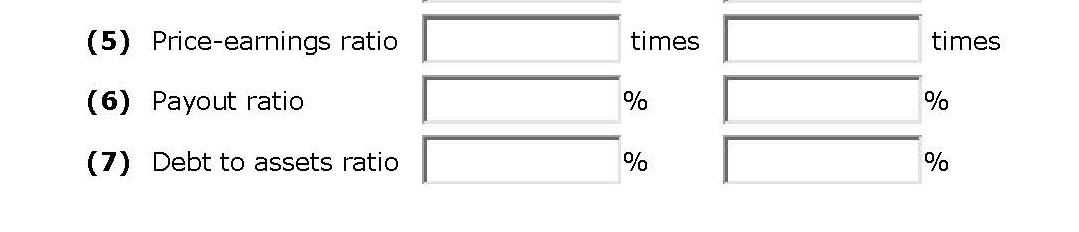

Question: Please help me answer the last 3 questions below, 5-7. Problem 18-03A a Condensed balance sheet and income statement data for Jergan Corporation are presented

Please help me answer the last 3 questions below, 5-7.

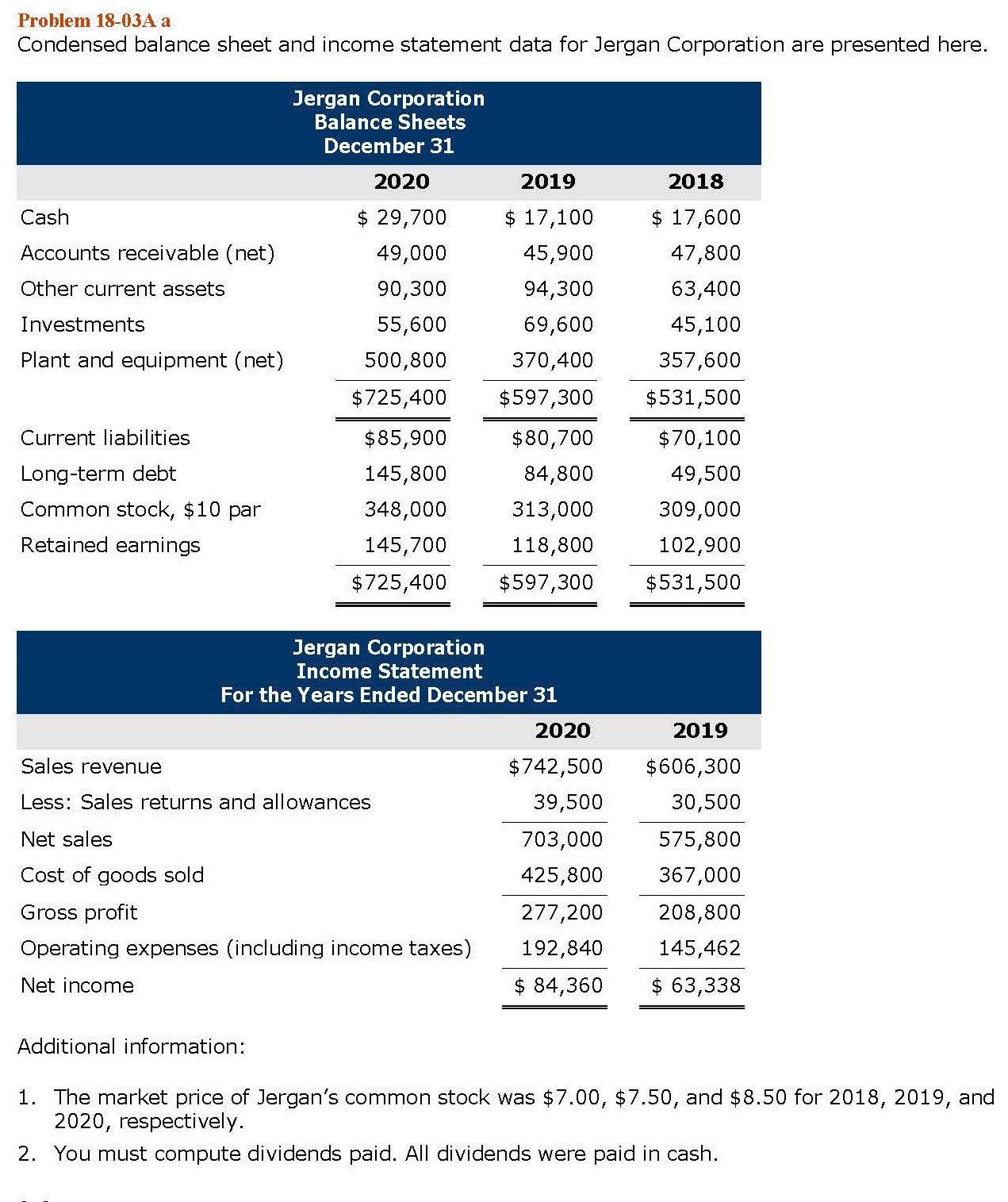

Problem 18-03A a Condensed balance sheet and income statement data for Jergan Corporation are presented here. Jergan Corporation Balance Sheets December 31 2020 2019 2018 Cash $ 29,700 $ 17,100 $ 17,600 Accounts receivable (net) 49,000 45,900 47,800 Other current assets 90,300 94,300 63,400 Investments 55,600 69,600 45,100 Plant and equipment (net) 500,800 370,400 357,600 $725,400 $597,300 $531,500 Current liabilities $85,900 $80,700 $70,100 Longterm debt 145,800 84,800 49,500 Common stock, $10 par 348,000 313,000 309,000 Retained earnings 145,700 118,800 102,900 $725,400 $597,300 $531,500 Jergan Corporation Income Statement For the Years Ended December 31 2020 2019 Sales revenue $742,500 $606,300 Less: Sales returns and allowances 39,500 30,500 Net sales 703,000 575,800 Cost of goods sold 425,800 367,000 Gross profit 277,200 208,800 Operating expenses (including income taxes) 192,840 145,462 Net income $ 84,360 $ 63,338 Additional information: 1. The market price of Jergan's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 2. You must compute dividends paid. All dividends were paid in cash. (5) Priceearnings ratio I times I times (6) Payout ratio I % I % (7) Debt to assets ratio I % I %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts