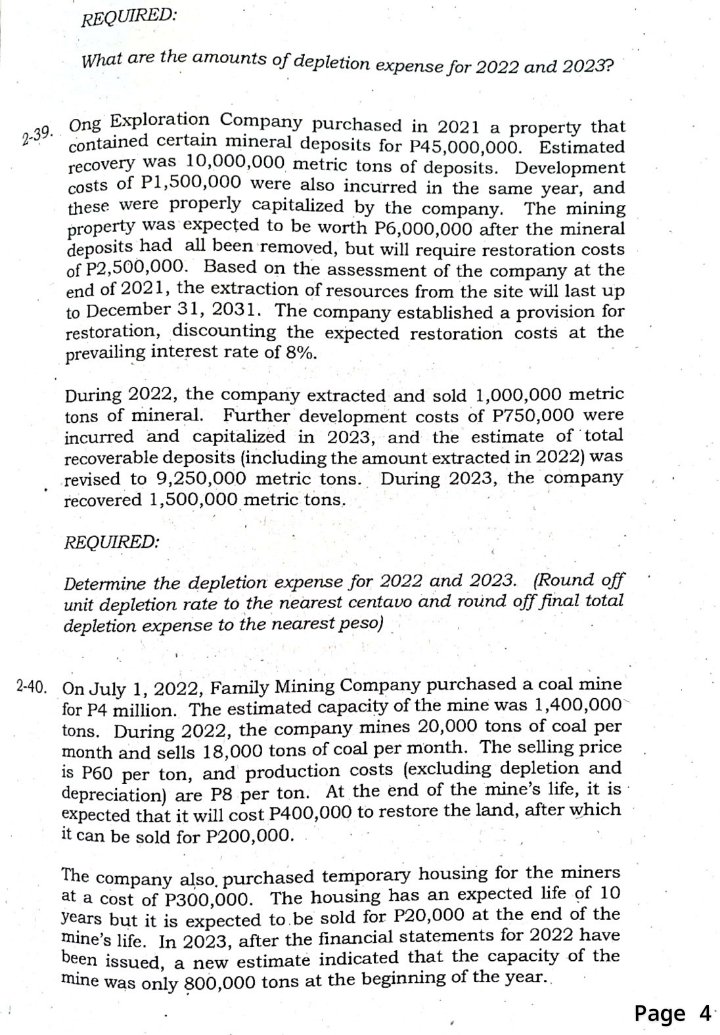

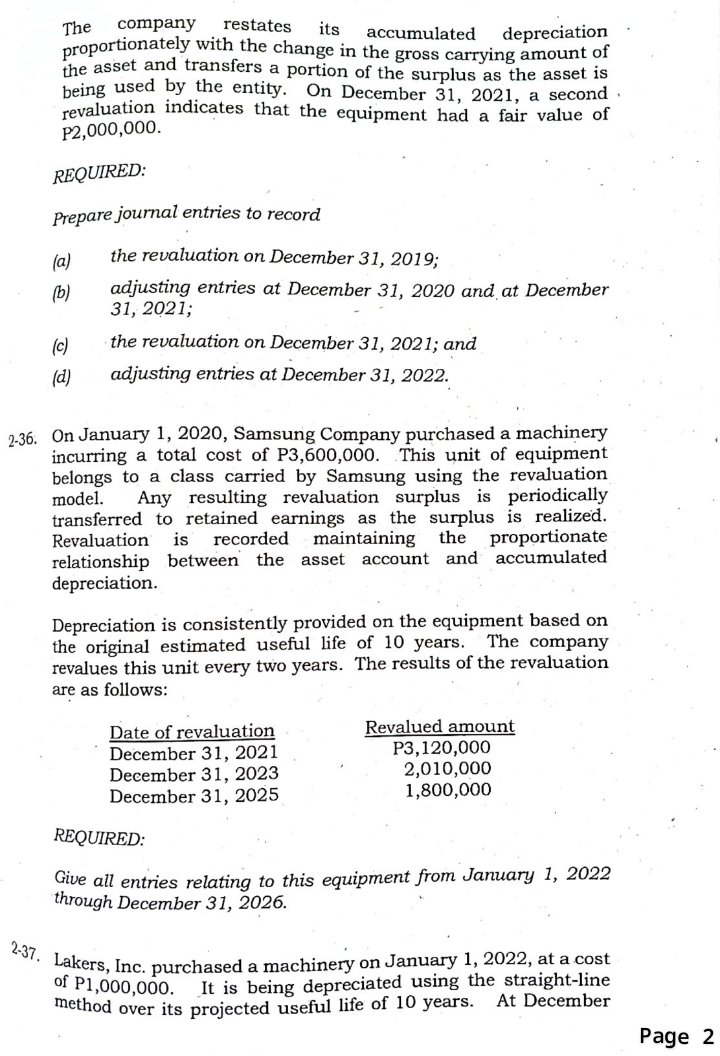

2-35. On December 31, 2019, after recording depreciation for the year, an item of equipment with cost of P4,000,000 and accumulated depreciation of P1,600,000 was revalued to have a fair market value of P3,600,000 and a remaining useful life of six years. The company adopts the policy of reporting this item of property, plant and equipment at revalued amount less any subsequent accumulated depreciation and subsequent impairment losses. Page 131, 2022, the asset's fair value was P1, 125,000. Accordingly, an entry was made on that date to recognize the revaluation surplus It is the company policy to transfer a portion of revaluation surplus to retained earnings every period. An impairment was detected on December 31, 2024 and the recoverable amount of the asset was determined to be P673,750, At December 31, 2025, the fair value of the asset was determined to be P730,000. REQUIRED: (a) What amount of revaluation surplus should be credited directly to equity on December 31, 2022? (b) What is the amount of impairment loss to be reported by Lakers on December 31, 2024? (c) How much is recognized as revaluation surplus on December 31, 2025? 2-38. Allied Company sought to increase reserves of a special mineral resource. During 2020, the company purchased a piece of property that was expected to retain some value after removal of the mineral resources was complete. Company records reveal the following: In the year 2020: Purchase price of property P 4,450,000 Estimated supply of mineral resource 3,500,000 tons Estimated property value after removal of mineral resource P650,000 Total resource removal this year 0 tons In the year 2021: Capitalized development costs P750,000 Total resource removal this year 0 tons In the year 2022: Total resource removal this year 550,000 tons In the year 2023: Estimated total resources to be recovered in future years (based on new discoveries) 3,660,000 tons Additional capitalized development costs P961,000 Total resource removal this year 700,000 tons Page 3Because of good business conditions, the company decided to move to a more strategic location. Transactions on the transfer of location during 2022 are described below: 1 . The land and building on the old site were sold for P1,700,000. 2. Equipment with a depreciated value of P150,000 (original cost P400,000) was sold for P120,000. 3. New equipment with an invoice price of P300,000 was purchased. A 2% discount was allowed. Delivery of the equipment to the site was P1,000 paid to the hauler and P3,000 was spent for installation. 4. The land where the company moved in was given by an associate of the company president as a gift. It had an appraised value of P8,000,000. However, the company paid to the BIR P200,000 for taxes on the gift. 5. An old building on the land had to be demolished and the company paid P240,000 on this. 6. A new equipment with an invoice cost of P150,000 was purchased. The company paid P103,000 cash and was granted a trade-in allowance of P47,000 on a used equipment which had a cost of P40,000 and accumulated depreciation of P15,000. 7. Yap constructed a new building at its new site for P28,000,000. REQUIRED: (a) Prepare journal entries to record the above transactions. (b) What is the net amount of the property, plant and equipment after considering all the given transactions? (Phil. CPA Adapted) Page 6REQUIRED: Determine the following: (a) Cost of ending inventory for 2022 (b ) Cost of goods sold for 2022 (c) Revised depletion and depreciation rate per ton in 2023 2-41. Dungeon Mining constructed a building costing P7,500,000 on a mine property. The building has an estimated useful life of twelve years with no residual value. After all the resources are removed, the building will be of no use and will be demolished by the entity. The estimated recoverable output from the mine is 1,000,000 tons. During the first two years, the company extracted 100,000 tons per year. Changes in the surrounding environment forced the entity to shut down its operation for the succeeding two years. Thus, there were no extractions during the third and fourth year. In the fifth year, the company resumed extractions and produced 150,000 tons. With improvements in production methods, it is now expected that the company will extract 150,000 tons per year. REQUIRED: Determine the following: (a) Depreciation expense for the first two years (b) Carrying value of the building at the end of fourth year from the date of acquisition of the building (c) Depreciation expense for the fifth year (d) Carrying value of the building at the end of sixth year from the date of acquisition 2-42. The property, plant, and equipment section of the statement of financial position at December 31, 2021 of Yap Machine Shop appears as follows: Land P 800,000 Building P1,500,000 Less Accumulated Depreciation 450,000 1,050,000 Equipment P 700,000 Less Accumulated Depreciation 400,000 300,000 P 2,150,000 Page 5e. Pat determined that the automotive equipment comprising the P1, 150,000 balance at January 1, 2022, would have been depreciated at a total amount of P180,000 for the year ended December 31, 2022. REQUIRED: (a) Compute the depreciation expense for the year ended December 31, 2022. (b) Compute the total gain/ loss from the disposal of assets for the year ended December 31, 2022. (Phil. CPA Adapted) Page 82-43. Information pertaining to Pat Corporation's property, plant, and equipment for 2022 is presented below: Account balances at January 1, 2022: Debit Credit P 1,500,000 Land 12,000,000 Buildings Accum. Depreciation - Buildings P2,631,000 Machinery and Equipment 9,000,000 Accum. Depreciation - Machinery & Equipment 2,500,000 Automotive Equipment 1, 150,000 Accum. Depreciation - Automotive Equipment 846,000 Depreciation data: Depreciation Method Useful Life Buildings 150% declining-balance 25 years Machinery & Equipment Straight-line 10 years Automotive Equipment Sum-of-the-years-digits 4 years Leasehold Improvements Straight-line The salvage values of the depreciable assets are immaterial. Depreciation is computed to the nearest month. Transactions during 2022 and other information are as follows: a. On January 2, 2022, Pat purchased a new car for P200,000 cash and trade-in of a two-year-old car with a cost of P180,000 and a book value of P54,000. The new car has a cash price of P240,000; the market value of the trade-in is not known. b. On April 1, 2022, a machine purchased for P230,000 on April 1, 2016, was destroyed by fire. Pat recovered P155,000 from its insurance company. C. On May 1, 2022, costs of P1,680,000 were incurred to improve leased office premises. The leasehold improvements have a useful life of eight years. The related lease terminates on December 31, 2028 d. On July 1, 2022, machinery and equipment were purchased at a total invoice cost of P2,800,000; additional costs of P50,000 for freight and P250,000 for installation were incurred. . page 7REQUIRED: What are the amounts of depletion expense for 2022 and 2023? 2.39. Ong Exploration Company purchased in 2021 a property that contained certain mineral deposits for P45,000,000. Estimated recovery was 10,000,000 metric tons of deposits. Development costs of P1,500,000 were also incurred in the same year, and these were properly capitalized by the company. The mining property was expected to be worth P6,000,000 after the mineral deposits had all been removed, but will require restoration costs of P2,500,000. Based on the assessment of the company at the end of 2021, the extraction of resources from the site will last up to December 31, 2031. The company established a provision for restoration, discounting the expected restoration costs at the prevailing interest rate of 8%. During 2022, the company extracted and sold 1,000,000 metric tons of mineral. Further development costs of P750,000 were incurred and capitalized in 2023, and the estimate of total recoverable deposits (including the amount extracted in 2022) was revised to 9,250,000 metric tons. During 2023, the company recovered 1,500,000 metric tons. REQUIRED: Determine the depletion expense for 2022 and 2023. (Round off unit depletion rate to the nearest centavo and round off final total depletion expense to the nearest peso) 2-40. On July 1, 2022, Family Mining Company purchased a coal mine for P4 million. The estimated capacity of the mine was 1,400,000 tons. During 2022, the company mines 20,000 tons of coal per month and sells 18,000 tons of coal per month. The selling price is P60 per ton, and production costs (excluding depletion and depreciation) are P8 per ton. At the end of the mine's life, it is expected that it will cost P400,000 to restore the land, after which it can be sold for P200,000. The company also, purchased temporary housing for the miners at a cost of P300,000. The housing has an expected life of 10 years but it is expected to be sold for P20,000 at the end of the mine's life. In 2023, after the financial statements for 2022 have been issued, a new estimate indicated that the capacity of the mine was only 800,000 tons at the beginning of the year. Page 4The company restates its accumulated depreciation proportionately with the change in the gross carrying amount of the asset and transfers a portion of the surplus as the asset is being used by the entity. On December 31, 2021, a second . revaluation indicates that the equipment had a fair value of P2,000,000. REQUIRED: Prepare journal entries to record (a) the revaluation on December 31, 2019; (b) adjusting entries at December 31, 2020 and at December 31, 2021; (c) the revaluation on December 31, 2021; and (d) adjusting entries at December 31, 2022. 2-36. On January 1, 2020, Samsung Company purchased a machinery incurring a total cost of P3,600,000. This unit of equipment belongs to a class carried by Samsung using the revaluation model. Any resulting revaluation surplus is periodically transferred to retained earnings as the surplus is realized. Revaluation is recorded maintaining the proportionate relationship between the asset account and accumulated depreciation. Depreciation is consistently provided on the equipment based on the original estimated useful life of 10 years. The company revalues this unit every two years. The results of the revaluation are as follows: Date of revaluation Revalued amount December 31, 2021 P3,120,000 December 31, 2023 2,010,000 December 31, 2025 1,800,000 REQUIRED: Give all entries relating to this equipment from January 1, 2022 through December 31, 2026. 2-37. Lakers, Inc. purchased a machinery on January 1, 2022, at a cost of P1,000,000. It is being depreciated using the straight-line method over its projected useful life of 10 years. At December Page 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts