Question: Please help me answer the following Use the compound interest formula to compute the balance in the following account after the stated period of time,

Please help me answer the following

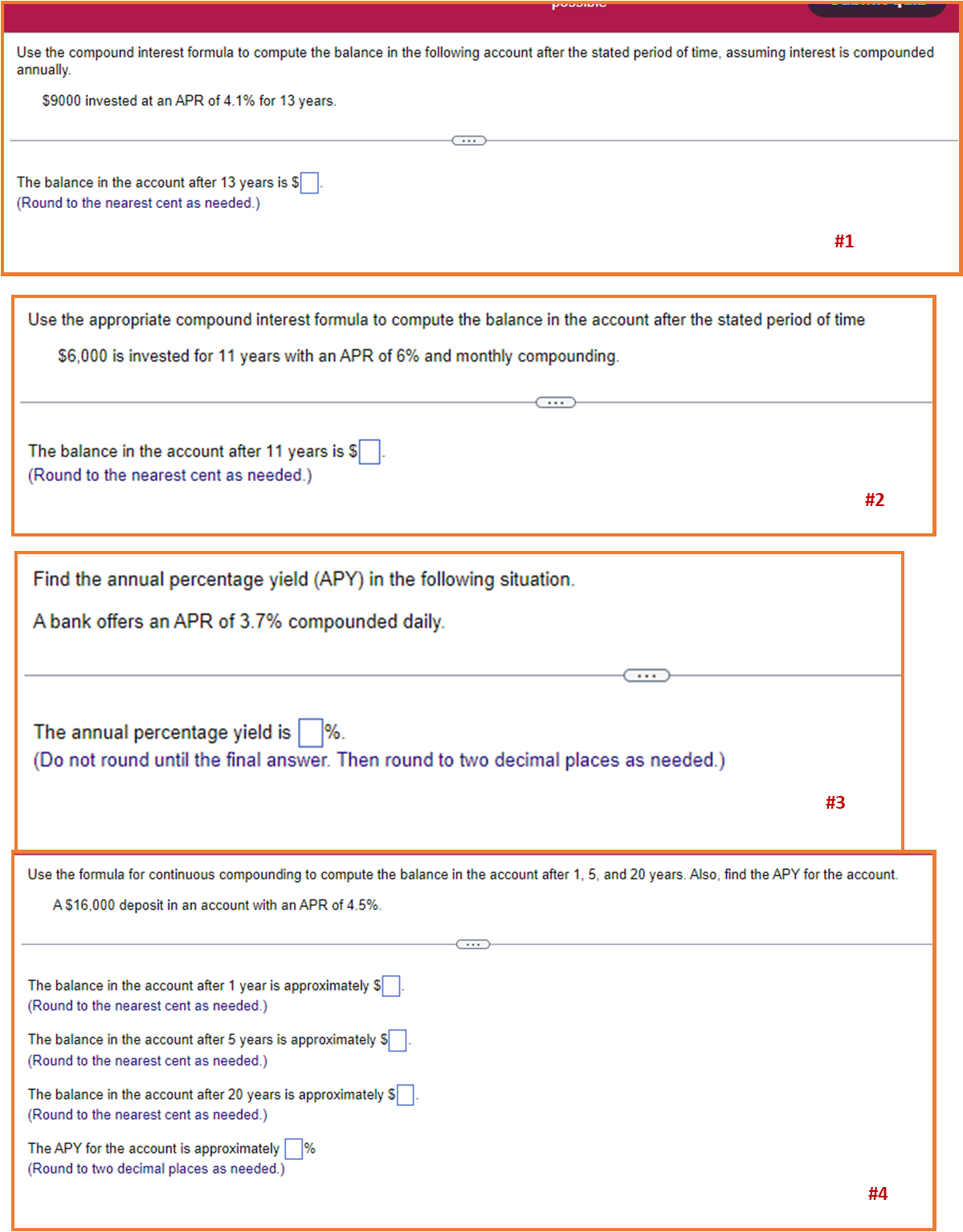

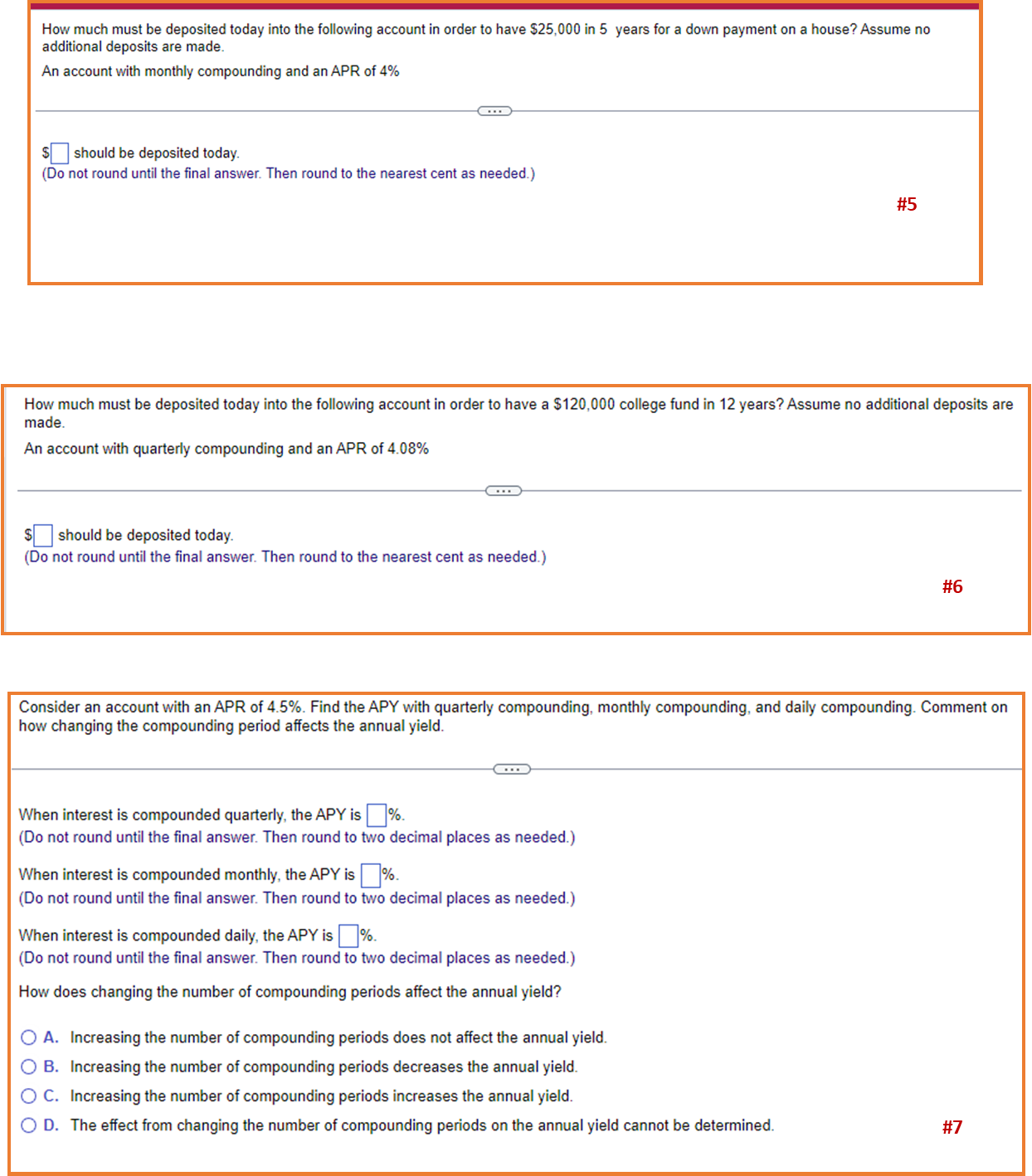

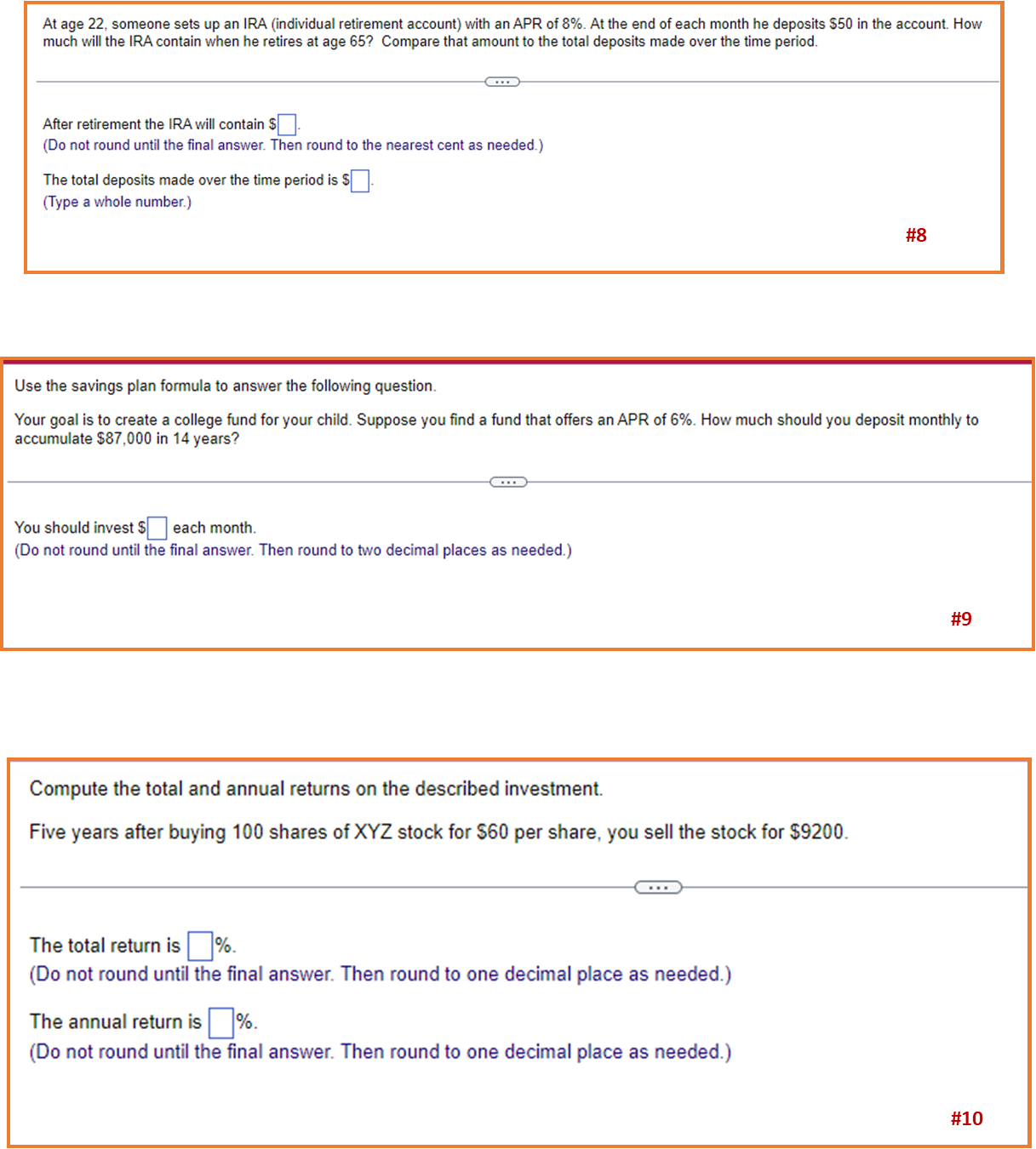

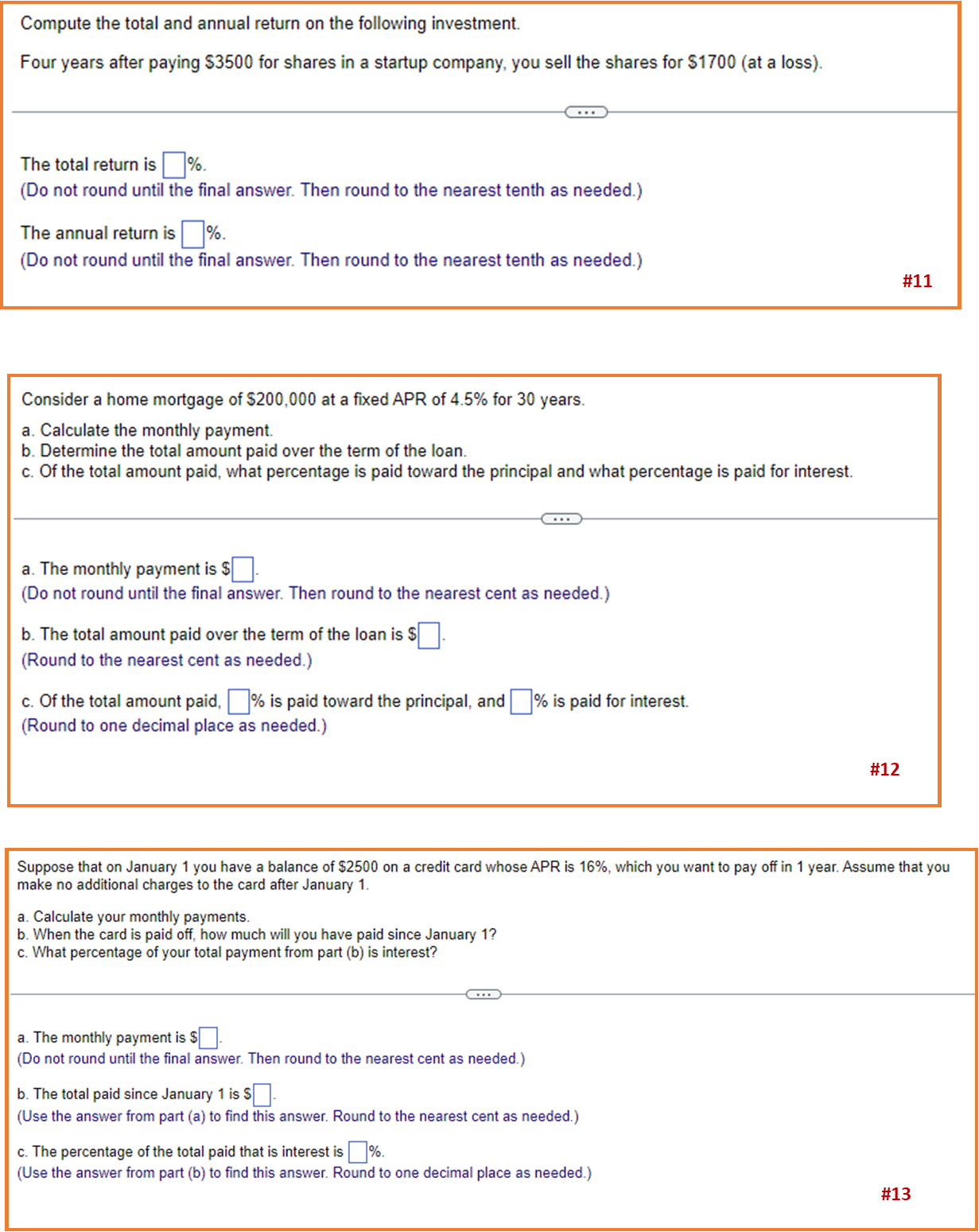

Use the compound interest formula to compute the balance in the following account after the stated period of time, assuming interest is compounded annually. $9000 invested at an APR of 4.1% for 13 years. The balance in the account after 13 years is $]. (Round to the nearest cent as needed.) #1 Use the appropriate compound interest formula to compute the balance in the account after the stated period of time $6,000 is invested for 11 years with an APR of 6% and monthly compounding. The balance in the account after 11 years is $]. (Round to the nearest cent as needed.) #2 Find the annual percentage yield (APY) in the following situation. A bank offers an APR of 3.7% compounded daily. The annual percentage yield is%. (Do not round until the final answer. Then round to two decimal places as needed.) #3 Use the formula for continuous compounding to compute the balance in the account after 1, 5, and 20 years. Also, find the APY for the account. A $16,000 deposit in an account with an APR of 4.5%. The balance in the account after 1 year is approximately $]. (Round to the nearest cent as needed.) The balance in the account after 5 years is approximately $ (Round to the nearest cent as needed.) The balance in the account after 20 years is approximately $] (Round to the nearest cent as needed.) The APY for the account is approximately% Round to two decimal places as needed.) #4How much must be deposited today into the tollowing account in order to have $25,000 in 5 years for a down payment on a house? Assume no additional deposits are made. An account with monthly compounding and an APR of 4% SSE] should be deposited today. (Do not round until the nal answer. Then round to the nearest cent as needed.) How much must be deposited today into the following account in order to have a 3120.000 college fund in 12 years? Assume no additional deposits are made. An account with quarterly compounding and an APR of 4.03% $|:| should be deposited today. (Do not round until the nal answer. Then round to the nearest cent as needed.) Consider an account with an APR of 4.5%. Find the APY with quarterly compounding. monthly compounding. and daily compounding Comment on how changing the compounding period affects the annual yield. When interest is compounded quarterly. the APY is D%. (Do not round until the nal answer. Then round to two decimal places as needed.) When interest is compounded monthly, the APY is |:|% (Do not round until the nal answer. Then round to two decimal places as needed.) When interest is compounded daily. the APY is [1%. (Do not round until the nal answer. Then round to two decimal places as needed.) How does changing the number of compounding periods affect the annual yield? . Increasing the number of compounding periods does not affect the annual yield. . Increasing the number of compounding periods decreases the annual yield. . Increasing the number of compounding periods increases the annual yield. . The effect from changing the number of compounding periods on the annual yield cannot be determined. At age 22. someone sets up an IRA (individual retirement account) with an APR of 8%. At the end of each month he deposits $50 in the account. How much will the IRA contain when he retires at age 65? Compare that amount to the total deposits made over the time period. E> After retirement the IRA will contain $|:]. (Do not round until the nal answer. Then round to the nearest cent as needed} The total deposits made over the time period is 5|]. (Type a whole number.) Use the savings plan formula to answer the following question. Your goal is to create a college fund for your child. Suppose you nd a fund that oers an APR of 6%. How much should you deposit monthly to accumulate $8?,000 in 14 years? You should invest 5D each month. (Do not round until the nal answer. Then round to two decimal places as needed.) Compute the total and annual returns on the described investment. Five years after buying 100 shares of XYZ stock for $60 per share. you sell the stock for $9200. (E The total return is [3%. (Do not round until the nal answer. Then round to one decimal place as needed.) The annual return is [1%. (Do not round until the nal answer. Then round to one decimal place as needed.) Compute the total and annual return on the following investment. Four years after paying $3500 for shares in a startup company. you sell the shares for $1700 (at a loss). The total return is |:|%. (Do not round until the nal answer. Then round to the nearest tenth as needed.) The annual return is [1%. (Do not round until the nal answer. Then round to the nearest tenth as needed.) Consider a home mortgage of $200.000 at a fixed APR 014.5% for 30 years. a. Calculate the monthly payment. b. Determine the total amount paid over the term of the loan. c. Of the total amount paid. what percentage is paid toward the principal and what percentage is paid for interest. E) a. The monthly payment is SD. (Do not round until the nal answer. Then round to the nearest cent as needed.) b. The total amount paid over the term of the loan is SD. (Round to the nearest cent as needed.) c. 0f the total amount paid. [1% is paid toward the principal. and |:|% is paid for interest. (Round to one decimal place as needed.) Suppose that on January 1 you have a balance of $2500 on a credit card whose APR is 16%. which you want to pay o in 1 year. Assume that you make no additional charges to the card after January 1. 3. Calculate your monthly payments. b. When the card is paid off, how much will you have paid since January 1? c. What percentage of your total payment from pan (b) is interest? a. The monthly payment is $|:|. (Do not round until the nal answer. Then round to the nearest cent as needed.) b. The total paid since January 1 is SD. (Use the answer from part (a) to nd this answer. Round to the nearest cent as needed.) c. The percentage of the total paid that is interest is |:|%. (Use the answer from part (b) to find this answer. Round to one decimal place as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts