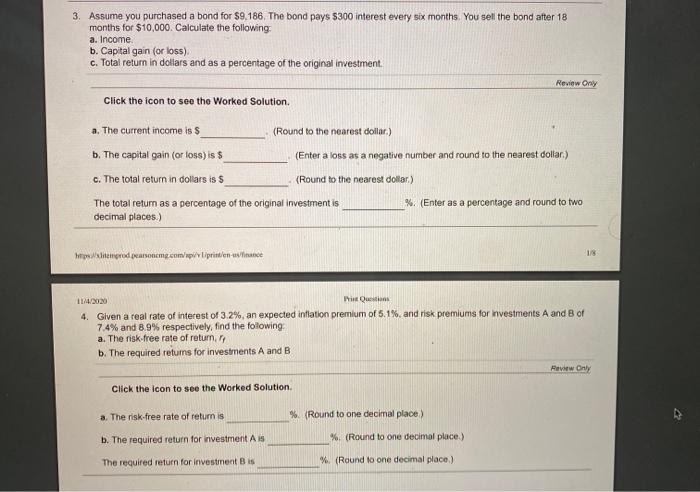

Question: Please, help me answer this 2 questions. Thank you! 3. Assume you purchased a bond for $9.186. The bond pays $300 interest every six months.

3. Assume you purchased a bond for $9.186. The bond pays $300 interest every six months. You sell the bond after 18 months for $10,000. Calculate the following a. Income b. Capital gain (or loss) c. Total return in dollars and as a percentage of the original investment Review Only Click the icon to see the Worked Solution. a. The current income is $ (Round to the nearest dollar.) (Enter a loss as a negative number and round to the nearest dollar.) b. The capital gain (or loss) is $ c. The total return in dollars is $ (Round to the nearest dollar.) %. (Enter as a percentage and round to two The total retum as a percentage of the original investment is decimal places.) 1/8 memprodonmg.com/p/xiprintiniane 1114/2020 Print Que 4. Given a real rate of interest of 3.2%, an expected inflation premium of 5.1%, and risk premiums for investments A and B of 7.4% and 8.9% respectively, find the following a. The risk-free rate of return b. The required returns for investments A and B Click the icon to see the Worked Solution a. The risk-free rate of return is % (Round to one decimal place) b. The required return for investment AS %. (Round to one decimal place) The required return for investment B is % (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts