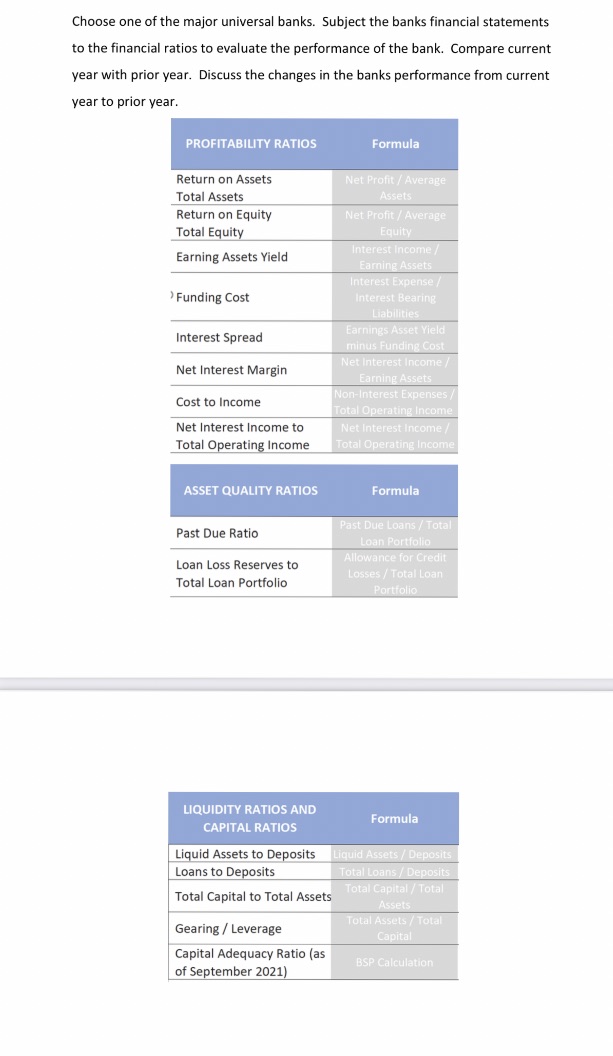

Question: PLEASE HELP ME ANSWER THESE QUESTIONS WITH SOLUTION. THANK YOU. Choose one of the major universal banks. Subject the banks financial statements to the financial

PLEASE HELP ME ANSWER THESE QUESTIONS WITH SOLUTION. THANK YOU.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock