Question: please help me answer this question asap. also please make sure the answers is correct. thanks A bank in Calgary issued bonds for $750,000 that

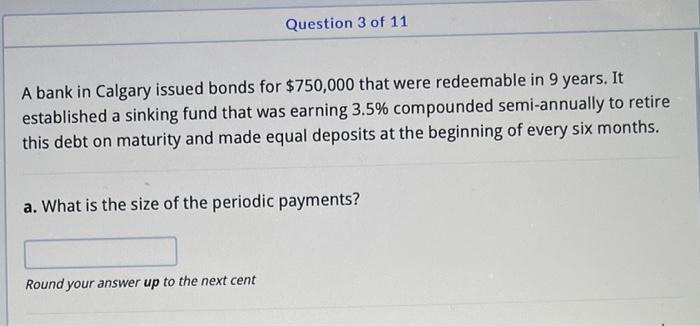

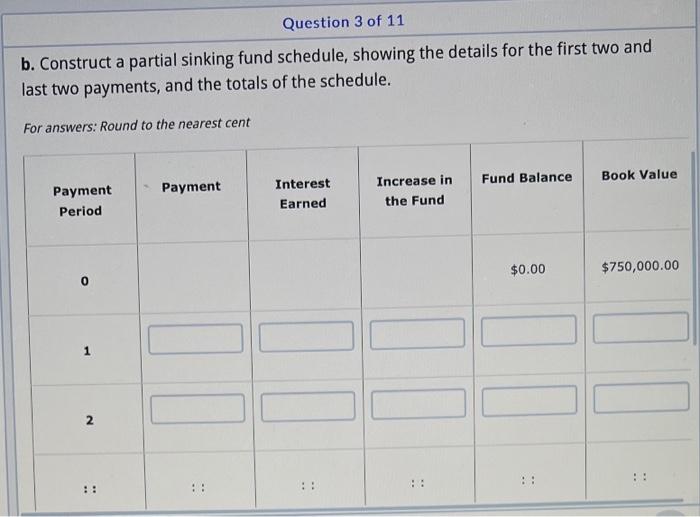

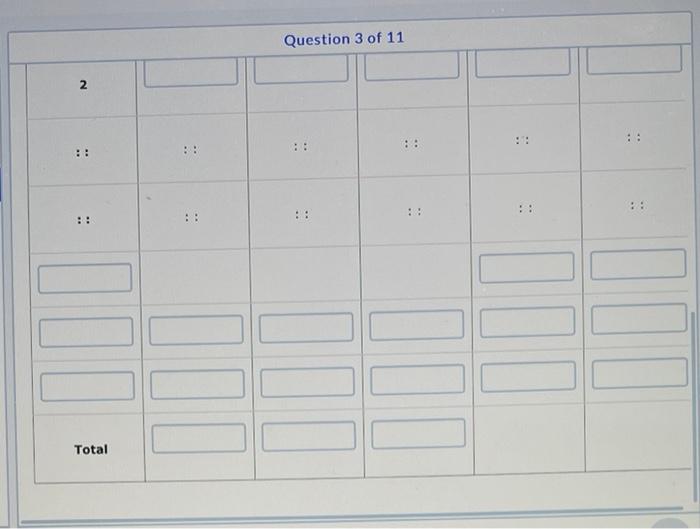

A bank in Calgary issued bonds for $750,000 that were redeemable in 9 years. It established a sinking fund that was earning 3.5% compounded semi-annually to retire this debt on maturity and made equal deposits at the beginning of every six months. a. What is the size of the periodic payments? Round your answer up to the next cent b. Construct a partial sinking fund schedule, showing the details for the first two and last two payments, and the totals of the schedule. For answers: Round to the nearest cent Question 3 of 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts