Question: Please help me answer these questions QUESTION 23 Taxpayer sells a building, land, and equipment for $2 million. The building had basis of $500,000 and

Please help me answer these questions

Please help me answer these questions

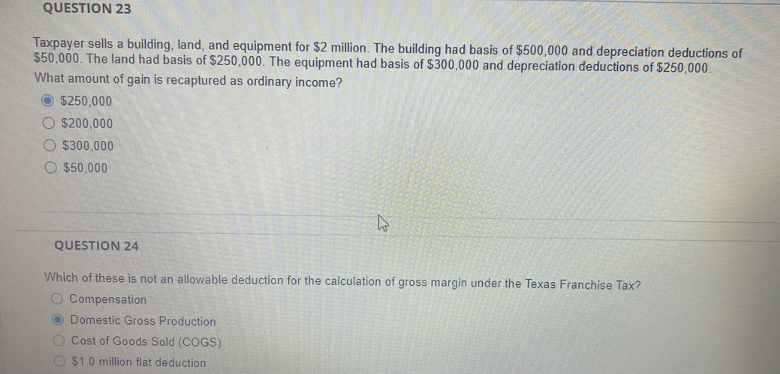

QUESTION 23 Taxpayer sells a building, land, and equipment for $2 million. The building had basis of $500,000 and depreciation deductions of $50,000. The land had basis of $250,000. The equipment had basis of $300,000 and depreciation deductions of $250,000 What amount of gain is recaptured as ordinary income? $250,000 $200,000 $300,000 $50,000 ho QUESTION 24 Which of these is not an allowable deduction for the calculation of gross margin under the Texas Franchise Tax? Compensation Domestic Gross Production Cost of Goods Sold (COGS) $1.0 million flat deduction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock