Question: PLEASE HELP ME ANSWER THESE QUESTIONS. I REALLY APPRECIATE IT. THANK YOU!! Q1-3. A hedge fund manager is managing a portfolio of stocks (E) and

PLEASE HELP ME ANSWER THESE QUESTIONS. I REALLY APPRECIATE IT. THANK YOU!!

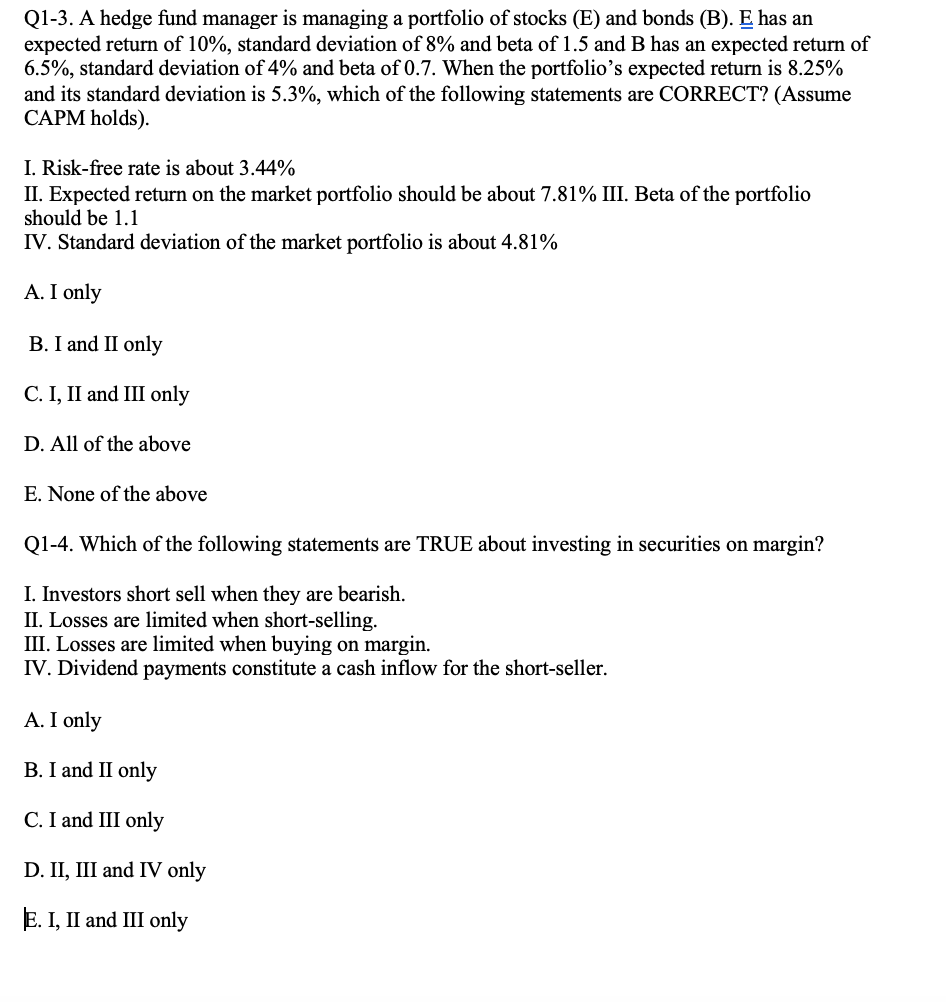

Q1-3. A hedge fund manager is managing a portfolio of stocks (E) and bonds (B). E has an expected return of 10%, standard deviation of 8% and beta of 1.5 and B has an expected return of 6.5%, standard deviation of 4% and beta of 0.7. When the portfolio's expected return is 8.25% and its standard deviation is 5.3%, which of the following statements are CORRECT? (Assume CAPM holds). I. Risk-free rate is about 3.44% II. Expected return on the market portfolio should be about 7.81% III. Beta of the portfolio should be 1.1 IV. Standard deviation of the market portfolio is about 4.81% A. I only B. I and II only C. I, II and III only D. All of the above E. None of the above Q1-4. Which of the following statements are TRUE about investing in securities on margin? I. Investors short sell when they are bearish. II. Losses are limited when short-selling. III. Losses are limited when buying on margin. IV. Dividend payments constitute a cash inflow for the short-seller. A. I only B. I and II only C. I and III only D. II, III and IV only E. I, II and III only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts