Question: please help me answer these 3 questions by 9pm tonight!! QUESTION 1 Martin, a single taxpayer, earns $96,000 per year in taxable income. What is

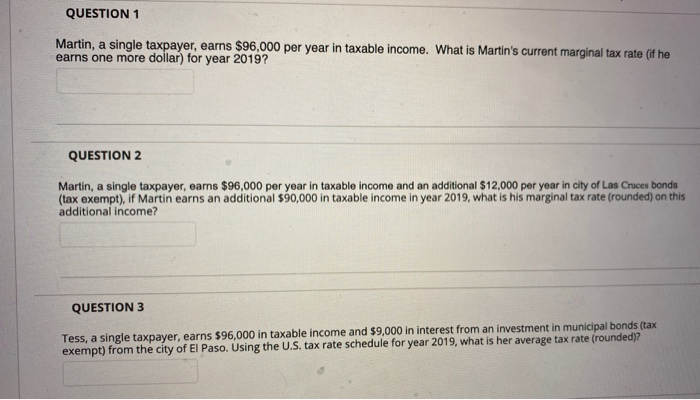

QUESTION 1 Martin, a single taxpayer, earns $96,000 per year in taxable income. What is Martin's current marginal tax rate (if he earns one more dollar) for year 2019? QUESTION 2 Martin, a single taxpayer, earns $96,000 per year in taxable income and an additional $12,000 per year in city of Las Cruces bonds (tax exempt), if Martin earns an additional $90,000 in taxable income in year 2019, what is his marginal tax rate (rounded) on this additional income? QUESTION 3 Tess, a single taxpayer, earns $96,000 in taxable income and $9,000 in interest from an investment in municipal bonds (tax exempt) from the city of El Paso. Using the U.S. tax rate schedule for year 2019, what is her average tax rate (rounded)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts