Question: please help me answer these two question Part 2 Ch 08 Assignment Question 5 of 9 View Policies Current Attempt in Progress Date Jan. 1,

please help me answer these two question

Part 2

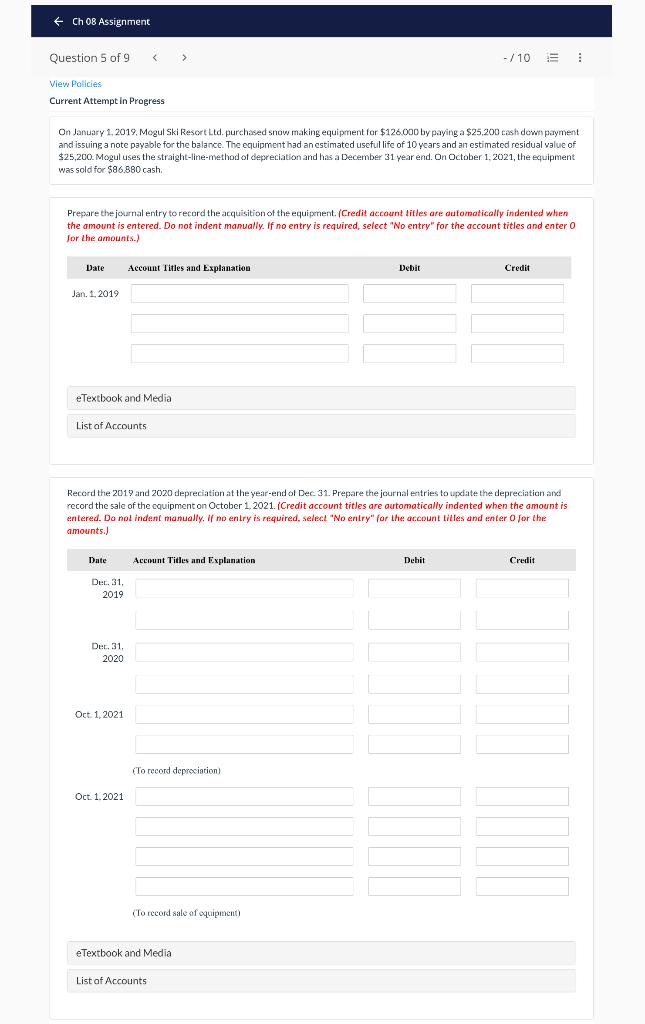

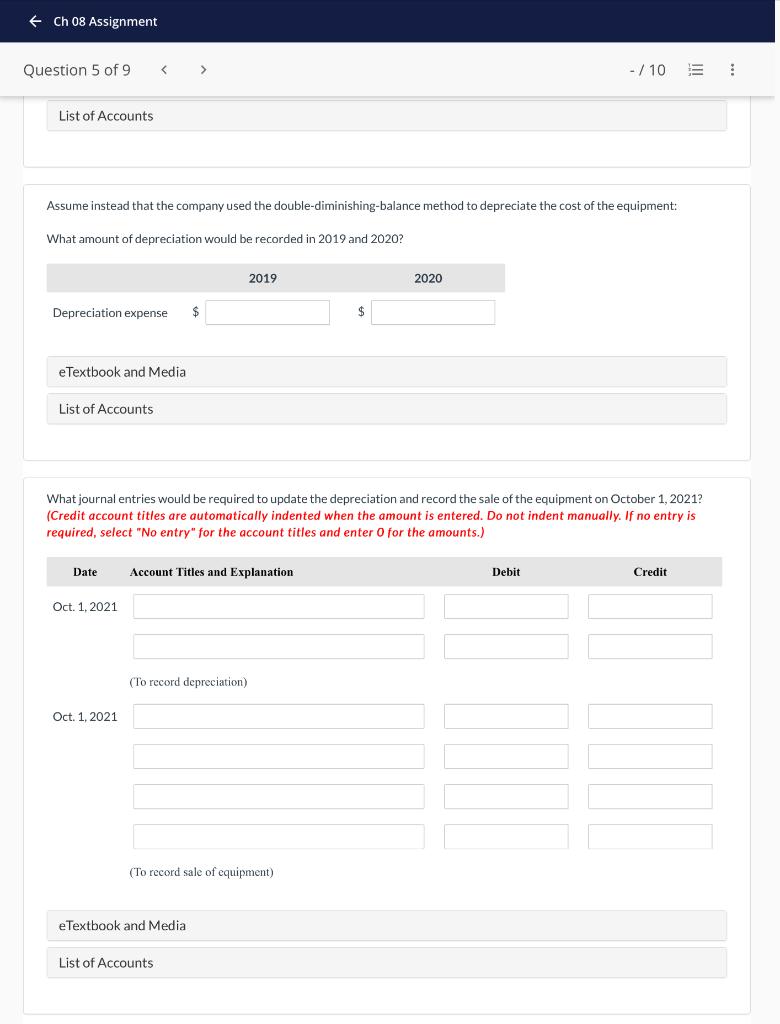

Ch 08 Assignment Question 5 of 9 View Policies Current Attempt in Progress Date Jan. 1, 2019. On January 1, 2019, Mogul Ski Resort Ltd. purchased snow making equipment for $126.000 by paying a $25.200 cash down payment and issuing a note payable for the balance. The equipment had an estimated useful life of 10 years and an estimated residual value of $25,200. Mogul uses the straight-line-method of depreciation and has a December 31 year end. On October 1, 2021, the equipment was sold for $86,880 cash. Prepare the journal entry to record the acquisition of the equipment. (Credit account titles are automatically inderted when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) eTextbook and Media List of Accounts Date Record the 2019 and 2020 depreciation at the year-end of Dec. 31. Prepare the journal entries to update the depreciation and record the sale of the equipment on October 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Account Titles and Explanation (To record depreciation). (To record sale of equipment) eTextbook and Media List of Accounts -/10 E Debit Debit Credit I Credit Ch 08 Assignment Question 5 of 9 List of Accounts Assume instead that the company used the double-diminishing-balance method to depreciate the cost of the equipment: What amount of depreciation would be recorded in 2019 and 2020? Depreciation expense $ eTextbook and Media List of Accounts What journal entries would be required to update the depreciation and record the sale of the equipment on October 1, 2021? (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation (To record depreciation) 2019 eTextbook and Media List of Accounts (To record sale of equipment) $ 2020 -/10 = I Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts