Question: Please help me answer this 1 Your company is facing a project that costs $5 million. You're trying to decide whether you'll be using rs

Please help me answer this

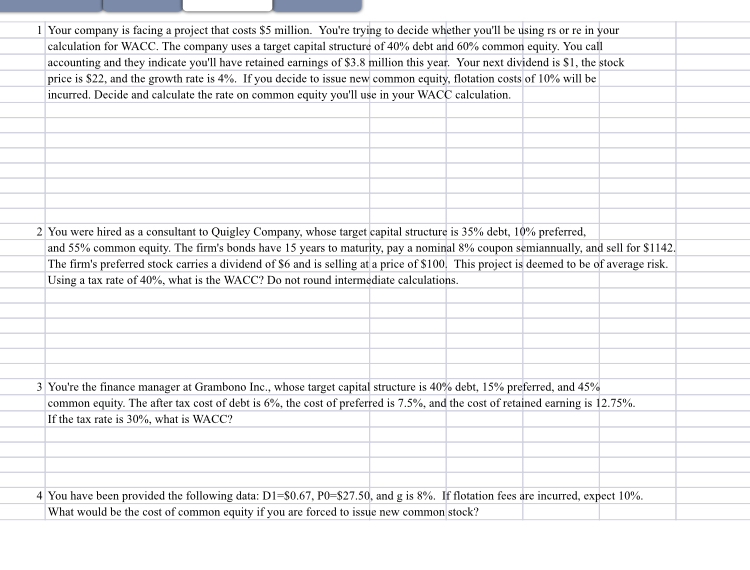

1 Your company is facing a project that costs $5 million. You're trying to decide whether you'll be using rs or re in your calculation for WACC The company uses a target capital structure of40% debt and 60% common equity. You call accounting and they indicate you'll have retained earnings of S3.8 million this year. Your next dividend is S1, the stock price is $22, and the growth rate is 4% If you decide to issue new common equity, flotation costs of 10% will be incurred. Decide and calculate the rate on common equity you'll use in your WACC calculation 2 You were hired as a consultant to ugley Company, whose target capital structure is 35% debt % preferred and 55% common equity. The firm's bonds have 15 years to maturity, pay a nominal 8% coupon semiannually, and sell for S142 The firm's preferred stock carries a dividend of S6 and is selling at a price of S100. This project is deemed to be of average risk. Using a tax rate of 40% what is the WACC? Do not round intermediate calculations. 3 You're the finance manager at Grambono Inc., whose target capital structure is 40% debt, l 5% preferred, and 45% common equity. The after tax cost of debt is 6%, the cost of preferred is 7.5%, and the cost of retained earnings 12.75%. If the tax rate is 30%, what is WACC? 4 You have been provided the f llowing data DI SO 67. Po-S27.50, and g is 8% f flota tion fees are incurred, expect 10% What would be the cost of common equity if you are forced to issue new common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts