Question: please help me answer this homework Use the following information to post the adjusting entries to the spreadsheet only (no joumal entries) for the year

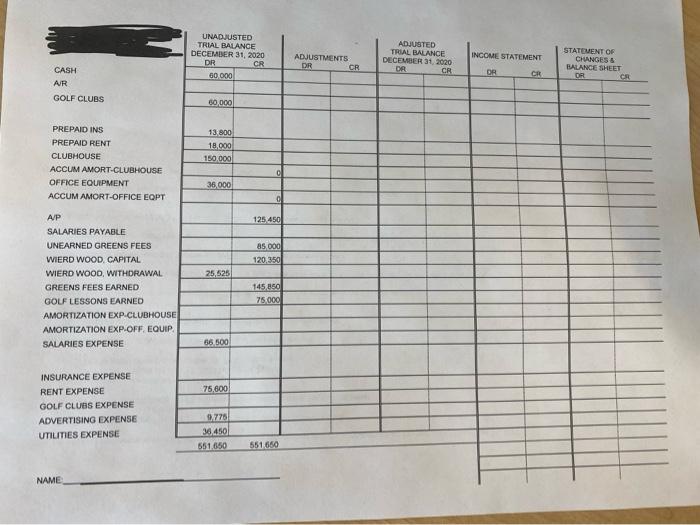

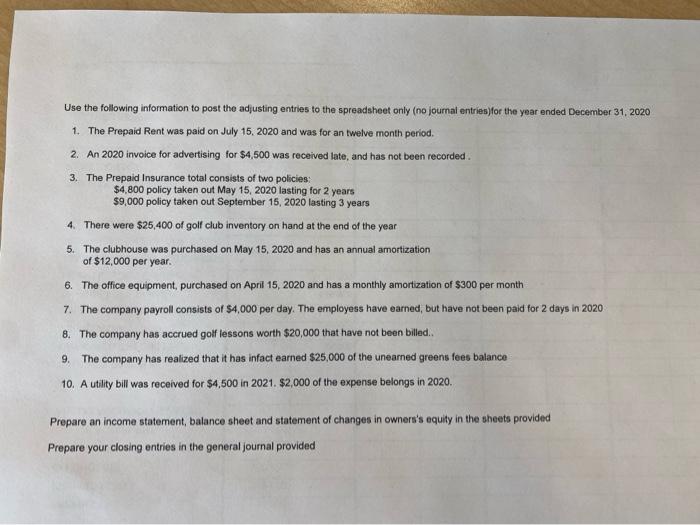

Use the following information to post the adjusting entries to the spreadsheet only (no joumal entries) for the year ended December 31,2020 1. The Prepaid Rent was paid on July 15,2020 and was for an twelve month period. 2. An 2020 invoice for advertising for $4,500 was received late, and has not been recorded. 3. The Prepaid Insurance total consists of two policies: $4,800 policy taken out May 15, 2020 lasting for 2 years $9,000 policy taken out September 15, 2020 lasting 3 years 4. There were $25,400 of golf club inventory on hand at the end of the year 5. The clubhouse was purchased on May 15, 2020 and has an annual amortization of $12,000 per year. 6. The office equipment, purchased on April 15, 2020 and has a monthly amortization of $300 per month 7. The company payroll consists of $4,000 per day. The employess have earned, but have not been paid for 2 days in 2020 8. The company has accrued goif lessons worth $20,000 that have not been billed.. 9. The company has realized that it has infact earned $25,000 of the unearned greens fees balance 10. A utility bill was received for $4,500 in 2021.$2,000 of the expense belongs in 2020 . Prepare an income statement, balance sheet and statement of changes in owners's equity in the sheets provided Prepare your closing entries in the general journal provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts