Question: Please help me answer these questions with formulas to help better my understanding. ACCT 285 SPRING 2022 Spreadsheet Project - Spring 2022 DUE DATE: FRIDAY,

Please help me answer these questions with formulas to help better my understanding.

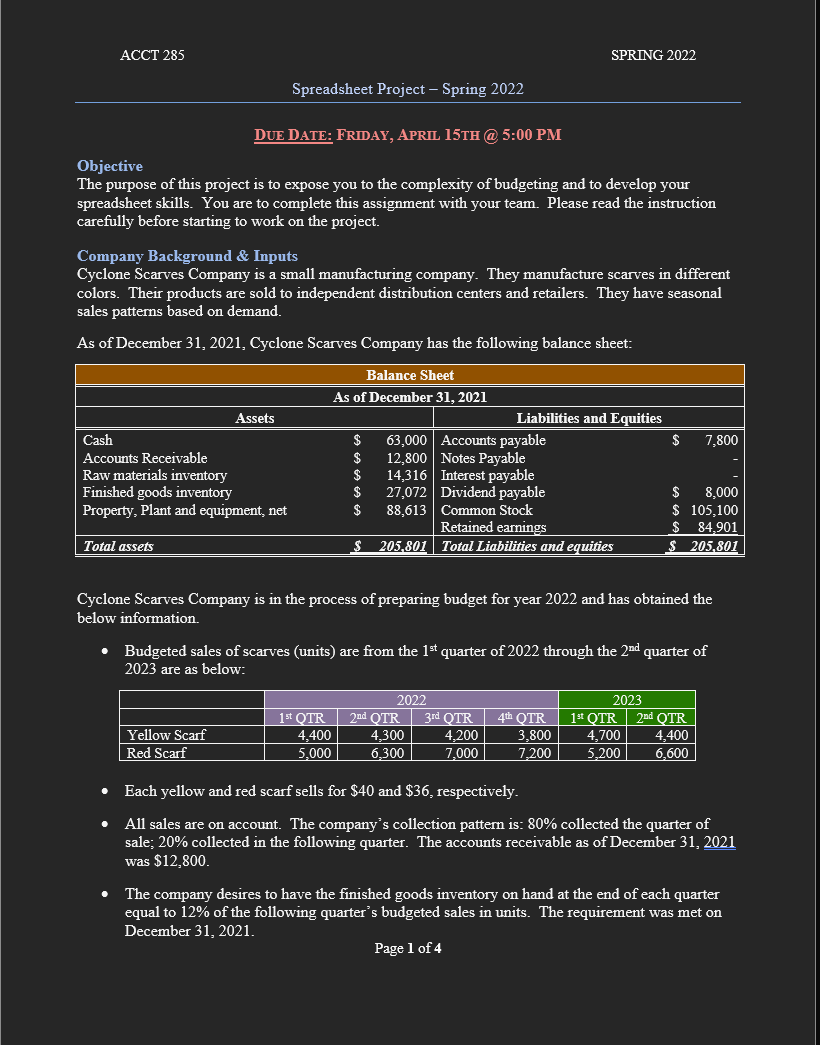

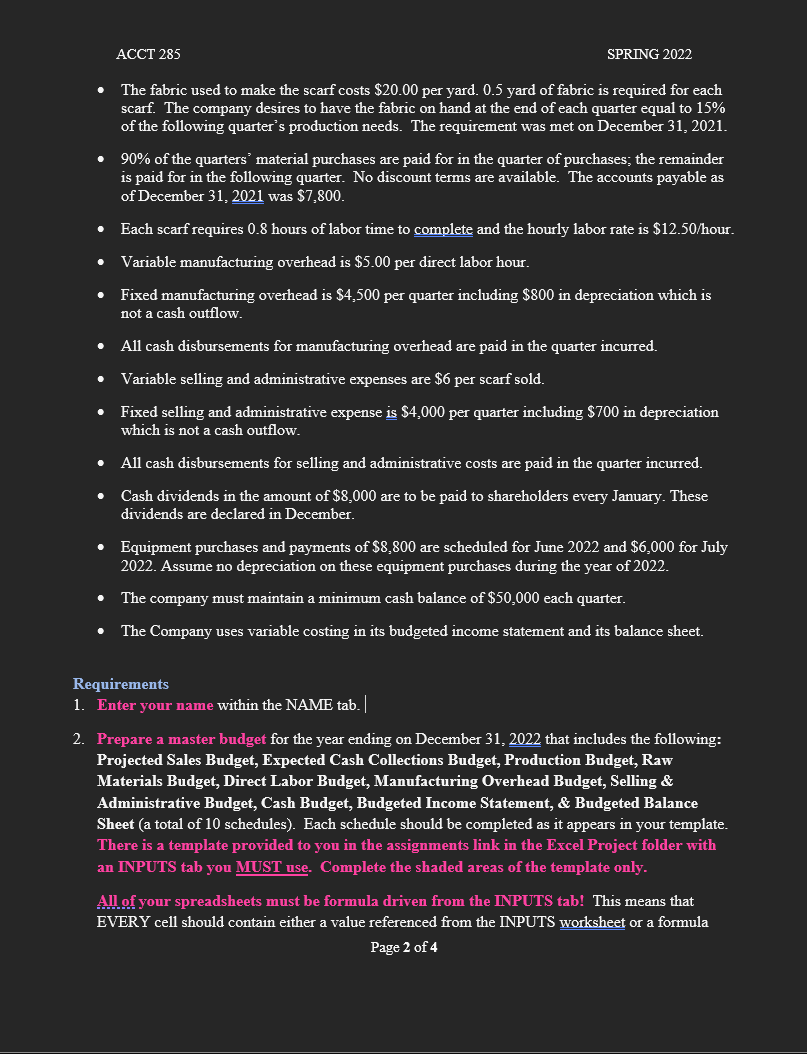

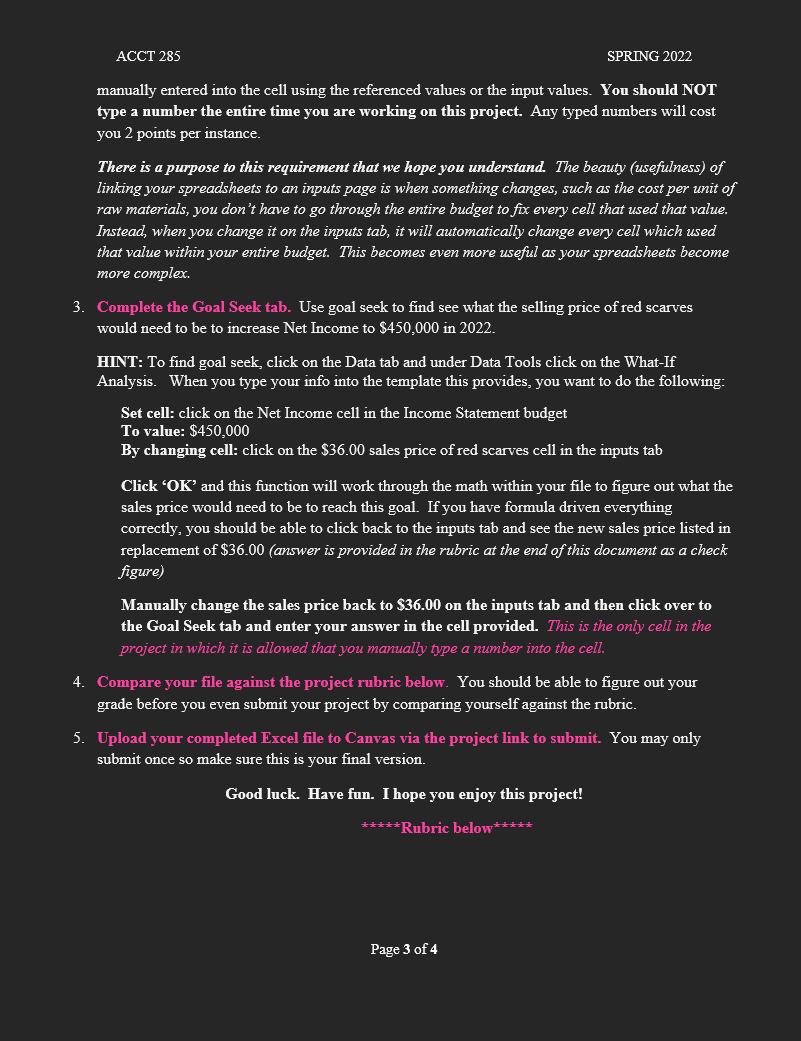

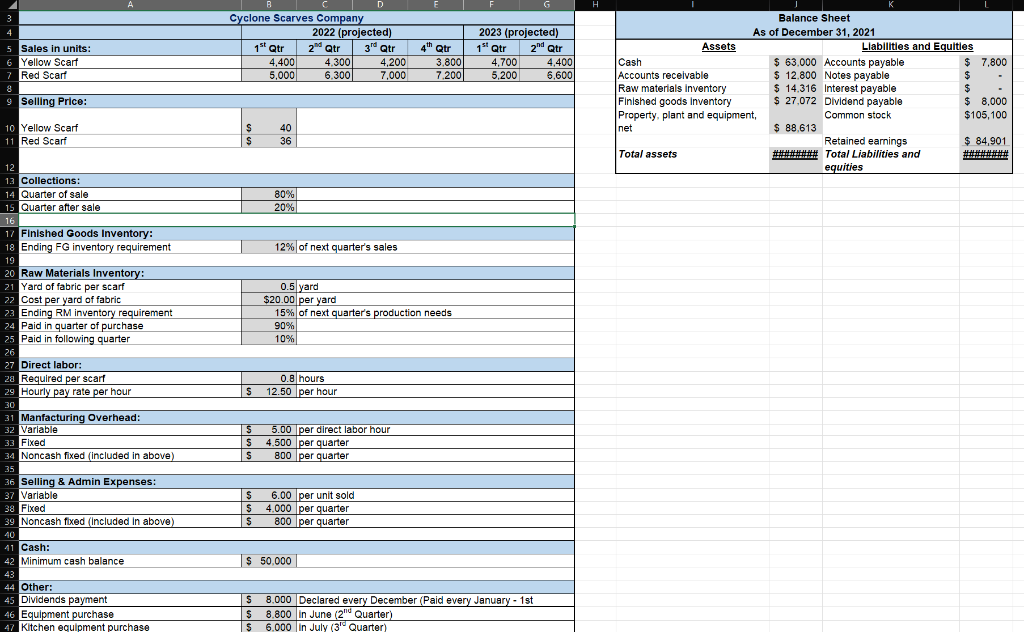

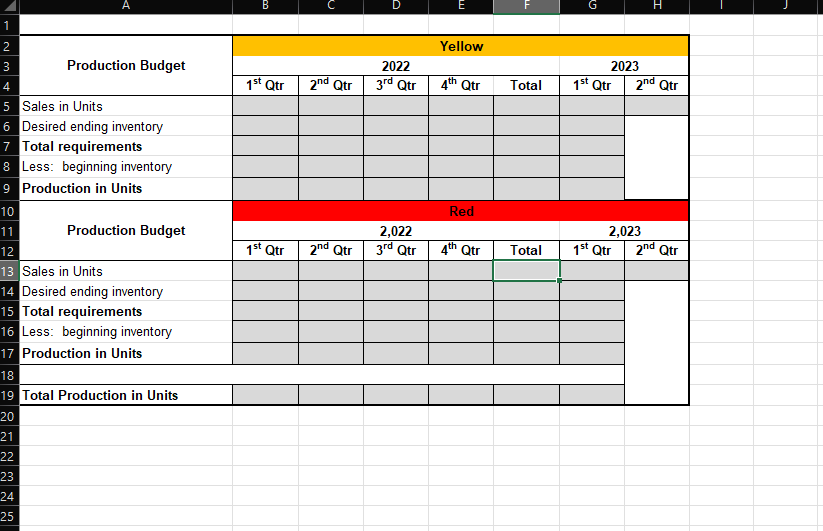

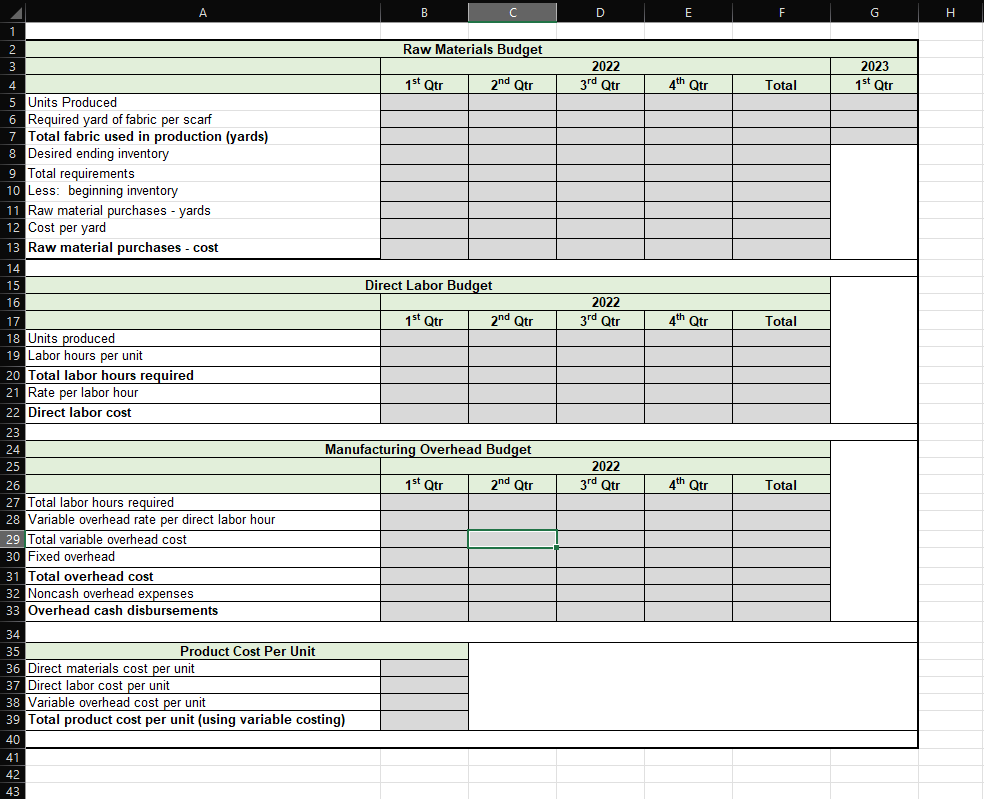

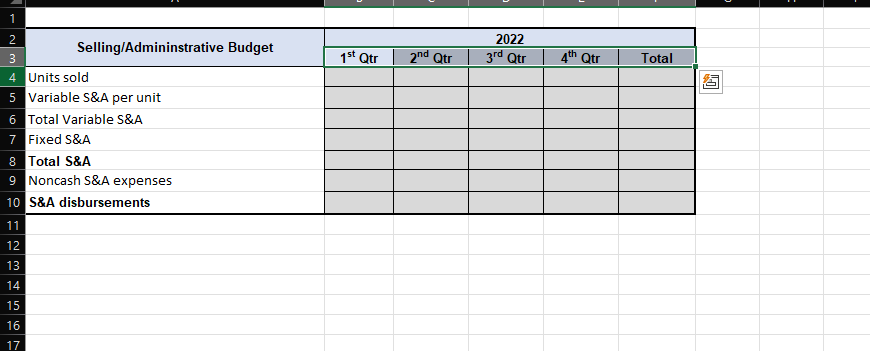

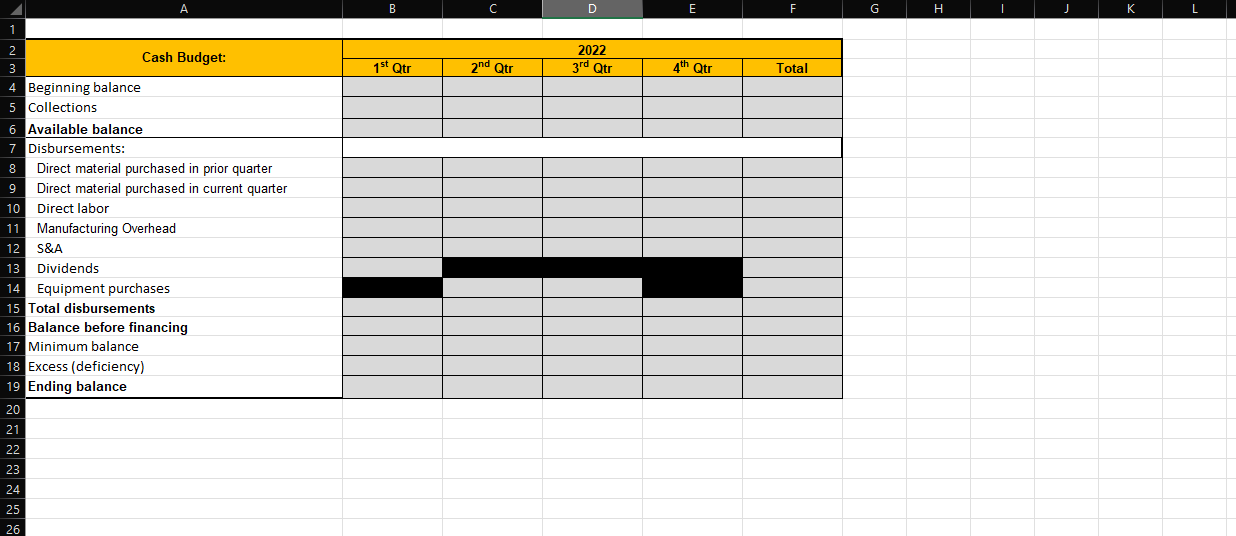

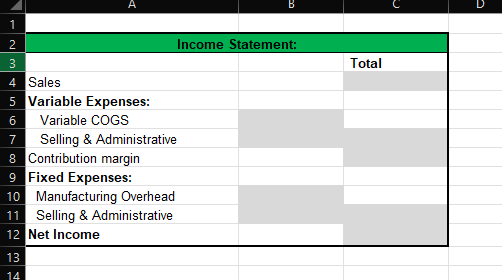

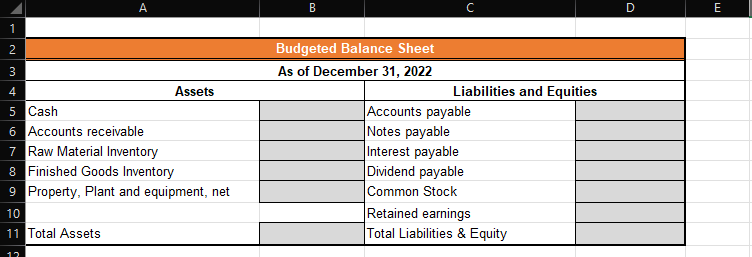

ACCT 285 SPRING 2022 Spreadsheet Project - Spring 2022 DUE DATE: FRIDAY, APRIL 15TH @ 5:00 PM Objective The purpose of this project is to expose you to the complexity of budgeting and to develop your spreadsheet skills. You are to complete this assignment with your team. Please read the instruction carefully before starting to work on the project. Company Background & Inputs Cyclone Scarves Company is a small manufacturing company. They manufacture scarves in different colors. Their products are sold to independent distribution centers and retailers. They have seasonal sales patterns based on demand. As of December 31, 2021, Cyclone Scarves Company has the following balance sheet: Balance Sheet 7,800 Assets Cash Accounts Receivable Raw materials inventory Finished goods inventory Property, Plant and equipment, net As of December 31, 2021 Liabilities and Equities $ 63,000 Accounts payable $ 12,800 Notes Payable $ 14,316 Interest payable 27,072 Dividend payable $ 88,613 Common Stock Retained earnings $ 205,801 Total Liabilities and equities $ 8,000 $ 105,100 $ 84,901 $ 205,801 Total assets Cyclone Scarves Company is in the process of preparing budget for year 2022 and has obtained the below information. Budgeted sales of scarves (units) are from the 1st quarter of 2022 through the 2nd quarter of 2023 are as below: 2023 Yellow Scarf Red Scarf 2022 1st QTR 2nd QTR 3rd QTR 4.400 4,300 4,200 5,000 6,300 7,000 4th QTR 3,800 7,200 1st QTR 4,700 5,200 2nd QTR 4,400 6,600 Each yellow and red scarf sells for $40 and $36, respectively. All sales are on account. The company's collection pattern is: 80% collected the quarter of sale: 20% collected in the following quarter. The accounts receivable as of December 31, 2021 was $12,800. The company desires to have the finished goods inventory on hand at the end of each quarter equal to 12% of the following quarter's budgeted sales in units. The requirement was met on December 31, 2021. Page 1 of 4 ACCT 285 SPRING 2022 . The fabric used to make the scarf costs $20.00 per yard. 0.5 yard of fabric is required for each scarf. The company desires to have the fabric on hand at the end of each quarter equal to 15% of the following quarter's production needs. The requirement was met on December 31, 2021. 90% of the quarters' material purchases are paid for in the quarter of purchases, the remainder is paid for in the following quarter. No discount terms are available. The accounts payable as of December 31, 2021 was $7,800. Each scarf requires 0.8 hours of labor time to complete and the hourly labor rate is $12.50/hour. Variable manufacturing overhead is $5.00 per direct labor hour. Fixed manufacturing overhead is $4,500 per quarter including $800 in depreciation which is not a cash outflow. All cash disbursements for manufacturing overhead are paid in the quarter incurred. Variable selling and administrative expenses are $6 per scarf sold. Fixed selling and administrative expense is $4,000 per quarter including $700 in depreciation which is not a cash outflow. All cash disbursements for selling and administrative costs are paid in the quarter incurred. Cash dividends in the amount of $8,000 are to be paid to shareholders every January. These dividends are declared in December. Equipment purchases and payments of $8,800 are scheduled for June 2022 and $6,000 for July 2022. Assume no depreciation on these equipment purchases during the year of 2022. The company must maintain a minimum cash balance of $50,000 each quarter. The Company uses variable costing in its budgeted income statement and its balance sheet. . . Requirements 1. Enter your name within the NAME tab. 2. Prepare a master budget for the year ending on December 31, 2022 that includes the following: Projected Sales Budget, Expected Cash Collections Budget, Production Budget, Raw Materials Budget, Direct Labor Budget, Manufacturing Overhead Budget, Selling & Administrative Budget, Cash Budget, Budgeted Income Statement, & Budgeted Balance Sheet (a total of 10 schedules). Each schedule should be completed as it appears in your template. There is a template provided to you in the assignments link in the Excel Project folder with an INPUTS tab you MUST use. Complete the shaded areas of the template only. All of your spreadsheets must be formula driven from the INPUTS tab! This means that EVERY cell should contain either a value referenced from the INPUTS worksheet or a formula Page 2 of 4 ACCT 285 SPRING 2022 manually entered into the cell using the referenced values or the input values. You should NOT type a number the entire time you are working on this project. Any typed numbers will cost you 2 points per instance. There is a purpose to this requirement that we hope you understand. The beauty (usefulness) of linking your spreadsheets to an inputs page is when something changes, such as the cost per unit of raw materials, you don't have to go through the entire budget to fix every cell that used that value. Instead, when you change it on the inputs tab, it will automatically change every cell which used that value within your entire budget. This becomes even more useful as your spreadsheets become more complex 3. Complete the Goal Seek tab. Use goal seek to find see what the selling price of red scarves would need to be to increase Net Income to $450,000 in 2022. HINT: To find goal seek, click on the Data tab and under Data Tools click on the What If Analysis. When you type your info into the template this provides you want to do the following: Set cell: click on the Net Income cell in the Income Statement budget To value: $450,000 By changing cell: click on the $36.00 sales price of red scarves cell in the inputs tab Click 'OK' and this function will work through the math within your file to figure out what the sales price would need to be to reach this goal. If you have formula driven everything correctly, you should be able to click back to the inputs tab and see the new sales price listed in replacement of $36.00 (answer is provided in the rubric at the end of this document as a check figure) Manually change the sales price back to $36.00 on the inputs tab and then click over to the Goal Seek tab and enter your answer in the cell provided. This is the only cell in the project in which it is allowed that you manually type a number into the cell. 4. Compare your file against the project rubric below. You should be able to figure out your grade before you even submit your project by comparing yourself against the rubric. 5. Upload your completed Excel file to Canvas via the project link to submit. You may only submit once so make sure this is your final version. Good luck. Have fun. I hope you enjoy this project! *****Rubric below***** Page 3 of 4 ACCT 285 SPRING 2022 Evaluation Rubric that will be used to assess your project following Possible Have correct answers that properly calculate & match check figures: Your Score Cash collections in the 1st quarter = $297,600 2 Desired ending finished goods inventory for red scarves for the year = 624 2 Raw material purchases in the 4th quarter = $107,426 2 Ending cash balance for the year 2022 = $263,531 2 Net income for the year 2022 = $286,000 2 Total assets at the end of the year 2022 = $486,744 2 Goal seek selling price per unit of the red scarf is $42.00 3 10 All cells are formula driven (you lose 2 points each time there is a number entered in the worksheets) Your worksheet passes the following tests of your formulas. Be sure that you only make one change at a time (and then change back to the original value on the inputs tab before moving on to the next test). On your input tab I will: Change the selling price of yellow scarf to $45.00 and net income should become $369,500. 5 Change raw material purchase payments to 85% in quarter of purchase and 15% in next quarter and the ending cash balance for the year on the cash budget is $268,902 5 Change the number of yellow scarves sold in the 3rd quarter to 6,000 and the balance sheet should balance with both Total Assets and Total Liabilities & Equity equaling $504,744. 5 Total Score 40 Page 4 of 4 E H 3 4 B D Cyclone Scarves Company 2022 (projected) 15 atr 3 Qtr 4,400 4,300 4.200 5,000 6.300 7,000 2023 (projected) 1 Qtr 200 qtr 24 qtr 5 Sales in units: 6 Yellow Scart 7 Red Scart 8 9 Selling Price: 4th Qtr 3.800 7.200 4,700 5,200 4,400 6,600 Balance Sheet As of December 31, 2021 Assets Liabilities and Equities Cash $ 63,000 Accounts payable $ 7,800 Accounts recelvable $ 12.800 Notes payable $ Raw materials inventory $ 14.316 Interest payable $ $ Finished goods Inventory $ 27,072 Dividend payable $ 8.000 Property, plant and equipment, Common stock $105,100 net $ 88,613 Retained earnings $ 84,901 Total assets Total Liabilities and equities 10 Yellow Scarf 11 Red Scarf $ $ 40 36 UMRLIHAN 80% 20% 12% of next quarter's sales 0.5 yard $20.00 per yard 15% of next quarter's production needs 90% 10% 0.8 hours 12.50 per hour S 12 13 Collections: 14 Quarter of sale 15 Quarter after sale 16 17 Finished Goods Inventory: 18 Ending FG inventory requirement 19 20 Raw Materials Inventory: 21 Yard of fabric per scarf Cost per yard of fabric 22 Ending RM inventory requirement 24 Paid in quarter of purchase 25 Paid in following quarter 26 27 Direct labor: za Required per scarf 29 Hourly pay rate per hour 30 Manfacturing Overhead: 32 Variable 33 Fixed 34 Noncash fixed (included in above) 35 36 Selling & Admin Expenses: 37 Variable 38 Fixed 39 Noncash fixed (Included in above) 40 41 Cash: 42 Minimum cash balance 43 44 Other: 45 Dividends payment 46 Equipment purchase 47 Kitchen equipment purchase S 5.00 per direct labor hour S 4.500 per quarter S 800 per quarter IS $ IS $ 6.00 per unit sold 4.000 per quarter 800 per quarter $ 50,000 S 8.000 Declared every December (Paid every January - 1st $ $ 8.800 in June (24 Quarter) S 6.000 in July (3 Quarter) A B E G 1 Yellow 2 3 Production Budget 2022 4 1st Qtr 2nd Qtr 2023 1st Qtr 2nd Qtr 3rd Qtr 4th atr Total Red 2,022 2,023 1st Qtr 2nd Qtr 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Total 5 Sales in Units 6 Desired ending inventory 7 Total requirements 8 Less: beginning inventory 9 Production in Units 10 11 Production Budget 12 13 Sales in Units 14 Desired ending inventory 15 Total requirements 16 Less: beginning inventory 17 Production in Units 18 19 Total Production in Units 20 21 22 23 24 25 D E F G . Raw Materials Budget 2022 3rd Qtr 2023 1st Qtr 4th Otr Total 2022 3rd Qtr 4th Qtr Total 1st Qtr 2nd Qtr Units Produced 6 Required yard of fabric per scarf 7 Total fabric used in production (yards) 8 Desired ending inventory 9 Total requirements 10 Less: beginning inventory 11 Raw material purchases - yards 12 Cost per yard 13 Raw material purchases - cost 14 15 Direct Labor Budget 16 17 1st Qtr 2nd Qtr 18 Units produced 19 Labor hours per unit 20 Total labor hours required 21 Rate per labor hour 22 Direct labor cost 23 24 Manufacturing Overhead Budget 25 26 1st Qtr 2nd Qtr 27 Total labor hours required 28 Variable overhead rate per direct labor hour 29 Total variable overhead cost 30 Fixed overhead 31 Total overhead cost 32 Noncash overhead expenses 33 Overhead cash disbursements 34 35 Product Cost Per Unit 36 Direct materials cost per unit 37 Direct labor cost per unit 38 Variable overhead cost per unit 39 Total product cost per unit (using variable costing) 40 2022 3rd Qur 4th Qtr Total 41 42 43 2022 1st Qtr 2nd Qtr 3rd Qur 4th Qtr Total 2 Selling/Admininstrative Budget 3 4 Units sold 5 Variable S&A per unit 6 Total Variable S&A 7 Fixed S&A 8 Total S&A 9 Noncash S&A expenses 10 S&A disbursements 11 12 13 14 15 16 17 D H 1 2 Cash Budget: 2022 3rd Qtr 1st Qtr 2nd Qtr 4th Qtr Total 4 Beginning balance 5 Collections 6 Available balance 7 Disbursements: 8 Direct material purchased in prior quarter 9 Direct material purchased in current quarter 10 Direct labor 11 Manufacturing Overhead 12 S&A 13 Dividends 14 Equipment purchases 15 Total disbursements 16 Balance before financing 17 Minimum balance 18 Excess (deficiency) 19 Ending balance 20 21 22 23 24 25 26 A B 1 IwN Total 2 Income Statement: 3 4 Sales 5 Variable Expenses: 6 Variable COGS 7 Selling & Administrative 8 Contribution margin 9 Fixed Expenses: 10 Manufacturing Overhead 11 Selling & Administrative 12 Net Income 13 14 A B D m 1 2 3 4 Assets 5 Cash 6 Accounts receivable 7 Raw Material Inventory 8 Finished Goods Inventory 9 Property, Plant and equipment, net 10 11 Total Assets Budgeted Balance Sheet As of December 31, 2022 Liabilities and Equities Accounts payable Notes payable Interest payable Dividend payable Common Stock Retained earnings Total Liabilities & Equity 17 B C A 1 GOAL SEEK selling price per unit 2 3 ACCT 285 SPRING 2022 Spreadsheet Project - Spring 2022 DUE DATE: FRIDAY, APRIL 15TH @ 5:00 PM Objective The purpose of this project is to expose you to the complexity of budgeting and to develop your spreadsheet skills. You are to complete this assignment with your team. Please read the instruction carefully before starting to work on the project. Company Background & Inputs Cyclone Scarves Company is a small manufacturing company. They manufacture scarves in different colors. Their products are sold to independent distribution centers and retailers. They have seasonal sales patterns based on demand. As of December 31, 2021, Cyclone Scarves Company has the following balance sheet: Balance Sheet 7,800 Assets Cash Accounts Receivable Raw materials inventory Finished goods inventory Property, Plant and equipment, net As of December 31, 2021 Liabilities and Equities $ 63,000 Accounts payable $ 12,800 Notes Payable $ 14,316 Interest payable 27,072 Dividend payable $ 88,613 Common Stock Retained earnings $ 205,801 Total Liabilities and equities $ 8,000 $ 105,100 $ 84,901 $ 205,801 Total assets Cyclone Scarves Company is in the process of preparing budget for year 2022 and has obtained the below information. Budgeted sales of scarves (units) are from the 1st quarter of 2022 through the 2nd quarter of 2023 are as below: 2023 Yellow Scarf Red Scarf 2022 1st QTR 2nd QTR 3rd QTR 4.400 4,300 4,200 5,000 6,300 7,000 4th QTR 3,800 7,200 1st QTR 4,700 5,200 2nd QTR 4,400 6,600 Each yellow and red scarf sells for $40 and $36, respectively. All sales are on account. The company's collection pattern is: 80% collected the quarter of sale: 20% collected in the following quarter. The accounts receivable as of December 31, 2021 was $12,800. The company desires to have the finished goods inventory on hand at the end of each quarter equal to 12% of the following quarter's budgeted sales in units. The requirement was met on December 31, 2021. Page 1 of 4 ACCT 285 SPRING 2022 . The fabric used to make the scarf costs $20.00 per yard. 0.5 yard of fabric is required for each scarf. The company desires to have the fabric on hand at the end of each quarter equal to 15% of the following quarter's production needs. The requirement was met on December 31, 2021. 90% of the quarters' material purchases are paid for in the quarter of purchases, the remainder is paid for in the following quarter. No discount terms are available. The accounts payable as of December 31, 2021 was $7,800. Each scarf requires 0.8 hours of labor time to complete and the hourly labor rate is $12.50/hour. Variable manufacturing overhead is $5.00 per direct labor hour. Fixed manufacturing overhead is $4,500 per quarter including $800 in depreciation which is not a cash outflow. All cash disbursements for manufacturing overhead are paid in the quarter incurred. Variable selling and administrative expenses are $6 per scarf sold. Fixed selling and administrative expense is $4,000 per quarter including $700 in depreciation which is not a cash outflow. All cash disbursements for selling and administrative costs are paid in the quarter incurred. Cash dividends in the amount of $8,000 are to be paid to shareholders every January. These dividends are declared in December. Equipment purchases and payments of $8,800 are scheduled for June 2022 and $6,000 for July 2022. Assume no depreciation on these equipment purchases during the year of 2022. The company must maintain a minimum cash balance of $50,000 each quarter. The Company uses variable costing in its budgeted income statement and its balance sheet. . . Requirements 1. Enter your name within the NAME tab. 2. Prepare a master budget for the year ending on December 31, 2022 that includes the following: Projected Sales Budget, Expected Cash Collections Budget, Production Budget, Raw Materials Budget, Direct Labor Budget, Manufacturing Overhead Budget, Selling & Administrative Budget, Cash Budget, Budgeted Income Statement, & Budgeted Balance Sheet (a total of 10 schedules). Each schedule should be completed as it appears in your template. There is a template provided to you in the assignments link in the Excel Project folder with an INPUTS tab you MUST use. Complete the shaded areas of the template only. All of your spreadsheets must be formula driven from the INPUTS tab! This means that EVERY cell should contain either a value referenced from the INPUTS worksheet or a formula Page 2 of 4 ACCT 285 SPRING 2022 manually entered into the cell using the referenced values or the input values. You should NOT type a number the entire time you are working on this project. Any typed numbers will cost you 2 points per instance. There is a purpose to this requirement that we hope you understand. The beauty (usefulness) of linking your spreadsheets to an inputs page is when something changes, such as the cost per unit of raw materials, you don't have to go through the entire budget to fix every cell that used that value. Instead, when you change it on the inputs tab, it will automatically change every cell which used that value within your entire budget. This becomes even more useful as your spreadsheets become more complex 3. Complete the Goal Seek tab. Use goal seek to find see what the selling price of red scarves would need to be to increase Net Income to $450,000 in 2022. HINT: To find goal seek, click on the Data tab and under Data Tools click on the What If Analysis. When you type your info into the template this provides you want to do the following: Set cell: click on the Net Income cell in the Income Statement budget To value: $450,000 By changing cell: click on the $36.00 sales price of red scarves cell in the inputs tab Click 'OK' and this function will work through the math within your file to figure out what the sales price would need to be to reach this goal. If you have formula driven everything correctly, you should be able to click back to the inputs tab and see the new sales price listed in replacement of $36.00 (answer is provided in the rubric at the end of this document as a check figure) Manually change the sales price back to $36.00 on the inputs tab and then click over to the Goal Seek tab and enter your answer in the cell provided. This is the only cell in the project in which it is allowed that you manually type a number into the cell. 4. Compare your file against the project rubric below. You should be able to figure out your grade before you even submit your project by comparing yourself against the rubric. 5. Upload your completed Excel file to Canvas via the project link to submit. You may only submit once so make sure this is your final version. Good luck. Have fun. I hope you enjoy this project! *****Rubric below***** Page 3 of 4 ACCT 285 SPRING 2022 Evaluation Rubric that will be used to assess your project following Possible Have correct answers that properly calculate & match check figures: Your Score Cash collections in the 1st quarter = $297,600 2 Desired ending finished goods inventory for red scarves for the year = 624 2 Raw material purchases in the 4th quarter = $107,426 2 Ending cash balance for the year 2022 = $263,531 2 Net income for the year 2022 = $286,000 2 Total assets at the end of the year 2022 = $486,744 2 Goal seek selling price per unit of the red scarf is $42.00 3 10 All cells are formula driven (you lose 2 points each time there is a number entered in the worksheets) Your worksheet passes the following tests of your formulas. Be sure that you only make one change at a time (and then change back to the original value on the inputs tab before moving on to the next test). On your input tab I will: Change the selling price of yellow scarf to $45.00 and net income should become $369,500. 5 Change raw material purchase payments to 85% in quarter of purchase and 15% in next quarter and the ending cash balance for the year on the cash budget is $268,902 5 Change the number of yellow scarves sold in the 3rd quarter to 6,000 and the balance sheet should balance with both Total Assets and Total Liabilities & Equity equaling $504,744. 5 Total Score 40 Page 4 of 4 E H 3 4 B D Cyclone Scarves Company 2022 (projected) 15 atr 3 Qtr 4,400 4,300 4.200 5,000 6.300 7,000 2023 (projected) 1 Qtr 200 qtr 24 qtr 5 Sales in units: 6 Yellow Scart 7 Red Scart 8 9 Selling Price: 4th Qtr 3.800 7.200 4,700 5,200 4,400 6,600 Balance Sheet As of December 31, 2021 Assets Liabilities and Equities Cash $ 63,000 Accounts payable $ 7,800 Accounts recelvable $ 12.800 Notes payable $ Raw materials inventory $ 14.316 Interest payable $ $ Finished goods Inventory $ 27,072 Dividend payable $ 8.000 Property, plant and equipment, Common stock $105,100 net $ 88,613 Retained earnings $ 84,901 Total assets Total Liabilities and equities 10 Yellow Scarf 11 Red Scarf $ $ 40 36 UMRLIHAN 80% 20% 12% of next quarter's sales 0.5 yard $20.00 per yard 15% of next quarter's production needs 90% 10% 0.8 hours 12.50 per hour S 12 13 Collections: 14 Quarter of sale 15 Quarter after sale 16 17 Finished Goods Inventory: 18 Ending FG inventory requirement 19 20 Raw Materials Inventory: 21 Yard of fabric per scarf Cost per yard of fabric 22 Ending RM inventory requirement 24 Paid in quarter of purchase 25 Paid in following quarter 26 27 Direct labor: za Required per scarf 29 Hourly pay rate per hour 30 Manfacturing Overhead: 32 Variable 33 Fixed 34 Noncash fixed (included in above) 35 36 Selling & Admin Expenses: 37 Variable 38 Fixed 39 Noncash fixed (Included in above) 40 41 Cash: 42 Minimum cash balance 43 44 Other: 45 Dividends payment 46 Equipment purchase 47 Kitchen equipment purchase S 5.00 per direct labor hour S 4.500 per quarter S 800 per quarter IS $ IS $ 6.00 per unit sold 4.000 per quarter 800 per quarter $ 50,000 S 8.000 Declared every December (Paid every January - 1st $ $ 8.800 in June (24 Quarter) S 6.000 in July (3 Quarter) A B E G 1 Yellow 2 3 Production Budget 2022 4 1st Qtr 2nd Qtr 2023 1st Qtr 2nd Qtr 3rd Qtr 4th atr Total Red 2,022 2,023 1st Qtr 2nd Qtr 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Total 5 Sales in Units 6 Desired ending inventory 7 Total requirements 8 Less: beginning inventory 9 Production in Units 10 11 Production Budget 12 13 Sales in Units 14 Desired ending inventory 15 Total requirements 16 Less: beginning inventory 17 Production in Units 18 19 Total Production in Units 20 21 22 23 24 25 D E F G . Raw Materials Budget 2022 3rd Qtr 2023 1st Qtr 4th Otr Total 2022 3rd Qtr 4th Qtr Total 1st Qtr 2nd Qtr Units Produced 6 Required yard of fabric per scarf 7 Total fabric used in production (yards) 8 Desired ending inventory 9 Total requirements 10 Less: beginning inventory 11 Raw material purchases - yards 12 Cost per yard 13 Raw material purchases - cost 14 15 Direct Labor Budget 16 17 1st Qtr 2nd Qtr 18 Units produced 19 Labor hours per unit 20 Total labor hours required 21 Rate per labor hour 22 Direct labor cost 23 24 Manufacturing Overhead Budget 25 26 1st Qtr 2nd Qtr 27 Total labor hours required 28 Variable overhead rate per direct labor hour 29 Total variable overhead cost 30 Fixed overhead 31 Total overhead cost 32 Noncash overhead expenses 33 Overhead cash disbursements 34 35 Product Cost Per Unit 36 Direct materials cost per unit 37 Direct labor cost per unit 38 Variable overhead cost per unit 39 Total product cost per unit (using variable costing) 40 2022 3rd Qur 4th Qtr Total 41 42 43 2022 1st Qtr 2nd Qtr 3rd Qur 4th Qtr Total 2 Selling/Admininstrative Budget 3 4 Units sold 5 Variable S&A per unit 6 Total Variable S&A 7 Fixed S&A 8 Total S&A 9 Noncash S&A expenses 10 S&A disbursements 11 12 13 14 15 16 17 D H 1 2 Cash Budget: 2022 3rd Qtr 1st Qtr 2nd Qtr 4th Qtr Total 4 Beginning balance 5 Collections 6 Available balance 7 Disbursements: 8 Direct material purchased in prior quarter 9 Direct material purchased in current quarter 10 Direct labor 11 Manufacturing Overhead 12 S&A 13 Dividends 14 Equipment purchases 15 Total disbursements 16 Balance before financing 17 Minimum balance 18 Excess (deficiency) 19 Ending balance 20 21 22 23 24 25 26 A B 1 IwN Total 2 Income Statement: 3 4 Sales 5 Variable Expenses: 6 Variable COGS 7 Selling & Administrative 8 Contribution margin 9 Fixed Expenses: 10 Manufacturing Overhead 11 Selling & Administrative 12 Net Income 13 14 A B D m 1 2 3 4 Assets 5 Cash 6 Accounts receivable 7 Raw Material Inventory 8 Finished Goods Inventory 9 Property, Plant and equipment, net 10 11 Total Assets Budgeted Balance Sheet As of December 31, 2022 Liabilities and Equities Accounts payable Notes payable Interest payable Dividend payable Common Stock Retained earnings Total Liabilities & Equity 17 B C A 1 GOAL SEEK selling price per unit 2 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts