Question: Please Help me answer this asap, thank you (Question 3) Dillo Corporation has asked its financial manager to measure cost of each specific type of

Please Help me answer this asap, thank you

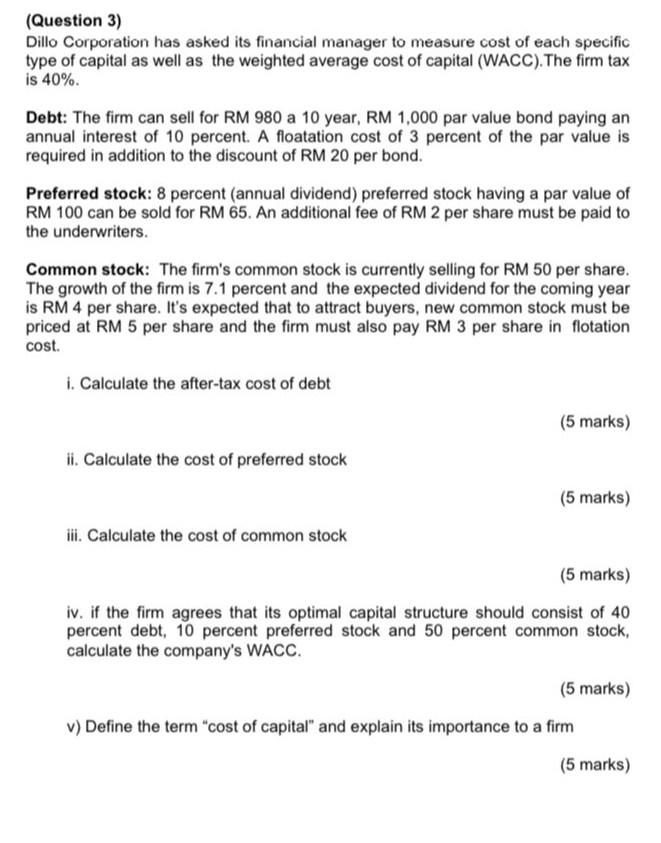

(Question 3) Dillo Corporation has asked its financial manager to measure cost of each specific type of capital as well as the weighted average cost of capital (WACC). The firm tax is 40% Debt: The firm can sell for RM 980 a 10 year, RM 1,000 par value bond paying an annual interest of 10 percent. A floatation cost of 3 percent of the par value is required in addition to the discount of RM 20 per bond. Preferred stock: 8 percent (annual dividend) preferred stock having a par value of RM 100 can be sold for RM 65. An additional fee of RM 2 per share must be paid to the underwriters. Common stock: The firm's common stock is currently selling for RM 50 per share. The growth of the firm is 7.1 percent and the expected dividend for the coming year is RM 4 per share. It's expected that to attract buyers, new common stock must be priced at RM 5 per share and the firm must also pay RM 3 per share in flotation cost. i. Calculate the after-tax cost of debt (5 marks) ii. Calculate the cost of preferred stock (5 marks) iii. Calculate the cost of common stock (5 marks) iv. if the firm agrees that its optimal capital structure should consist of 40 percent debt, 10 percent preferred stock and 50 percent common stock, calculate the company's WACC. (5 marks) v) Define the term "cost of capital and explain its importance to a firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts