Question: Please help me answer the following questions: Problem 1 (50 points) Suppose a stock follows the process: 50 = 100 Suppose also that the risk-free

Please help me answer the following questions:

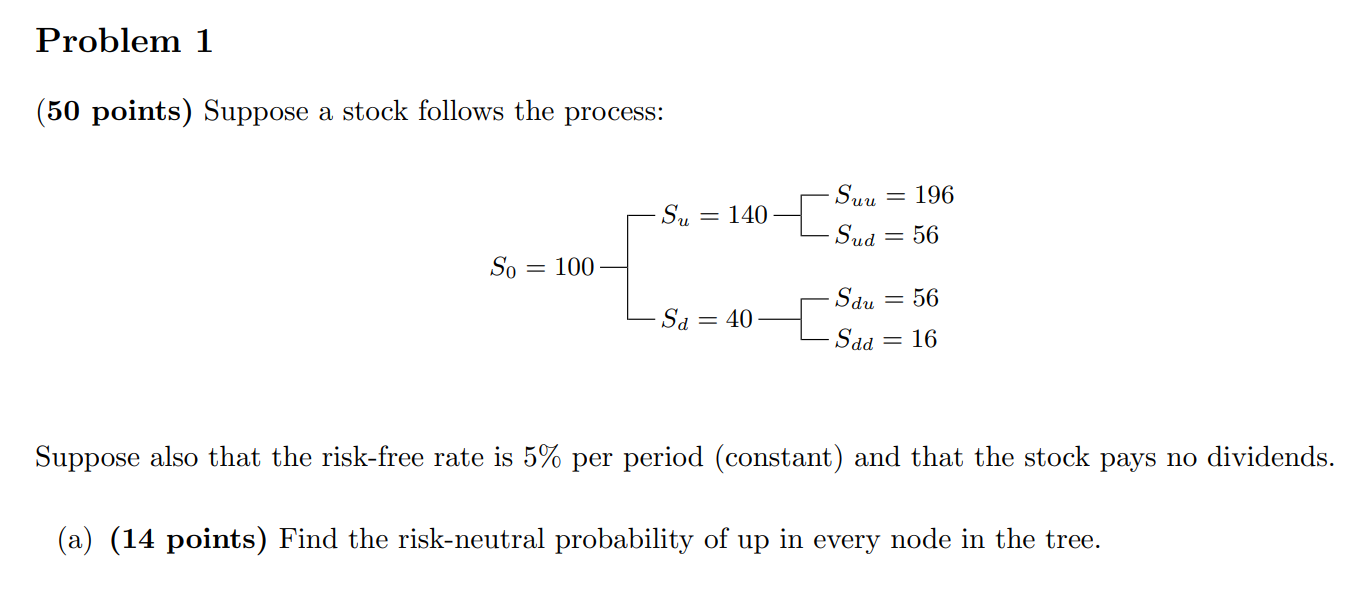

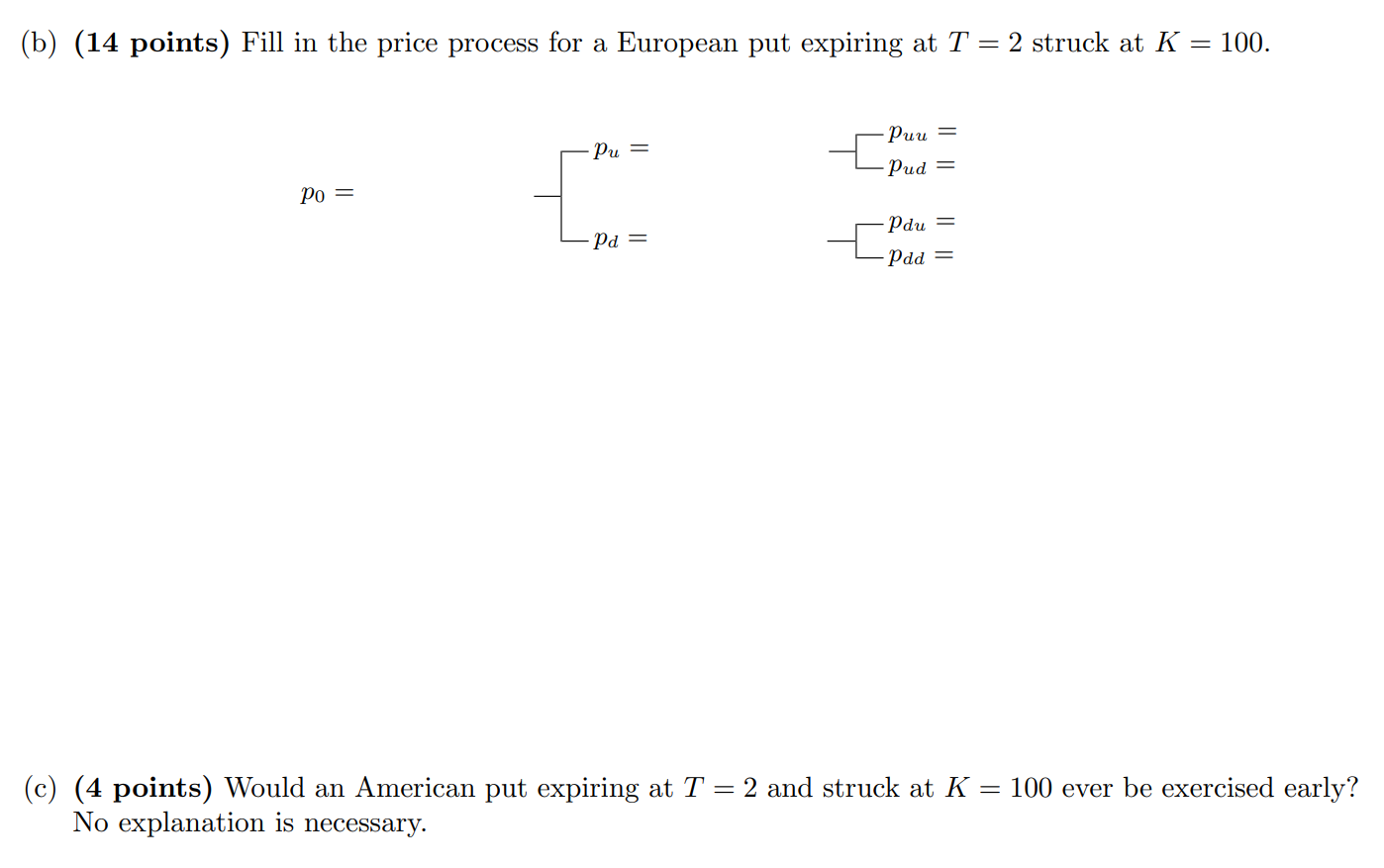

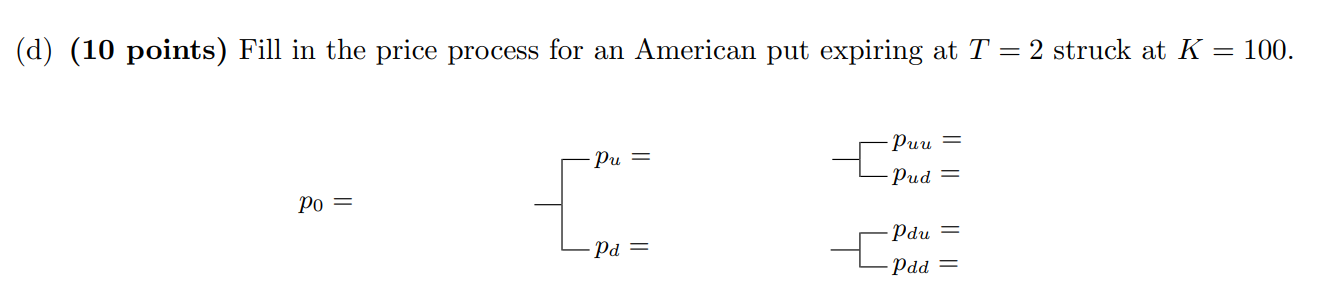

Problem 1 (50 points) Suppose a stock follows the process: 50 = 100 Suppose also that the risk-free rate is 5% per period (constant) and that the stock pays no dividends. (a) (14 points) Find the riskneutral probability of up in every node in the tree. (b) (14 points) Fill in the price process for a European put expiring at T = 2 struck at K = 100. pun = p\" = {pad 2 pa\" = {pdu = (c) (4 points) Would an American put expiring at T = 2 and struck at K = 100 ever be exercised early? No explanation is necessary. (d) (10 points) Fill in the price process for an American put expiring at T = 2 struck at K = 100. _ pun = p\" {pad 2 p0 = m= {W pdd = (e) (4 points) Suppose that the stock has an expected return of 10% in each period. Which of the following is true: (i) the expected return of the European put will be equal to 10%, (ii) the expected return of the European put will be less than 10%, (iii) the expected return of the European put will be greater than 10%, (iv) we don't have enough information to tell. Explain briey. (f) (4 points) Suppose instead of being a stock, the asset was a currency (paying out a positive interest rate). Would the put be more or less valuable? Explain briey

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts