Question: please help me answer these questions, I provided all the information. thank you You are the financial analyst of the Management and Budgeting Oftice (MBO)

please help me answer these questions, I provided all the information. thank you

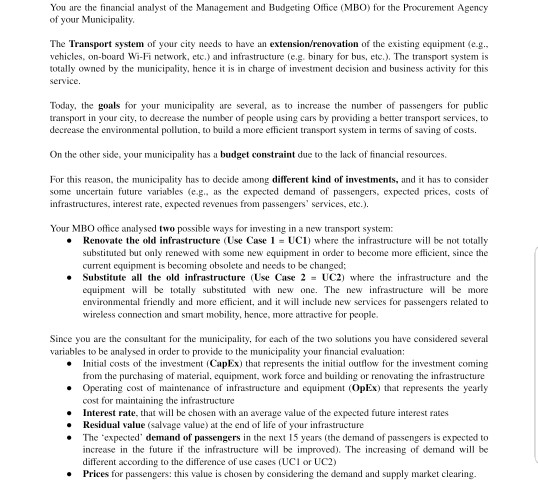

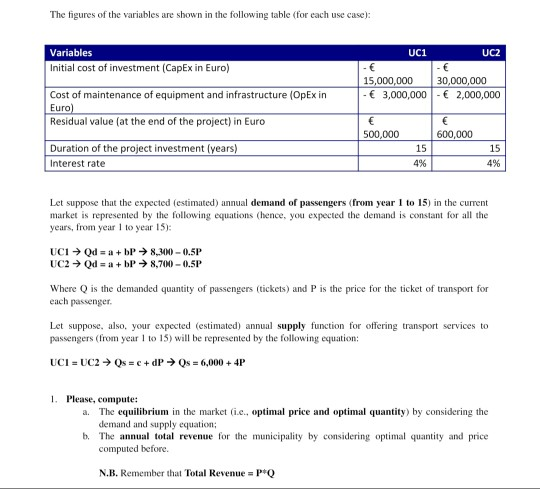

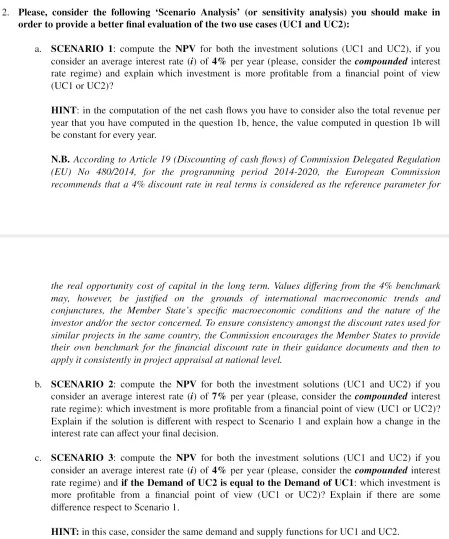

You are the financial analyst of the Management and Budgeting Oftice (MBO) for the Procurement Agency of your Municipality The Transport system of your city needs to have an extension/renovation of the existing equipment (eg vehicles, on-board Wi-Fi network, etc.) and infrastructure (e.g. binary for bus, etc). The transport system is totally owned by the municipality, hence it is in charge of investment decision and business activity for this service Today, the goals for your municipality are several, as to increase the number of passengers for public transport in your city, to decrease the number of people using cars by providing a better transport services, to decrease the environmental pollution, to build a more efficient transport system in terms of saving of costs On the other side, your municipality has a budget constraint due to the lack of financial resources For this reason, the municipality has to decide among different kind of investments, ad has to consider some uncertain future variables (e.g., as the expected demand of passengers, expected prices, costs of infrastructures, interest rate, expected revenues from passengers services, etc.) Your MBO oflice analysed two possible ways for investing in a new transport system: Renovate the old infrastructure (Use Case 1 = UCI, where the infrastructure will be not totally substituted but only renewed with some new equipment in order to become more efficient, since the current equipment is becoming obsolete and needs to be changed: Substitute all the old infrastructure (Use Case 2-UC2) where the infrastructure and the equipment will be totally substituted with new one. The new infrastructure will be more environmental friendly and more efficient, and twll include new services for passengers related to wireless connection and smart mobility, hence, more attractive for people. * Since you are the consultant for the municipality, for each of the two solutions you have considered several variables to be analysed in order to provide to the municipality your financial evaluation: Initial costs of the investment i CapEx) that represents the initial outflow for the investment coming from the purchasing of material, equipment, work force and building or renovating the infrastructure Operating cost of maintenance of infrastructure and equipment (OpEx) that represents the yearly cost for maintaining the infrastructure Interest rate, that l be chosen with an average value of the expected future interest rates Residual value (salvage value) at the end of life of your infrastructure The 'expected' demnd of passengers in the next 15 years the demand of passengers is expected to increase in the future if the infrastructure wl be improved). The increasing of demand will be different according to the difference of use cases (UCI or UC2) Prices for passengers: this value is chosen by considering the demand and supply market clearing. * The figures of the variables are shown in the following table (for each use case): Variables UC1 UC2 Initial cost of investment (CapEx in Euro) Cost of maintenance of equipment and infrastructure (OpEx in Residual value (at the end of the project) in Euro Duration of the project investment (years) 15,000,000 30,000,000 3,000,000 2,000,000 500,000 600,000 15 4% 15 4% Interest rate Let suppose that the expected (estimated) annual demand of passengers (from year 1 to 15) in the current market is represented by the following equations (hence, you expected the demand is constant for all the years, from year 1 to year 15): UC2Qd-abP 8,700-0.5P Where Q is the demanded quantity of passengers (tickets) and P is the price for the ticket of transport for each passenger Let suppose, also, your expected (estimated) annual supply function for offering transport services to passengers (rom year o 15) will be represented by the following equation: . Please, compute: a. The equilibrium in the market (ie., optimal price and optimal quantity) by considering the demand and supply equation computed before. N.B. Remember that Total Revenue b. The annua total revenue for the municipality by considering optimal quantity and price PQ 2. Please, consider the following Scenario Analysis' (or sensitivity analysis) you should make in order to provide a better final evaluation of the two use cases (UCI and UC2): a. SCENARIO 1: compute the NPV for both the investment solutionsStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts