Question: Please help me answer the following question with clear answers. Thank you Question 19 Data table Consider the financial statement data and stock price data

Please help me answer the following question with clear answers. Thank you

Question 19

Data table

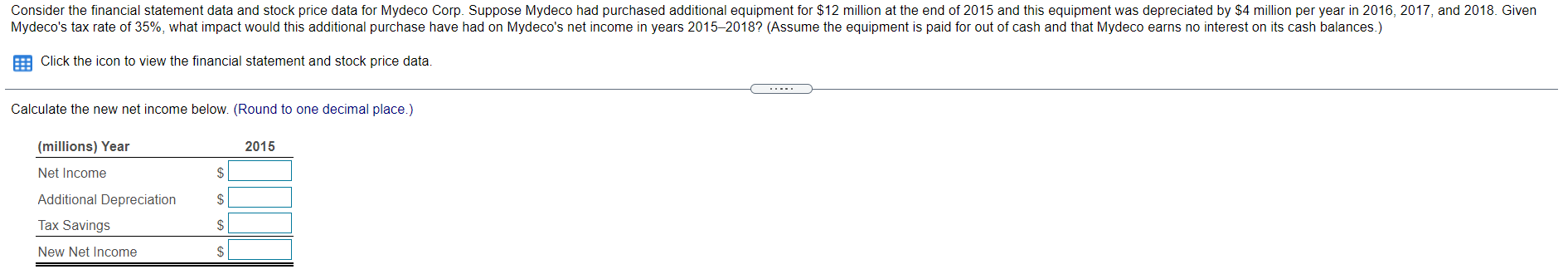

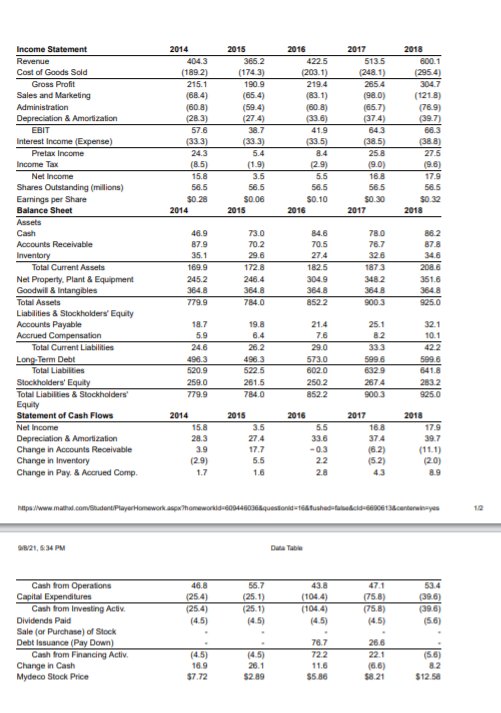

Consider the financial statement data and stock price data for Mydeco Corp. Suppose Mydeco had purchased additional equipment for $12 million at the end of 2015 and this equipment was depreciated by $4 million per year in 2016, 2017, and 2018. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydeco's net income in years 2015-2018? (Assume the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances.) Click the icon to view the financial statement and stock price data. Calculate the new net income below. (Round to one decimal place.) (millions) Year 2015 Net Income $ $ Additional Depreciation Tax Savings S New Net Income S 2014 404.3 (1892) 215.1 (68.4) (608) (283) 57.6 (33.3) 24.3 2015 366.2 (1743) 190.9 (65.4) (59.4) (27.4) 38.7 (33.3) 5.4 (1.9) 3.5 58.5 $0.06 2015 2016 422.5 (203.1) 219.4 (83.1) (608) (33.6) 41.9 (335) 8.4 (29) 5.5 56.5 $0.10 2016 2017 513.5 (248.1) 265.4 (98.0) (65.7) (37.4) 64.3 (38.5) 25.8 (9.0) 16.8 56.5 $0.30 2017 2018 600.1 (295.4) 304.7 (1218) (789) (39.7) 68.3 (388) 27.5 (9.6) 17.9 56.5 $0.32 2018 (85) 15.8 56.5 $0.28 2014 Income Statement Revenue Cost of Goods Sold Gross Profit Sales and Marketing Administration Depreciation & Amortization EBIT Interest Income (Expense) Prelax Income Income Tax Net Income Shares Outstanding (milions) Earnings per Share Balance Sheet Assets Cash Accounts Receivable Inventory Total Current Assets Net Property, Plant & Equipment Goodwill & Intangibles Total Assets Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation Total Current Liabilities Long Term Debt Total Liabilities Stockholders' Equity Total Liabilities & Stockholders Equity Statement of Cash Flows Net Income Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay & Accrued Comp. 48.9 87.9 35.1 169.9 2452 364.8 779.9 73.0 70.2 29.6 1728 246.4 364.8 784.0 84.6 70.5 27.4 182.5 304.9 364.8 8522 78.0 76.7 32.6 1873 3482 384.8 900 3 88.2 87.8 34.6 208.6 3516 364.8 925.0 18.7 5.9 24.6 498.3 520.9 250.0 779.9 19.8 6.4 20.2 496.3 522.5 261.5 784.0 21.4 7.6 29.0 573.0 6020 2502 8522 25.1 8.2 333 599.6 8329 2674 900 3 32.1 10.1 422 599.6 841.8 2832 925.0 2016 2014 15.8 28.3 3.9 (29) 1.7 2015 3.5 27.4 17.7 5.5 1.6 5.5 33.6 -0.3 2.2 2.8 2017 168 374 (62) (5.2) 4.3 2018 17.9 39.7 (11.1) (20) 8.9 https://www.matud.com/StudentPlayer Homework.aspxThamewordid=608448036&questionid=16&fushateci-6006138.centerwineyes 821, 8:34 PM Data Table 46.8 (25.4) (254) (4.5) 56.7 (25.1) (25.1) (4.5) 43.8 (1044) (104.4) (4.5) 47.1 (75.8) (75.8) (4.5) 53.4 (396) (39.6) (56) Cash from Operations Capital Expenditures Cash from investing Activ Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ. Change in Cash Mydeco Stock Price (4.5) 16.9 $7.72 (4.5) 26.1 $2.89 78.7 722 11.6 $5.88 266 221 (6.6) $8.21 (56) 8.2 $12.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts