Question: PLEASE HELP ME ANSWER THIS PRACTICE PROBLEM QUESTION 1 (15 MARKS) a) Nile Ink has 250,000 shares of common stock outstanding at a market price

PLEASE HELP ME ANSWER THIS PRACTICE PROBLEM

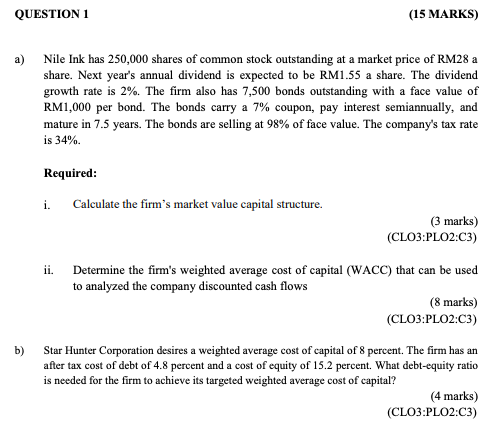

QUESTION 1 (15 MARKS) a) Nile Ink has 250,000 shares of common stock outstanding at a market price of RM28 a share. Next year's annual dividend is expected to be RM1.55 a share. The dividend growth rate is 2%. The firm also has 7,500 bonds outstanding with a face value of RM1,000 per bond. The bonds carry a 7% coupon, pay interest semiannually, and mature in 7.5 years. The bonds are selling at 98% of face value. The company's tax rate is 34%. Required: i. Calculate the firm's market value capital structure. (3 marks) (CLO3:PLO2C3) ii. Determine the firm's weighted average cost of capital (WACC) that can be used to analyzed the company discounted cash flows (8 marks) (CLO3:PLO2:C3) b) Star Hunter Corporation desires a weighted average cost of capital of 8 percent. The firm has an after tax cost of debt of 4.8 percent and a cost of equity of 15.2 percent. What debt-equity ratio is needed for the firm to achieve its targeted weighted average cost of capital? (4 marks) (CLO3:PLO2:C3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts