Question: please help me answer this multi step problem Required information Use the following information for the Exercises below. (Algo) [The following information applies to the

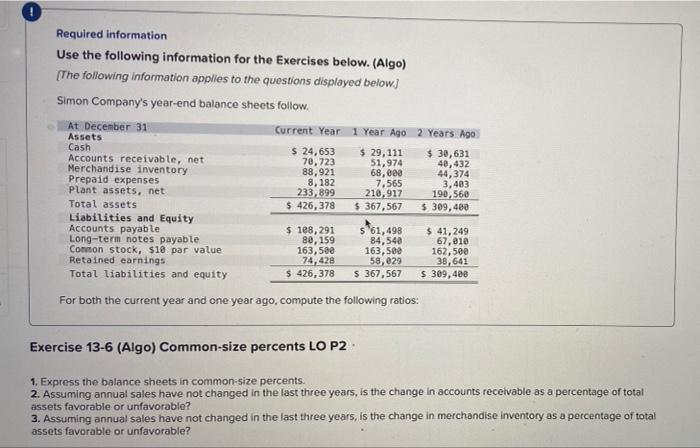

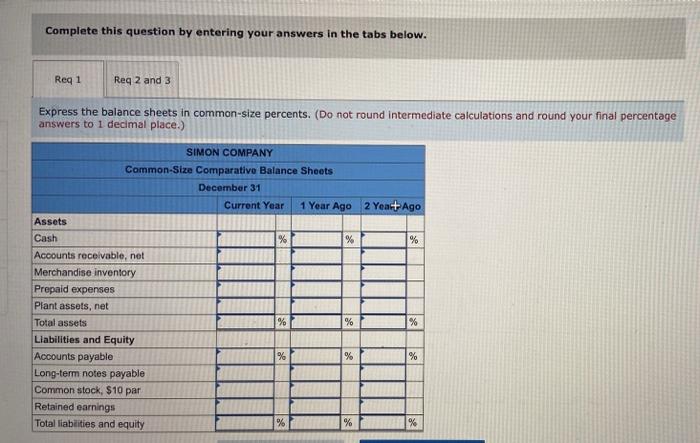

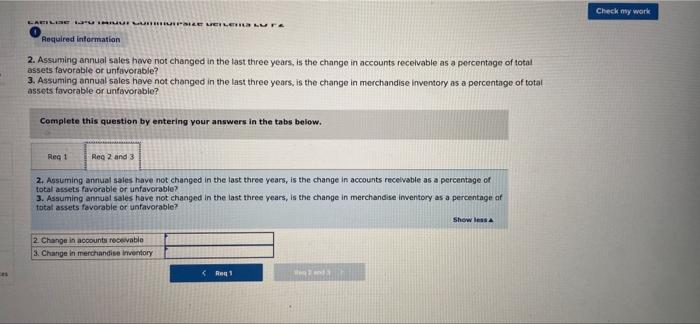

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below) Simon Company's year-end balance sheets follow, At December 31 Current Year 1 Year Ago 2 Years Ago Assets Cash $ 24,653 $ 29,111 $ 30,631 Accounts receivable, net 70, 723 51,974 Merchandise inventory 40,432 88,921 68,000 44,374 Prepaid expenses 8,182 7.565 3,403 Plant assets, net 233,899 210,917 190,560 Total assets $426,378 $367,567 $ 309,400 Liabilities and Equity Accounts payable $ 188,291 $ 61,498 $ 41,249 Long-term notes payable 88, 159 84,540 67,810 Common stock, $10 par value 163,500 163,500 162,500 Retained earnings 74,428 58, 029 38,641 Total liabilities and equity $426,378 5 367,567 $ 309, 488 For both the current year and one year ago, compute the following ratios: Exercise 13-6 (Algo) Common-size percents LO P2 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Yeart Ago Assets Cash % % % Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets % % Liabilities and Equity Accounts payable % % Long-term notes payable Common stock, $10 par Retained earnings Total liabilities and equity % % % % Check my work CARILE ULTIMELILLA Required information 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Show less 2. Change in accounts recevable 3. Change in merchandise inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts