Question: Please help me answer these two questions. Thank you so much!! The question is completed.Question 3-1 and 3-2 are together. Q3-1. (Credit Default SWAPS and

Please help me answer these two questions. Thank you so much!! The question is completed.Question 3-1 and 3-2 are together.

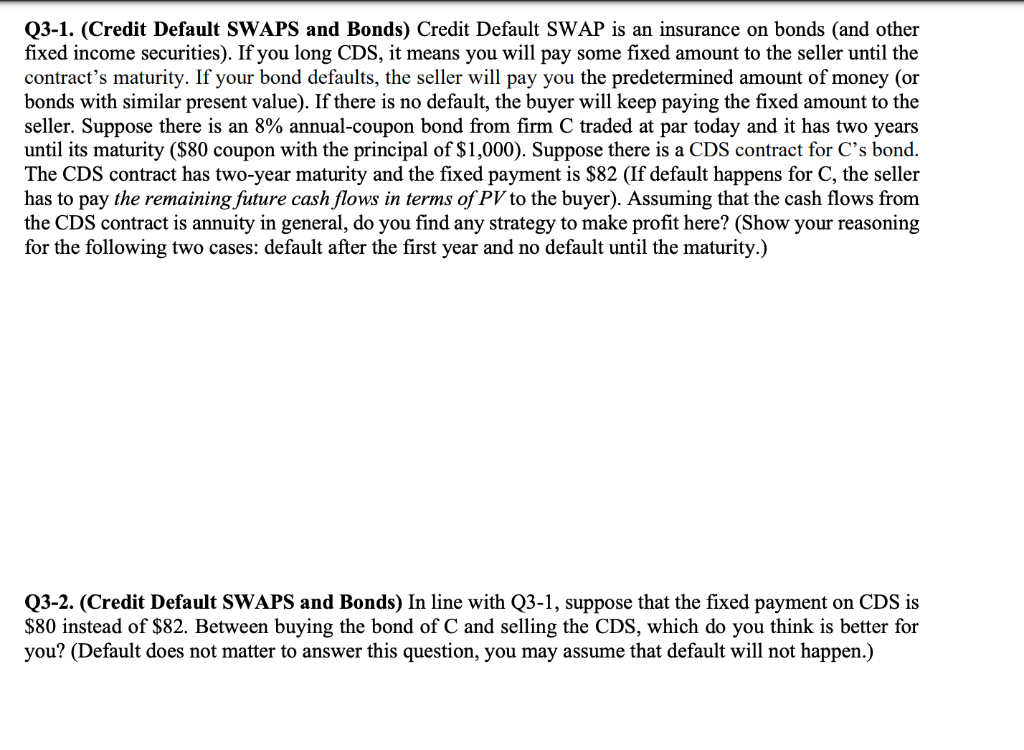

Q3-1. (Credit Default SWAPS and Bonds) Credit Default SWAP is an insurance on bonds (and other fixed income securities). If you long CDS, it means you will pay some fixed amount to the seller until the contract's maturity. If your bond defaults, the seller will pay you the predetermined amount of money (or bonds with similar present value). If there is no default, the buyer will keep paying the fixed amount to the seller. Suppose there is an 8% annual-coupon bond from firm C traded at par today and it has two years until its maturity ($80 coupon with the principal of $1,000). Suppose there is a CDS contract for C's bond. The CDS contract has two-year maturity and the fixed payment is $82 (If default happens for C, the seller has to pay the remaining future cash flows in terms of PV to the buyer). Assuming that the cash flows from the CDS contract is annuity in general, do you find any strategy to make profit here? (Show your reasoning for the following two cases: default after the first year and no default until the maturity.) Q3-2. (Credit Default SWAPS and Bonds) In line with Q3-1, suppose that the fixed payment on CDS is $80 instead of $82. Between buying the bond of C and selling the CDS, which do you think is better for you? (Default does not matter to answer this question, you may assume that default will not happen.) Q3-1. (Credit Default SWAPS and Bonds) Credit Default SWAP is an insurance on bonds (and other fixed income securities). If you long CDS, it means you will pay some fixed amount to the seller until the contract's maturity. If your bond defaults, the seller will pay you the predetermined amount of money (or bonds with similar present value). If there is no default, the buyer will keep paying the fixed amount to the seller. Suppose there is an 8% annual-coupon bond from firm C traded at par today and it has two years until its maturity ($80 coupon with the principal of $1,000). Suppose there is a CDS contract for C's bond. The CDS contract has two-year maturity and the fixed payment is $82 (If default happens for C, the seller has to pay the remaining future cash flows in terms of PV to the buyer). Assuming that the cash flows from the CDS contract is annuity in general, do you find any strategy to make profit here? (Show your reasoning for the following two cases: default after the first year and no default until the maturity.) Q3-2. (Credit Default SWAPS and Bonds) In line with Q3-1, suppose that the fixed payment on CDS is $80 instead of $82. Between buying the bond of C and selling the CDS, which do you think is better for you? (Default does not matter to answer this question, you may assume that default will not happen.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts