Question: Please help me answer these multi choice questions, thanks! (all info provided) Good-Names Co. is deciding how to best use their engineers for the projects

Please help me answer these multi choice questions, thanks! (all info provided)

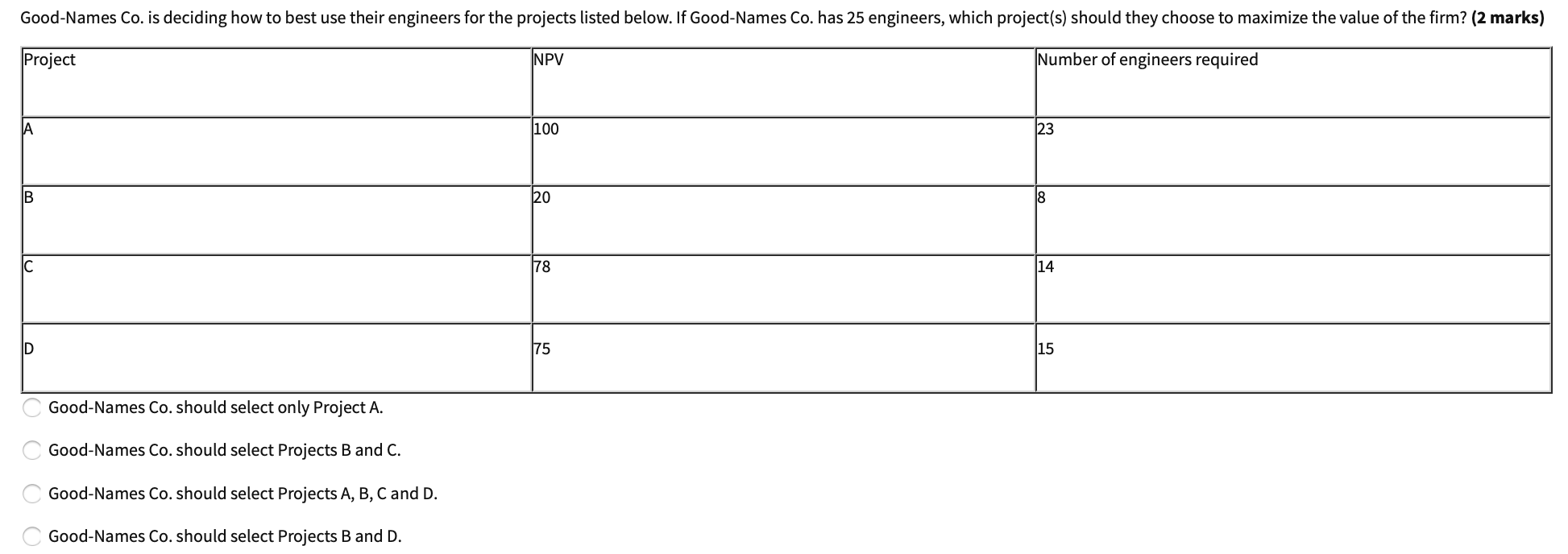

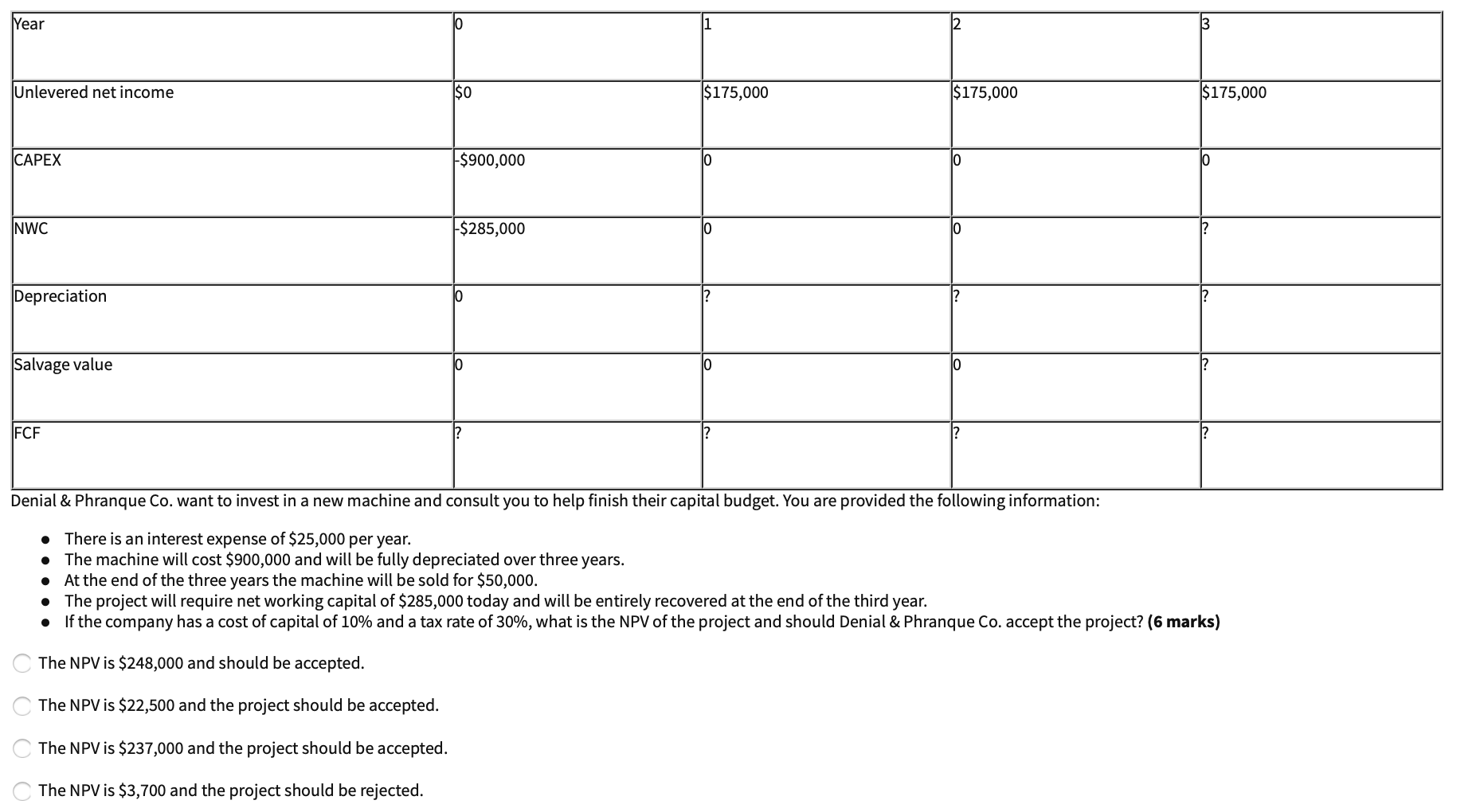

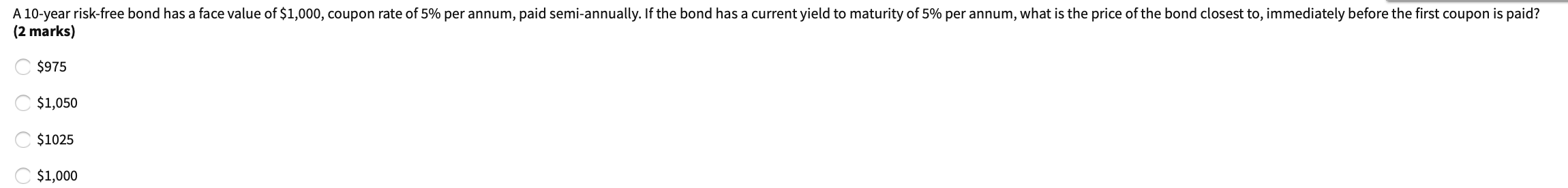

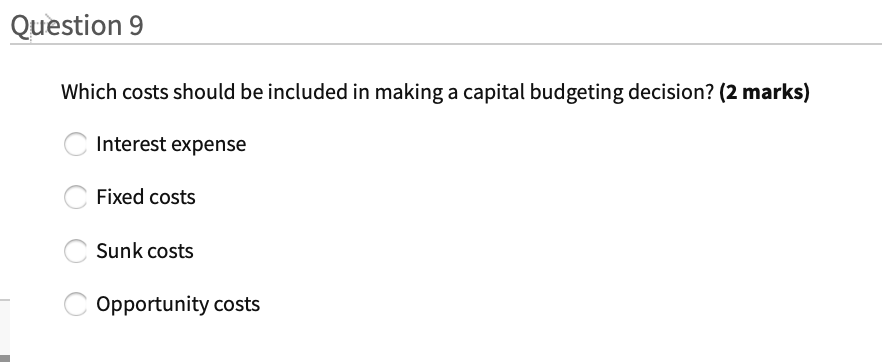

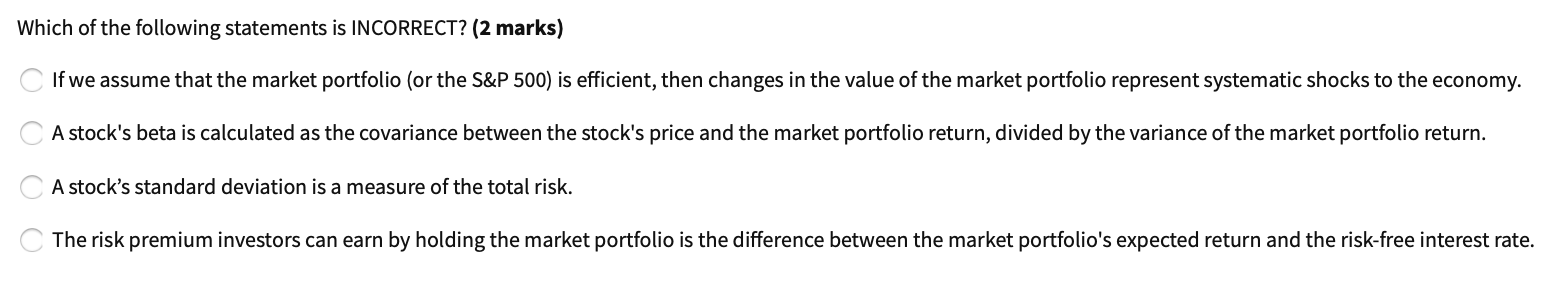

Good-Names Co. is deciding how to best use their engineers for the projects listed below. If Good-Names Co. has 25 engineers, which project(s) should they choose to maximize the value of the firm? (2 marks) Project NPV Number of engineers required A 100 23 B 20 8 C 78 14 D 75 15 Good-Names Co. should select only Project A. Good-Names Co. should select Projects B and C. Good-Names Co. should select Projects A, B, C and D. Good-Names Co. should select Projects B and D. Year 0 2 3 Unlevered net income so $175,000 $175,000 $175,000 CAPEX -$900,000 0 0 0 NWC $285,000 0 0 Depreciation Salvage value 0 FCF Denial & Phranque Co. want to invest in a new machine and consult you to help finish their capital budget. You are provided the following information: There is an interest expense of $25,000 per year. . The machine will cost $900,000 and will be fully depreciated over three years. At the end of the three years the machine will be sold for $50,000. The project will require net working capital of $285,000 today and will be entirely recovered at the end of the third year. . . If the company has a cost of capital of 10% and a tax rate of 30%, what is the NPV of the project and should Denial & Phranque Co. accept the project? (6 marks) The NPV is $248,000 and should be accepted. The NPV is $22,500 and the project should be accepted. The NPV is $237,000 and the project should be accepted. The NPV is $3,700 and the project should be rejected.A 10-year risk-free bond has a face value of $1,000, coupon rate of 5% per annum, paid semi-annually. If the bond has a current yield to maturity of 5% per annum, what is the price of the bond closest to, immediately before the first coupon is paid? (2 marks) $975 C $1,050 C$1025 $1,000Question 9 Which costs should be included in making a capital budgeting decision? (2 marks) Interest expense C Fixed costs Sunk costs Opportunity costsWhich of the following statements is INCORRECI'? (2 marks) A If we assume that the market portfolio {or the S&P 500) is efficient, then changes in the value of the market portfolio represent systematic shocks to the economy. A A stock's beta is calculated as the covariance between the stock's price and the market portfolio return, divided by the variance of the market portfolio return. A A stock's standard deviation is a measure of the total risk. A The risk premium investors can earn by holding the market portfolio is the difference between the market portfolio's expected return and the risk-free interest rate