Question: Please help me answer the whole problem. Thank you! Indigo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2021, the

Please help me answer the whole problem. Thank you!

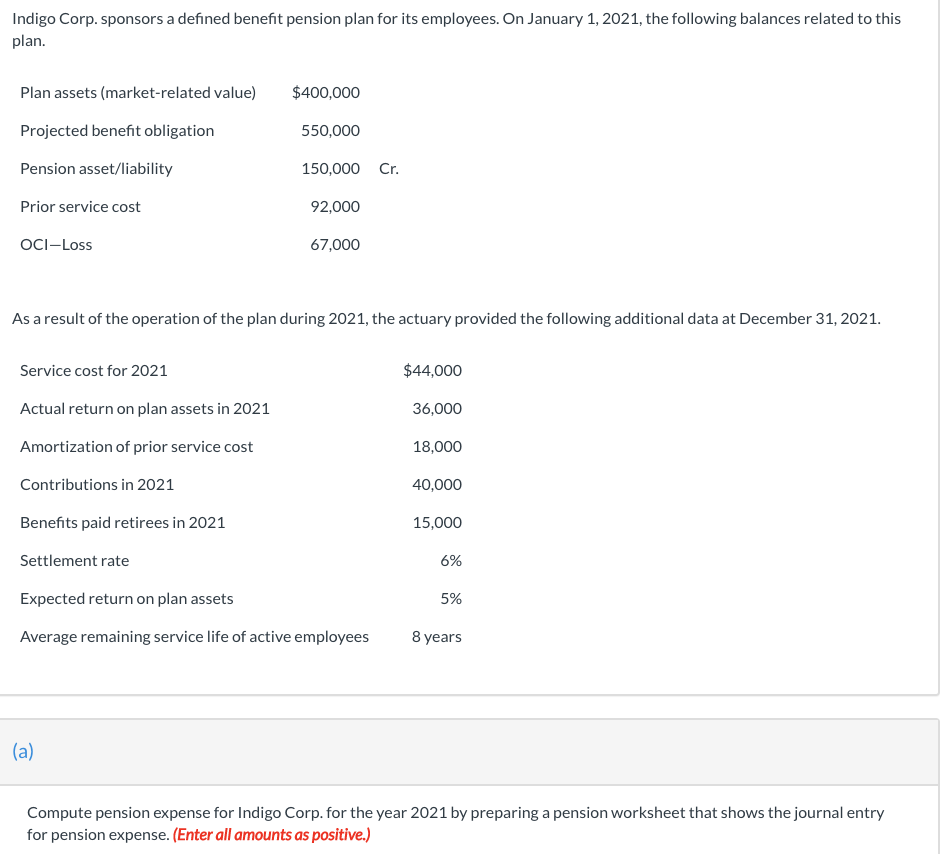

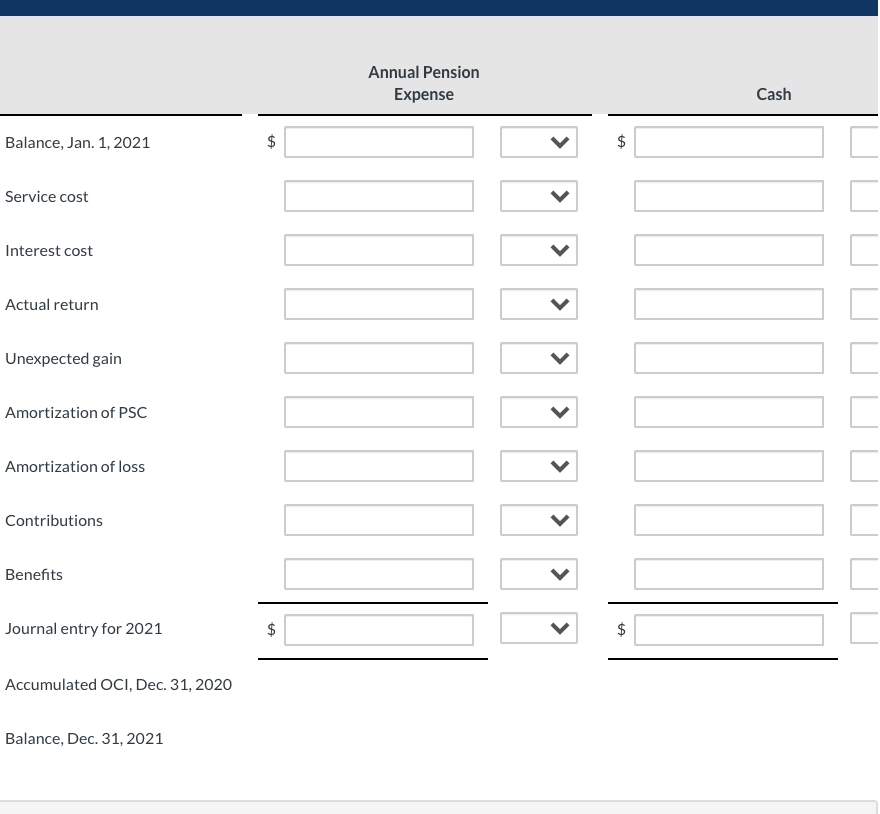

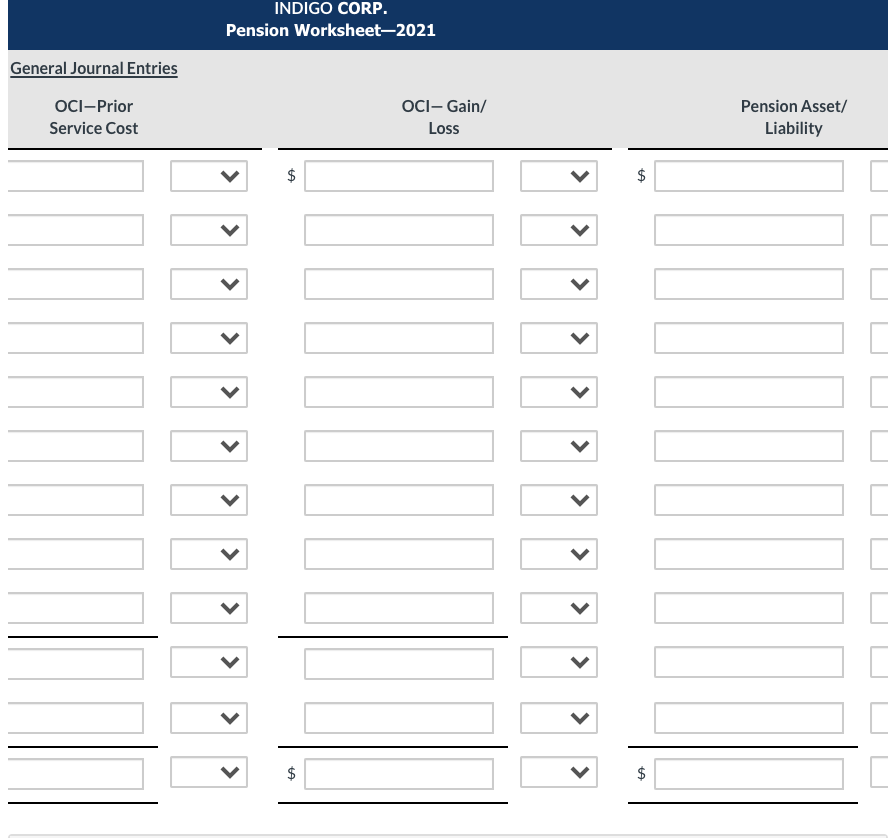

Indigo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2021, the following balances related to this plan. Plan assets (market-related value) $400,000 550,000 Projected benefit obligation Pension asset/liability 150,000 Cr. Prior service cost 92,000 OCI-Loss 67,000 As a result of the operation of the plan during 2021, the actuary provided the following additional data at December 31, 2021. Service cost for 2021 $44,000 Actual return on plan assets in 2021 36,000 Amortization of prior service cost 18,000 Contributions in 2021 40,000 Benefits paid retirees in 2021 15,000 Settlement rate 6% 5% Expected return on plan assets Average remaining service life of active employees 8 years (a) Compute pension expense for Indigo Corp. for the year 2021 by preparing a pension worksheet that shows the journal entry for pension expense. (Enter all amounts as positive.) Annual Pension Expense Cash Balance, Jan. 1, 2021 $ $ Service cost Amortization of PSC > Amortization of loss Contributions $ Accumulated OCI, Dec. 31, 2020 Balance, Dec. 31, 2021 INDIGO CORP. Pension Worksheet-2021 General Journal Entries OCI-Prior Service Cost OCI- Gain/ Loss Pension Asset/ Liability $ $ > > > > > > > > > > > > $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts