Question: please help me answer this. Dividends 1. What caused the steep drop in Hanesbrands, Inc. stock price in this article? 2. Discuss how both elements

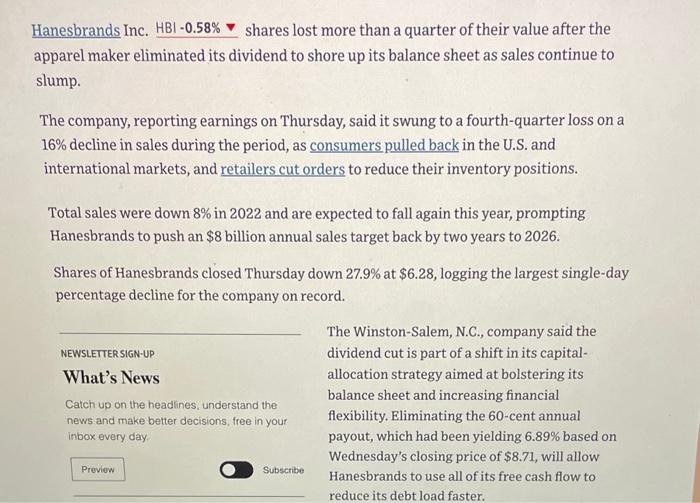

Dividends 1. What caused the steep drop in Hanesbrands, Inc. stock price in this article? 2. Discuss how both elements of the constant growth dividend model (dividend yield and capital gains yield) appear in the article. Hanesbrands Shares Plunge After Dividend Cut, Gloomy Earnings and Forecast Apparel maker to pay down debt after fourth-quarter sales fall 16% Hanesbrands Inc. HBI0.58% shares lost more than a quarter of their value after the apparel maker eliminated its dividend to shore up its balance sheet as sales continue to slump. The company, reporting earnings on Thursday, said it swung to a fourth-quarter loss on a 16% decline in sales during the period, as consumers pulled back in the U.S. and international markets, and retailers cut orders to reduce their inventory positions. Total sales were down 8% in 2022 and are expected to fall again this year, prompting Hanesbrands to push an $8 billion annual sales target back by two years to 2026. Shares of Hanesbrands closed Thursday down 27.9% at $6.28, logging the largest single-day percentage decline for the company on record. The Winston-Salem, N.C., company said the NEWSLETIER SIGN-UP dividend cut is part of a shift in its capitalWhat's News allocation strategy aimed at bolstering its Catchupontheheadines,understandthenewsandmakebetterdecisions,treeinyourbalancesheetandincreasingfinancialflexibility.Eliminatingthe60-centannual inbox every day. payout, which had been yielding 6.89% based on Wednesday's closing price of $8.71, will allow Hanesbrands to use all of its free cash flow to reduce its debt load faster. Home World U.S. Politics Economy Business Tech Markets Opinion Books \& Arts Real Esta The company, which paid nearly $157 million in dividends during the first nine months of 2022, said it expects about $500 million in cash flow from operations during fiscal 2023. It expects to refinance its 2024 debt maturities during the first quarter. The dividend cut comes as Hanesbrands posted a loss of $418.1 million, or $1.19 a share, compared with a profit of $60 million, or 17 cents a share, in the same period a year ago. Stripping out one-time items, adjusted earnings were 7 cents a share, under analyst expectations of 8 cents a share and in line with the company's guidance for between 4 cents and 11 cents a share, according to FactSet. Sales were $1.47 billion, down from $1.75 billion last year but in line with analyst expectations. The strong dollar dragged down revenue by about $55 million in the quarter. Hanesbrands expects sales between $6.05 billion and $6.2 billion this year, down from $6.23 billion in 2022. Earnings are expected between 14 cents and 25 cents a share, compared with a loss of 37 cents a share in 2022. Adjusted earnings per share are expected between 31 cents and 42 cents. Analysts polled by FactSet were expecting adjusted earnings of 93 cents. For the first quarter of 2023 , Hanesbrands expects sales of about $1.35 billion to $1.4 billion, marking an 11% decline at the midpoint compared with the year-earlier quarter, along with a per-share loss of between 9 cents and 14 cents. Dividends 1. What caused the steep drop in Hanesbrands, Inc. stock price in this article? 2. Discuss how both elements of the constant growth dividend model (dividend yield and capital gains yield) appear in the article. Hanesbrands Shares Plunge After Dividend Cut, Gloomy Earnings and Forecast Apparel maker to pay down debt after fourth-quarter sales fall 16% Hanesbrands Inc. HBI0.58% shares lost more than a quarter of their value after the apparel maker eliminated its dividend to shore up its balance sheet as sales continue to slump. The company, reporting earnings on Thursday, said it swung to a fourth-quarter loss on a 16% decline in sales during the period, as consumers pulled back in the U.S. and international markets, and retailers cut orders to reduce their inventory positions. Total sales were down 8% in 2022 and are expected to fall again this year, prompting Hanesbrands to push an $8 billion annual sales target back by two years to 2026. Shares of Hanesbrands closed Thursday down 27.9% at $6.28, logging the largest single-day percentage decline for the company on record. The Winston-Salem, N.C., company said the NEWSLETIER SIGN-UP dividend cut is part of a shift in its capitalWhat's News allocation strategy aimed at bolstering its Catchupontheheadines,understandthenewsandmakebetterdecisions,treeinyourbalancesheetandincreasingfinancialflexibility.Eliminatingthe60-centannual inbox every day. payout, which had been yielding 6.89% based on Wednesday's closing price of $8.71, will allow Hanesbrands to use all of its free cash flow to reduce its debt load faster. Home World U.S. Politics Economy Business Tech Markets Opinion Books \& Arts Real Esta The company, which paid nearly $157 million in dividends during the first nine months of 2022, said it expects about $500 million in cash flow from operations during fiscal 2023. It expects to refinance its 2024 debt maturities during the first quarter. The dividend cut comes as Hanesbrands posted a loss of $418.1 million, or $1.19 a share, compared with a profit of $60 million, or 17 cents a share, in the same period a year ago. Stripping out one-time items, adjusted earnings were 7 cents a share, under analyst expectations of 8 cents a share and in line with the company's guidance for between 4 cents and 11 cents a share, according to FactSet. Sales were $1.47 billion, down from $1.75 billion last year but in line with analyst expectations. The strong dollar dragged down revenue by about $55 million in the quarter. Hanesbrands expects sales between $6.05 billion and $6.2 billion this year, down from $6.23 billion in 2022. Earnings are expected between 14 cents and 25 cents a share, compared with a loss of 37 cents a share in 2022. Adjusted earnings per share are expected between 31 cents and 42 cents. Analysts polled by FactSet were expecting adjusted earnings of 93 cents. For the first quarter of 2023 , Hanesbrands expects sales of about $1.35 billion to $1.4 billion, marking an 11% decline at the midpoint compared with the year-earlier quarter, along with a per-share loss of between 9 cents and 14 cents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts