Question: Please help me answer the following question: Prepare common-sized financial statements for Leslie Fay for the period 1987 1991. For that same period, compute for

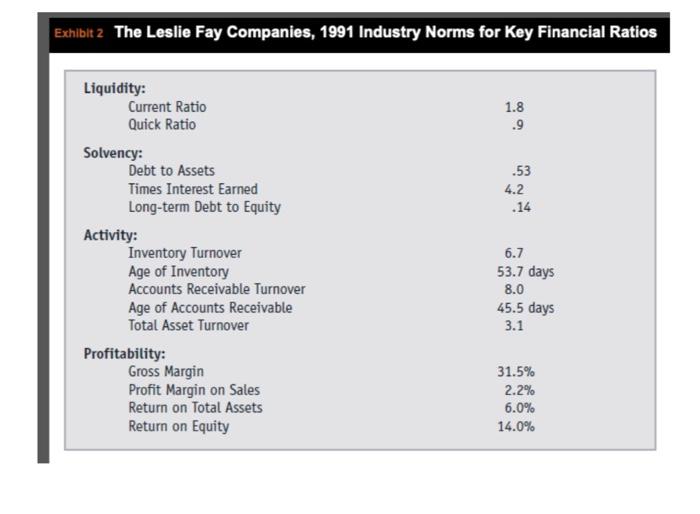

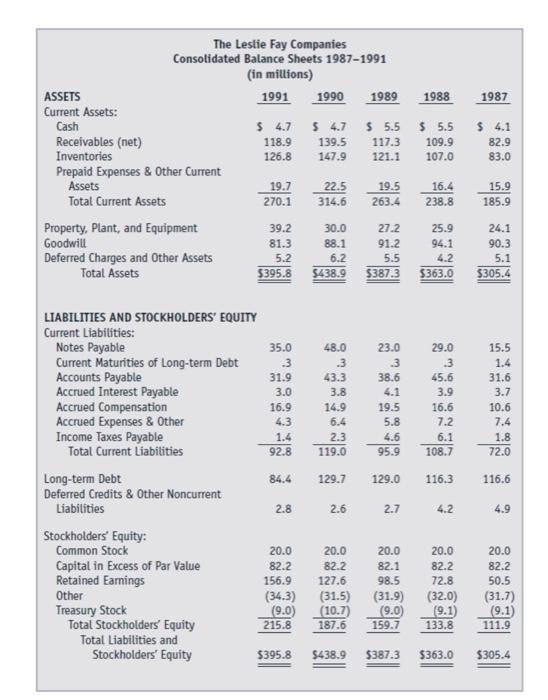

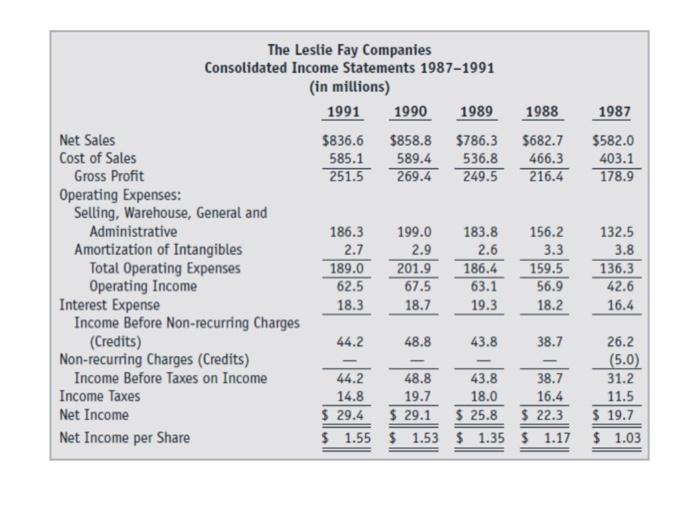

It 2 The Leslie Fay Companies, 1991 Industry Norms for Key Financial Ratios \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ ASSETS } & \begin{tabular}{l} stie Fay Co \\ Batance Sh \\ (in miltion \end{tabular} & \begin{tabular}{l} mpanies \\ gets 1987 \\ s) \end{tabular} & 1991 & \multirow[b]{2}{*}{1988} & \multirow[b]{2}{*}{1987} \\ \hline & 1991 & 1990 & 1989 & & \\ \hline \multicolumn{6}{|l|}{ Current Assets: } \\ \hline Cash & S 4.7 & s 4.7 & \$ 5.5 & $5.5 & $4.1 \\ \hline Receivables (net) & 118.9 & 139.5 & 117.3 & 109.9 & 82.9 \\ \hline Inventories & 126.8 & 147.9 & 121.1 & 107.0 & 83.0 \\ \hline \multicolumn{6}{|l|}{ Prepaid Expenses \& Other Current } \\ \hline Assets & 19.7 & 22.5 & 19.5 & 16.4 & 15.9 \\ \hline Total Current Assets & 270.1 & 314.6 & 263.4 & 238.8 & 185.9 \\ \hline Property, Plant, and Equipment & 39.2 & 30.0 & 27.2 & 25.9 & 24.1 \\ \hline Goodwill & 81.3 & 88.1 & 91.2 & 94.1 & 90.3 \\ \hline Deferred Charges and Other Assets & 5.2 & 6.2 & 5.5 & 4.2 & 5.1 \\ \hline Total Assets & 5395.8 & $438.9 & & $363.0 & $305.4 \\ \hline \multicolumn{6}{|l|}{ LIABILITIES AND STOCKHOLDERS' EQUITY } \\ \hline \multicolumn{6}{|l|}{ Current Liabilities: } \\ \hline Notes Payable & 35.0 & 48.0 & 23.0 & 29.0 & 15.5 \\ \hline Current Maturities of Long-term Debt & 3 & 3 & 3 & .3 & 1.4 \\ \hline Accounts Payable & 31.9 & 43.3 & 38.6 & 45.6 & 31.6 \\ \hline Accrued Interest Payable & 3.0 & 3.8 & 4.1 & 3.9 & 3.7 \\ \hline Accrued Compensation & 16.9 & 14.9 & 19.5 & 16.6 & 10.6 \\ \hline Accrued Expenses \& Other & 4.3 & 6.4 & 5.8 & 7.2 & 7.4 \\ \hline Income Taxes Payable & 1.4 & 2.3 & 4.6 & 6.1 & 1.8 \\ \hline Total Current Liabilities & 92.8 & 119.0 & 95.9 & 108.7 & 72.0 \\ \hline Long-term Debt & 84.4 & 129.7 & 129.0 & 116.3 & 116.6 \\ \hline \multicolumn{6}{|l|}{ Deferred Credits \& Other Noncurrent } \\ \hline Liabilities & 2.8 & 2.6 & 2.7 & 4.2 & 4.9 \\ \hline \multicolumn{6}{|l|}{ Stockholders Equity: } \\ \hline Common Stock & 20.0 & 20.0 & 20.0 & 20.0 & 20.0 \\ \hline Capital in Excess of Par Value & 82.2 & 82.2 & 82.1 & 82.2 & 82.2 \\ \hline Retained Earnings & 156.9 & 127.6 & 98.5 & 72.8 & 50.5 \\ \hline Other & (34.3) & (31.5) & (31.9) & (32.0) & (31.7) \\ \hline Treasury Stock & (9.0) & (10.7) & (9.0) & (9.1) & (9.1) \\ \hline Total Stockholders Equity & 215.8 & 187.6 & 159.7 & 133.8 & 111.9 \\ \hline \multicolumn{6}{|l|}{ Total Liabilities and } \\ \hline Stockholders' Equity & $395.8 & $438.9 & $387.3 & $363.0 & $305.4 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{\begin{tabular}{l} The Lestie Fay Companies \\ Consolidated Income Statements 1987-1991 \\ (in millions) \end{tabular}} \\ \hline & 1991 & 1990 & 1989 & 1988 & 1987 \\ \hline Net Sales & $836.6 & $858.8 & $786.3 & $682.7 & $582.0 \\ \hline Cost of Sales & 585.1 & 589.4 & 536.8 & 466.3 & 403.1 \\ \hline Gross Profit & 251.5 & 269.4 & 249.5 & 216.4 & 178.9 \\ \hline \multicolumn{6}{|l|}{ Operating Expenses: } \\ \hline \multicolumn{6}{|l|}{ Selling, Warehouse, General and } \\ \hline Administrative & 186.3 & 199.0 & 183.8 & 156.2 & 132.5 \\ \hline Amortization of Intangibles & 2.7 & 2.9 & 2.6 & 3.3 & 3.8 \\ \hline Total Operating Expenses & 189.0 & 201.9 & 186.4 & 159.5 & 136.3 \\ \hline Operating Income & 62.5 & 67.5 & 63.1 & 56.9 & 42.6 \\ \hline Interest Expense & 18.3 & 18.7 & 19.3 & 18.2 & 16.4 \\ \hline \begin{tabular}{l} Income Before Non-recurring Charges \\ (Credits) \end{tabular} & 44.2 & 48.8 & 43.8 & 38.7 & 26.2 \\ \hline Non-recurring Charges (Credits) & - & - & - & - & (5.0) \\ \hline Income Before Taxes on Income & 44.2 & 48.8 & 43.8 & 38.7 & 31.2 \\ \hline Income Taxes & 14.8 & 19.7 & 18.0 & 16.4 & 11.5 \\ \hline Net Income & $29.4 & $29.1 & $25.8 & $22.3 & $19.7 \\ \hline Net Income per Share & $1.55 & \begin{tabular}{ll} $1.53 \\ \end{tabular} & \begin{tabular}{ll} $ & 1.35 \\ \end{tabular} & \begin{tabular}{ll} $ & 1.17 \\ \end{tabular} & \begin{tabular}{ll} $ & 1.03 \\ \end{tabular} \\ \hline \end{tabular} It 2 The Leslie Fay Companies, 1991 Industry Norms for Key Financial Ratios \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ ASSETS } & \begin{tabular}{l} stie Fay Co \\ Batance Sh \\ (in miltion \end{tabular} & \begin{tabular}{l} mpanies \\ gets 1987 \\ s) \end{tabular} & 1991 & \multirow[b]{2}{*}{1988} & \multirow[b]{2}{*}{1987} \\ \hline & 1991 & 1990 & 1989 & & \\ \hline \multicolumn{6}{|l|}{ Current Assets: } \\ \hline Cash & S 4.7 & s 4.7 & \$ 5.5 & $5.5 & $4.1 \\ \hline Receivables (net) & 118.9 & 139.5 & 117.3 & 109.9 & 82.9 \\ \hline Inventories & 126.8 & 147.9 & 121.1 & 107.0 & 83.0 \\ \hline \multicolumn{6}{|l|}{ Prepaid Expenses \& Other Current } \\ \hline Assets & 19.7 & 22.5 & 19.5 & 16.4 & 15.9 \\ \hline Total Current Assets & 270.1 & 314.6 & 263.4 & 238.8 & 185.9 \\ \hline Property, Plant, and Equipment & 39.2 & 30.0 & 27.2 & 25.9 & 24.1 \\ \hline Goodwill & 81.3 & 88.1 & 91.2 & 94.1 & 90.3 \\ \hline Deferred Charges and Other Assets & 5.2 & 6.2 & 5.5 & 4.2 & 5.1 \\ \hline Total Assets & 5395.8 & $438.9 & & $363.0 & $305.4 \\ \hline \multicolumn{6}{|l|}{ LIABILITIES AND STOCKHOLDERS' EQUITY } \\ \hline \multicolumn{6}{|l|}{ Current Liabilities: } \\ \hline Notes Payable & 35.0 & 48.0 & 23.0 & 29.0 & 15.5 \\ \hline Current Maturities of Long-term Debt & 3 & 3 & 3 & .3 & 1.4 \\ \hline Accounts Payable & 31.9 & 43.3 & 38.6 & 45.6 & 31.6 \\ \hline Accrued Interest Payable & 3.0 & 3.8 & 4.1 & 3.9 & 3.7 \\ \hline Accrued Compensation & 16.9 & 14.9 & 19.5 & 16.6 & 10.6 \\ \hline Accrued Expenses \& Other & 4.3 & 6.4 & 5.8 & 7.2 & 7.4 \\ \hline Income Taxes Payable & 1.4 & 2.3 & 4.6 & 6.1 & 1.8 \\ \hline Total Current Liabilities & 92.8 & 119.0 & 95.9 & 108.7 & 72.0 \\ \hline Long-term Debt & 84.4 & 129.7 & 129.0 & 116.3 & 116.6 \\ \hline \multicolumn{6}{|l|}{ Deferred Credits \& Other Noncurrent } \\ \hline Liabilities & 2.8 & 2.6 & 2.7 & 4.2 & 4.9 \\ \hline \multicolumn{6}{|l|}{ Stockholders Equity: } \\ \hline Common Stock & 20.0 & 20.0 & 20.0 & 20.0 & 20.0 \\ \hline Capital in Excess of Par Value & 82.2 & 82.2 & 82.1 & 82.2 & 82.2 \\ \hline Retained Earnings & 156.9 & 127.6 & 98.5 & 72.8 & 50.5 \\ \hline Other & (34.3) & (31.5) & (31.9) & (32.0) & (31.7) \\ \hline Treasury Stock & (9.0) & (10.7) & (9.0) & (9.1) & (9.1) \\ \hline Total Stockholders Equity & 215.8 & 187.6 & 159.7 & 133.8 & 111.9 \\ \hline \multicolumn{6}{|l|}{ Total Liabilities and } \\ \hline Stockholders' Equity & $395.8 & $438.9 & $387.3 & $363.0 & $305.4 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{\begin{tabular}{l} The Lestie Fay Companies \\ Consolidated Income Statements 1987-1991 \\ (in millions) \end{tabular}} \\ \hline & 1991 & 1990 & 1989 & 1988 & 1987 \\ \hline Net Sales & $836.6 & $858.8 & $786.3 & $682.7 & $582.0 \\ \hline Cost of Sales & 585.1 & 589.4 & 536.8 & 466.3 & 403.1 \\ \hline Gross Profit & 251.5 & 269.4 & 249.5 & 216.4 & 178.9 \\ \hline \multicolumn{6}{|l|}{ Operating Expenses: } \\ \hline \multicolumn{6}{|l|}{ Selling, Warehouse, General and } \\ \hline Administrative & 186.3 & 199.0 & 183.8 & 156.2 & 132.5 \\ \hline Amortization of Intangibles & 2.7 & 2.9 & 2.6 & 3.3 & 3.8 \\ \hline Total Operating Expenses & 189.0 & 201.9 & 186.4 & 159.5 & 136.3 \\ \hline Operating Income & 62.5 & 67.5 & 63.1 & 56.9 & 42.6 \\ \hline Interest Expense & 18.3 & 18.7 & 19.3 & 18.2 & 16.4 \\ \hline \begin{tabular}{l} Income Before Non-recurring Charges \\ (Credits) \end{tabular} & 44.2 & 48.8 & 43.8 & 38.7 & 26.2 \\ \hline Non-recurring Charges (Credits) & - & - & - & - & (5.0) \\ \hline Income Before Taxes on Income & 44.2 & 48.8 & 43.8 & 38.7 & 31.2 \\ \hline Income Taxes & 14.8 & 19.7 & 18.0 & 16.4 & 11.5 \\ \hline Net Income & $29.4 & $29.1 & $25.8 & $22.3 & $19.7 \\ \hline Net Income per Share & $1.55 & \begin{tabular}{ll} $1.53 \\ \end{tabular} & \begin{tabular}{ll} $ & 1.35 \\ \end{tabular} & \begin{tabular}{ll} $ & 1.17 \\ \end{tabular} & \begin{tabular}{ll} $ & 1.03 \\ \end{tabular} \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts