Question: please help me answer this case study THE FAMILY Candi and Bob Sweet own a boutique truffle shop that offers delectable treats that are enjoyed

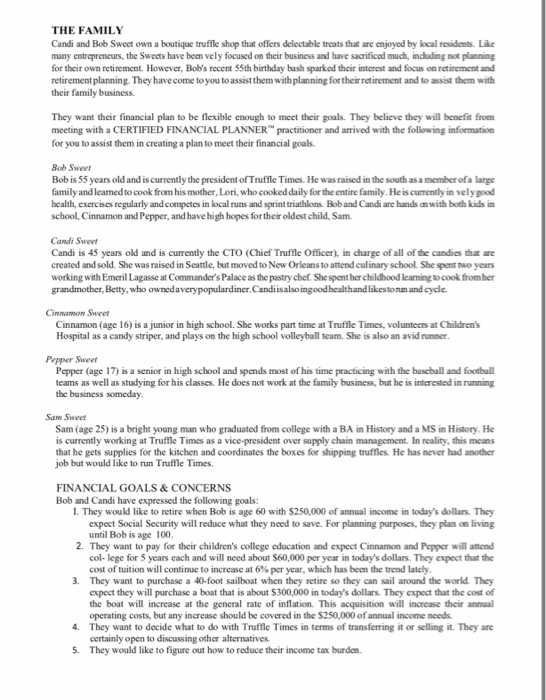

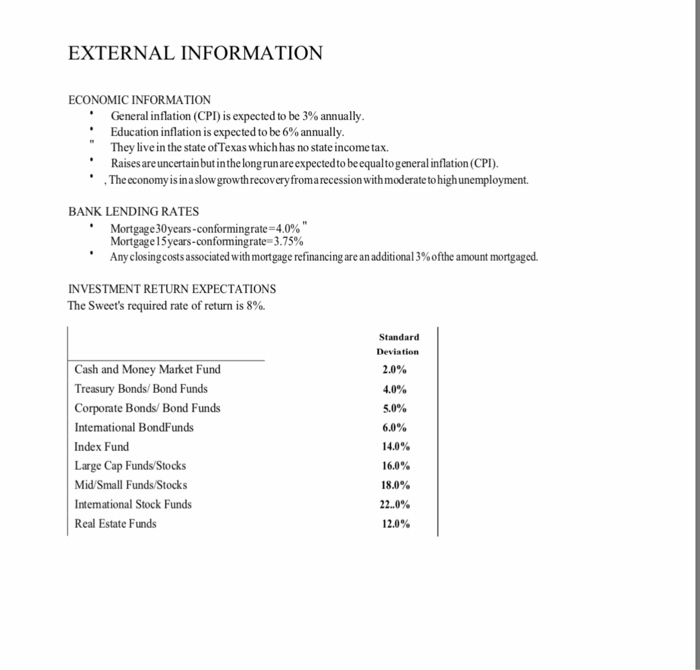

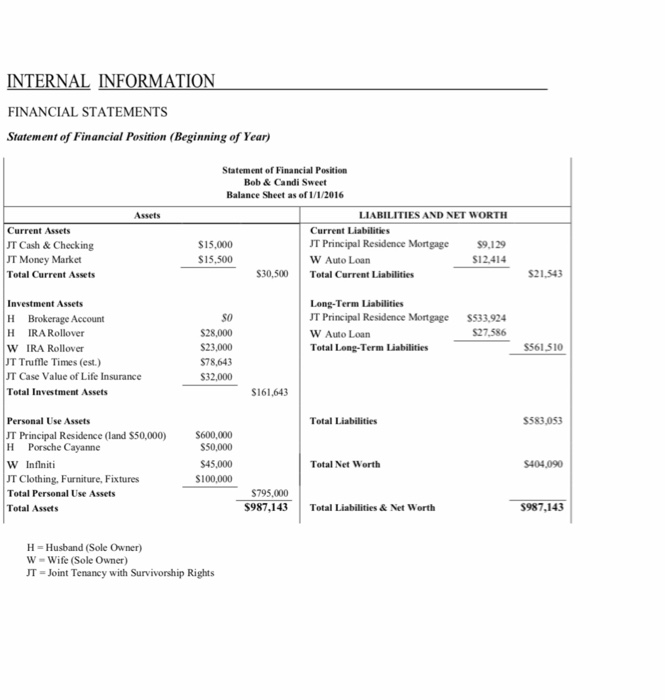

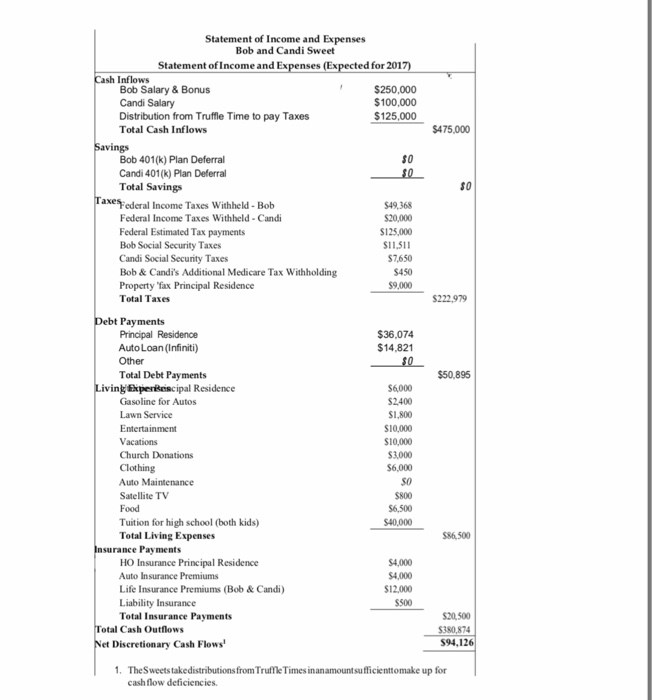

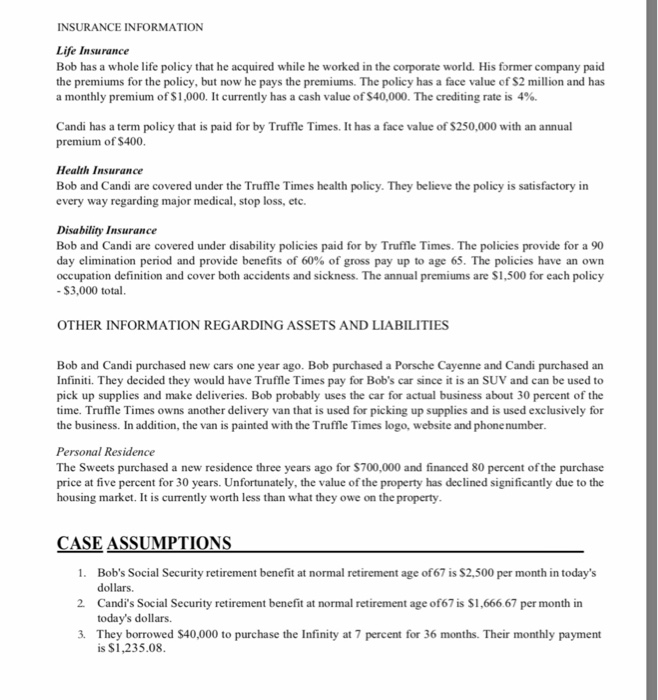

THE FAMILY Candi and Bob Sweet own a boutique truffle shop that offers delectable treats that are enjoyed by local residents. Like many entrepreneurs, the Swects have been vely focused on their business and have sacrificod much, including not planning for their own retirement. However, Bob's recent 55th birthday bash sparkod their intcrest and focus on retirement and retirement planning. They havecome to you to assist them with planning fortheirretirement and to assist them with their family business. They want their financial plan to be flexible enough to meet their goals. They believe they will benefit from meeting with a CERTIFIED FINANCIAL PLANNER practitioner and arrived with the following information for you to assist them in creating a plan to meet their financial goals. Bob Swee Bob is 55 years old and is currently the president of Truffle Times. He was raised in the south as a member of a large family and leaned to cook from his mother, Lori, who cooked daily for the entire family. He is currently in vely good health, exercises regularly and competes in local runs and sprint triathlons. Bob and Candi are hands anwith both kids in school, Cinnamon and Pepper, and have high hopes for their oldest child, Sam. Candi Sweet Candi is 45 years old and is currently the CTO (Chief Trufle Officer), in charge of all of the candies that are created and sold. She was raised in Scattle, but moved to New Orleans to attend culinary school. She spent two years working with Emeril Lagasse at Commander's Palace as the pastry chef. She spent her childhood learning to cook fromher Cinmamon Sweet Cinnamon (age 16) is a junior in high school. She works part time at Truffle Times, volunteers at Children's Hospital as a candy striper, and plays on the high school volleyball team. She is also an avid runner Pepper Sweet Pepper (age 17) is a senior in high school and spends most of his time practicing with the bascball and foothall teams as well as studying for his classes. He does not work at the family business, but he is interested in running the business someday. Sam Sweet Sam (age 25) is a bright young man who graduated from college with a BA in History and a MS in History. He is currently working at Truffie Times as a vice-president over supply chain management. In reality, this means that he gets supplies for the kitchen and coordinates the boxes for shipping truffles. He has never had another job but would like to run Truffle Times. FINANCIAL GOALS&CONCERNS Bob and Candi have expressed the following goals: I. They would like to retire when Bob is age 60 with $250,000 of annual income in today's dollars. They expect Social Security will reduce what they need to save. For planning purposes, they plan on living until Bob is age 100. 2. They want to pay for their children's college education and expect Cinnamon and Pepper will attend col- lege for 5 years each and will need about $60,000 per year in today's dollars. They expect that the cost of tuition will continue to increase at 6% per year, which has been the trend lately. They want to purchase a 40-foot sailboat when they retire so they can sail around the world They expect they will purchase a boat that is about $300,000 in today's dollars. They expect that the cost of the boat will increase at the general rate of inflation. This acquisition will increase their annual operating costs, but any increase should be covered in the $250,000 of annual income needs They want to decide what to do with Truffle Times in terms of transferring it or selling it. They are certainly open to discussing other alternatives They would like to figure out how to reduce their income tax burden. 3 4. 5. EXTERNAL INFORMATION ECONOMIC INFORMATION * General inflation (CPI) is expected to be 3% annually Education inflation is expected to be 6% annually They live in the state of Texas which has no state incometax Raises are uncertain but inthe longrun areexpectedto be equaltogeneral inflation (CPI). Thecconomy is in a slow growthrecoveryfromarecession withmoderatetohighunemployment. BANK LENDING RATES 4.0%" * Mortgage30years-conformingrate Mortgage l 5 years. conforming rate-3.75% Any closingcosts associated with mortgage refinancing are an additional 3%ofthe amount mortgaged. INVESTMENT RETURN EXPECTATIONS The Sweet's required rate of return is 8%. Cash and Money Market Fund Treasury Bonds/ Bond Funds Corporate Bonds/ Bond Funds Intemational BondFunds Index Fund Large Cap Funds/Stocks Mid/Small Funds/Stocks Intemational Stock Funds Real Estate Funds Standard Deviation 2.0% 4.0% 5.0% 6,0% 14.0% 16.0% 18.0% 22.0% 12.0% INTERNAIL FINANCIAL STATEMENTS Statement of Financial Position (Beginning of Year) ON Statement of Financial Position Bob & Candi Sweet Balance Sheet as ef 1/1/2016 Assets LIABILITIES AND NET WORTH Current Assets T Cash & Checking T Money Market Total Current Assets Current Liabilities JT Principal Residence Mortgage $9,129 W Auto Loan $15,000 $15,500 S12414 30,500Total Current Liabilities - $21.543 Investment Assets H Brokerage Account H IRARollover W IRA Rollover T Truffle Times (est.) JT Case Value of Life Insurance Total Investment Assets SO $28,000 $23,000 $78,643 $32,000 Long-Term Liabilities JT Principal Residence Mortgage $533,924 W Auto Loan Total Long-Term Liabilities 27.586 $561,510 S161,643 $583,053 Personal Use Assets JT Principal Residence (land $50,000 H Porsche Cayanne W Inflniti T Clothing, Furniture, Fixtures Total Personal Use Assets Total Assets Total Liabilities S600,000 $50,000 $45,000 $100,000 Total Net Worth $404,090 $795,000 $987.143 Total Liabilities & Net Werth $987,143 H = Husband (Sole Owner) W- Wife (Sole Owner) JT = Joint Tenancy with Survivorship Rights Statement of Income and Expenses Bob and Candi Sweet Statement ofIncome and Ex d for 201 Inflows Bob Salary & Bonus Candi Salary Distribution from Truffle Time to pay Taxes Total Cash Inflows $250,000 $100,000 $125,000 $475,000 Bob 401(k) Plan Deferral Candi 401(k) Plan Deferral Total Savings S0 axeFederal Income Taxes Withheld-Bob $49,368 Federal Income Taxes Withheld-Candi Federal Estimated Tax payments Bob Social Security Taxes Candi Social Security Taxes Bob & Candi's Additional Medicare Tax Withholding Property ax Principal Residence Total Taxes S11,511 $7,650 $450 $9,000 $222,979 Payments Principal Residence AutoLoan (Infiniti) 36,074 $14,821 Total Debt Payments 50,895 ivingEipereiscipal Residence Gasoline for Autos Lawn Service $1,800 $10,000 S10,000 $3,000 Vacations Church Donations Auto Maintenance Satellite TV Food Tuition for high school (both kids) Total Living Expenses S40,000 $86,500 nsurance Payments HO Insurance Principal Residence Auto Insurance Premiums Life Insurance Premiums (Bob & Candi) Liability Insurance Total Insurance Payments S12,000 S500 $20,500 $380,874 Total Cash Outflows et Discretionary Cash Flows . TheSweetstakedistributions from TruffleTimes inanamountsufficienttomake up for cashflow deficiencies. INSURANCE INFORMATION Life Insurance Bob has a whole life policy that he acquired while he worked in the corporate world. His former company paid the premiums for the policy, but now he pays the premiums. The policy has a face value of S2 million and has a monthly premium of $1,000. It currently has a cash value of $40,000. The crediting rate is 4%. Candi has a term policy that is paid for by Truffle Times. It has a face value of $250,000 with an annual premium of $400 Health Insuranae Bob and Candi are covered under the Truffle Times health policy. They believe the policy is satisfactory in every way regarding major medical, stop loss, etc. Disability Insurance Bob and Candi are covered under disability policies paid for by Truffle Times. The policies provide for a 90 day elimination period and provide benefits of 60% of gross pay up to age 65 . The policies have an own occupation definition and cover both accidents and sickness. The annual premiums are S1,500 for each policy -$3,000 total OTHER INFORMATION REGARDING ASSETS AND LIABILITIES Bob and Candi purchased new cars one year ago. Bob purchased a Porsche Cayenne and Candi purchased an Infiniti. They decided they would have Truffle Times pay for Bob's car since it is an SUV and can be used to pick up supplies and make deliveries. Bob probably uses the car for actual business about 30 percent of the time. Truffle Times owns another delivery van that is used for picking up supplies and is used exclusively for the business. In addition, the van is painted with the Truffle Times logo, website and phone number Personal Residence The Sweets purchased a new residence three years ago for $700,000 and financed 80 percent of the purchase price at five percent for 30 years. Unfortunately, the value of the property has declined significantly due to the housing market. It is currently worth less than what they owe on the property CASE ASSUMPTIONS 1. Bob's Social Security retirement benefit at normal retirement age of67 is $2,500 per month in today's 2. Candi's Social Security retirement benefit at normal retirement age of67 is $1,666.67 per month in 3. They borrowed $40,000 to purchase the Infinity at 7 percent for 36 months. Their monthly payment dollars. today's dollars. is $1,235.08 THE FAMILY Candi and Bob Sweet own a boutique truffle shop that offers delectable treats that are enjoyed by local residents. Like many entrepreneurs, the Swects have been vely focused on their business and have sacrificod much, including not planning for their own retirement. However, Bob's recent 55th birthday bash sparkod their intcrest and focus on retirement and retirement planning. They havecome to you to assist them with planning fortheirretirement and to assist them with their family business. They want their financial plan to be flexible enough to meet their goals. They believe they will benefit from meeting with a CERTIFIED FINANCIAL PLANNER practitioner and arrived with the following information for you to assist them in creating a plan to meet their financial goals. Bob Swee Bob is 55 years old and is currently the president of Truffle Times. He was raised in the south as a member of a large family and leaned to cook from his mother, Lori, who cooked daily for the entire family. He is currently in vely good health, exercises regularly and competes in local runs and sprint triathlons. Bob and Candi are hands anwith both kids in school, Cinnamon and Pepper, and have high hopes for their oldest child, Sam. Candi Sweet Candi is 45 years old and is currently the CTO (Chief Trufle Officer), in charge of all of the candies that are created and sold. She was raised in Scattle, but moved to New Orleans to attend culinary school. She spent two years working with Emeril Lagasse at Commander's Palace as the pastry chef. She spent her childhood learning to cook fromher Cinmamon Sweet Cinnamon (age 16) is a junior in high school. She works part time at Truffle Times, volunteers at Children's Hospital as a candy striper, and plays on the high school volleyball team. She is also an avid runner Pepper Sweet Pepper (age 17) is a senior in high school and spends most of his time practicing with the bascball and foothall teams as well as studying for his classes. He does not work at the family business, but he is interested in running the business someday. Sam Sweet Sam (age 25) is a bright young man who graduated from college with a BA in History and a MS in History. He is currently working at Truffie Times as a vice-president over supply chain management. In reality, this means that he gets supplies for the kitchen and coordinates the boxes for shipping truffles. He has never had another job but would like to run Truffle Times. FINANCIAL GOALS&CONCERNS Bob and Candi have expressed the following goals: I. They would like to retire when Bob is age 60 with $250,000 of annual income in today's dollars. They expect Social Security will reduce what they need to save. For planning purposes, they plan on living until Bob is age 100. 2. They want to pay for their children's college education and expect Cinnamon and Pepper will attend col- lege for 5 years each and will need about $60,000 per year in today's dollars. They expect that the cost of tuition will continue to increase at 6% per year, which has been the trend lately. They want to purchase a 40-foot sailboat when they retire so they can sail around the world They expect they will purchase a boat that is about $300,000 in today's dollars. They expect that the cost of the boat will increase at the general rate of inflation. This acquisition will increase their annual operating costs, but any increase should be covered in the $250,000 of annual income needs They want to decide what to do with Truffle Times in terms of transferring it or selling it. They are certainly open to discussing other alternatives They would like to figure out how to reduce their income tax burden. 3 4. 5. EXTERNAL INFORMATION ECONOMIC INFORMATION * General inflation (CPI) is expected to be 3% annually Education inflation is expected to be 6% annually They live in the state of Texas which has no state incometax Raises are uncertain but inthe longrun areexpectedto be equaltogeneral inflation (CPI). Thecconomy is in a slow growthrecoveryfromarecession withmoderatetohighunemployment. BANK LENDING RATES 4.0%" * Mortgage30years-conformingrate Mortgage l 5 years. conforming rate-3.75% Any closingcosts associated with mortgage refinancing are an additional 3%ofthe amount mortgaged. INVESTMENT RETURN EXPECTATIONS The Sweet's required rate of return is 8%. Cash and Money Market Fund Treasury Bonds/ Bond Funds Corporate Bonds/ Bond Funds Intemational BondFunds Index Fund Large Cap Funds/Stocks Mid/Small Funds/Stocks Intemational Stock Funds Real Estate Funds Standard Deviation 2.0% 4.0% 5.0% 6,0% 14.0% 16.0% 18.0% 22.0% 12.0% INTERNAIL FINANCIAL STATEMENTS Statement of Financial Position (Beginning of Year) ON Statement of Financial Position Bob & Candi Sweet Balance Sheet as ef 1/1/2016 Assets LIABILITIES AND NET WORTH Current Assets T Cash & Checking T Money Market Total Current Assets Current Liabilities JT Principal Residence Mortgage $9,129 W Auto Loan $15,000 $15,500 S12414 30,500Total Current Liabilities - $21.543 Investment Assets H Brokerage Account H IRARollover W IRA Rollover T Truffle Times (est.) JT Case Value of Life Insurance Total Investment Assets SO $28,000 $23,000 $78,643 $32,000 Long-Term Liabilities JT Principal Residence Mortgage $533,924 W Auto Loan Total Long-Term Liabilities 27.586 $561,510 S161,643 $583,053 Personal Use Assets JT Principal Residence (land $50,000 H Porsche Cayanne W Inflniti T Clothing, Furniture, Fixtures Total Personal Use Assets Total Assets Total Liabilities S600,000 $50,000 $45,000 $100,000 Total Net Worth $404,090 $795,000 $987.143 Total Liabilities & Net Werth $987,143 H = Husband (Sole Owner) W- Wife (Sole Owner) JT = Joint Tenancy with Survivorship Rights Statement of Income and Expenses Bob and Candi Sweet Statement ofIncome and Ex d for 201 Inflows Bob Salary & Bonus Candi Salary Distribution from Truffle Time to pay Taxes Total Cash Inflows $250,000 $100,000 $125,000 $475,000 Bob 401(k) Plan Deferral Candi 401(k) Plan Deferral Total Savings S0 axeFederal Income Taxes Withheld-Bob $49,368 Federal Income Taxes Withheld-Candi Federal Estimated Tax payments Bob Social Security Taxes Candi Social Security Taxes Bob & Candi's Additional Medicare Tax Withholding Property ax Principal Residence Total Taxes S11,511 $7,650 $450 $9,000 $222,979 Payments Principal Residence AutoLoan (Infiniti) 36,074 $14,821 Total Debt Payments 50,895 ivingEipereiscipal Residence Gasoline for Autos Lawn Service $1,800 $10,000 S10,000 $3,000 Vacations Church Donations Auto Maintenance Satellite TV Food Tuition for high school (both kids) Total Living Expenses S40,000 $86,500 nsurance Payments HO Insurance Principal Residence Auto Insurance Premiums Life Insurance Premiums (Bob & Candi) Liability Insurance Total Insurance Payments S12,000 S500 $20,500 $380,874 Total Cash Outflows et Discretionary Cash Flows . TheSweetstakedistributions from TruffleTimes inanamountsufficienttomake up for cashflow deficiencies. INSURANCE INFORMATION Life Insurance Bob has a whole life policy that he acquired while he worked in the corporate world. His former company paid the premiums for the policy, but now he pays the premiums. The policy has a face value of S2 million and has a monthly premium of $1,000. It currently has a cash value of $40,000. The crediting rate is 4%. Candi has a term policy that is paid for by Truffle Times. It has a face value of $250,000 with an annual premium of $400 Health Insuranae Bob and Candi are covered under the Truffle Times health policy. They believe the policy is satisfactory in every way regarding major medical, stop loss, etc. Disability Insurance Bob and Candi are covered under disability policies paid for by Truffle Times. The policies provide for a 90 day elimination period and provide benefits of 60% of gross pay up to age 65 . The policies have an own occupation definition and cover both accidents and sickness. The annual premiums are S1,500 for each policy -$3,000 total OTHER INFORMATION REGARDING ASSETS AND LIABILITIES Bob and Candi purchased new cars one year ago. Bob purchased a Porsche Cayenne and Candi purchased an Infiniti. They decided they would have Truffle Times pay for Bob's car since it is an SUV and can be used to pick up supplies and make deliveries. Bob probably uses the car for actual business about 30 percent of the time. Truffle Times owns another delivery van that is used for picking up supplies and is used exclusively for the business. In addition, the van is painted with the Truffle Times logo, website and phone number Personal Residence The Sweets purchased a new residence three years ago for $700,000 and financed 80 percent of the purchase price at five percent for 30 years. Unfortunately, the value of the property has declined significantly due to the housing market. It is currently worth less than what they owe on the property CASE ASSUMPTIONS 1. Bob's Social Security retirement benefit at normal retirement age of67 is $2,500 per month in today's 2. Candi's Social Security retirement benefit at normal retirement age of67 is $1,666.67 per month in 3. They borrowed $40,000 to purchase the Infinity at 7 percent for 36 months. Their monthly payment dollars. today's dollars. is $1,235.08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts