Question: Please help me answer the following question. Please do it for the years 2021, 2022, 2023. Thank you Question 11 Data table Assuming that KXS's

Please help me answer the following question. Please do it for the years 2021, 2022, 2023. Thank you

Question 11

Data table

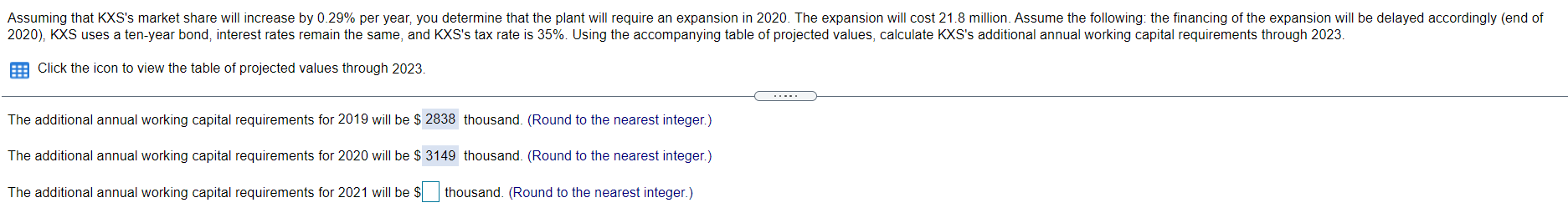

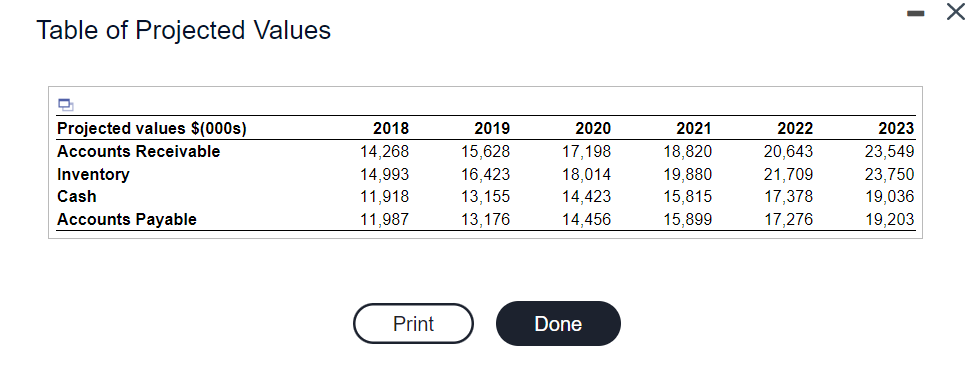

Assuming that KXS's market share will increase by 0.29% per year, you determine that the plant will require an expansion in 2020. The expansion will cost 21.8 million. Assume the following: the financing of the expansion will be delayed accordingly (end of 2020), KXS uses a ten-year bond, interest rates remain the same, and KXS's tax rate is 35%. Using the accompanying table of projected values, calculate KXS's additional annual working capital requirements through 2023. Click the icon to view the table of projected values through 2023. The additional annual working capital requirements for 2019 will be $ 2838 thousand. (Round to the nearest integer.) The additional annual working capital requirements for 2020 will be $ 3149 thousand. (Round to the nearest integer.) The additional annual working capital requirements for 2021 will be $ thousand. (Round to the nearest integer.) - Table of Projected Values Projected values $(000s) Accounts Receivable Inventory Cash Accounts Payable 2018 14,268 14,993 11,918 11,987 2019 15,628 16,423 13,155 13,176 2020 17,198 18,014 14,423 14,456 2021 18,820 19,880 15,815 15,899 2022 20,643 21,709 17,378 17,276 2023 23,549 23,750 19,036 19,203 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts