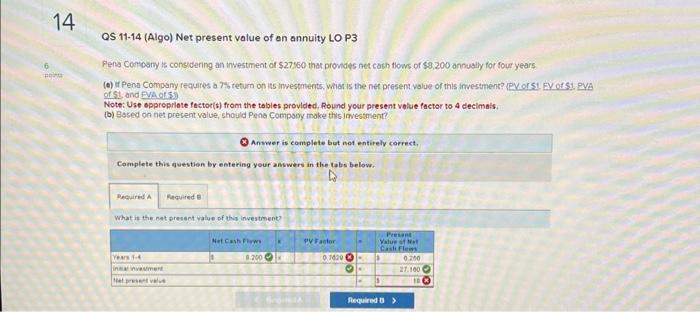

Question: please help me answer this practice problem. QS 11-14 (Algo) Net present value of on annuity LO P3 Pena compony is considering an investment of

QS 11-14 (Algo) Net present value of on annuity LO P3 Pena compony is considering an investment of $27,60 that provides net cash tlows of $9,200 annually for four years of St, and PVA otsis Note: Use opprepriate factor(s) from the tobies provided. Round your present value factor to 4 decimals. (b) Based on net present value, should Pena Compory make this investment? Anwer is complete but not entirely correct, Complete this question by entering your answers in the tabs below. What is the not presect value of this investment? QS 11-14 (Algo) Net present value of on annuity LO P3 Pena compony is considering an investment of $27,60 that provides net cash tlows of $9,200 annually for four years of St, and PVA otsis Note: Use opprepriate factor(s) from the tobies provided. Round your present value factor to 4 decimals. (b) Based on net present value, should Pena Compory make this investment? Anwer is complete but not entirely correct, Complete this question by entering your answers in the tabs below. What is the not presect value of this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts