Question: Please help me answer the following question with a clear answer. There are two parts of the question. Thank you Question 3 For the next

Please help me answer the following question with a clear answer. There are two parts of the question. Thank you

Question 3

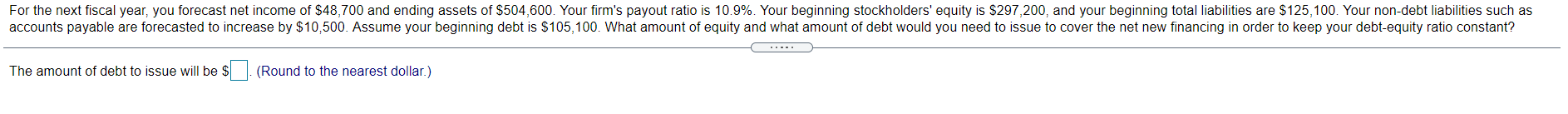

For the next fiscal year, you forecast net income of $48,700 and ending assets of $504,600. Your firm's payout ratio is 10.9%. Your beginning stockholders' equity is $297,200, and your beginning total liabilities are $125,100. Your non-debt liabilities such as accounts payable are forecasted to increase by $10,500. Assume your beginning debt is $105,100. What amount of equity and what amount of debt would you need to issue to cover the net new financing in order to keep your debt-equity ratio constant? C.E. The amount of debt to issue will be $ . (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts