Question: please help me answer this question by 11:30pm today!! thank you so much. Sunland Company produces a molded briefcase that is distributed to luggage stores.

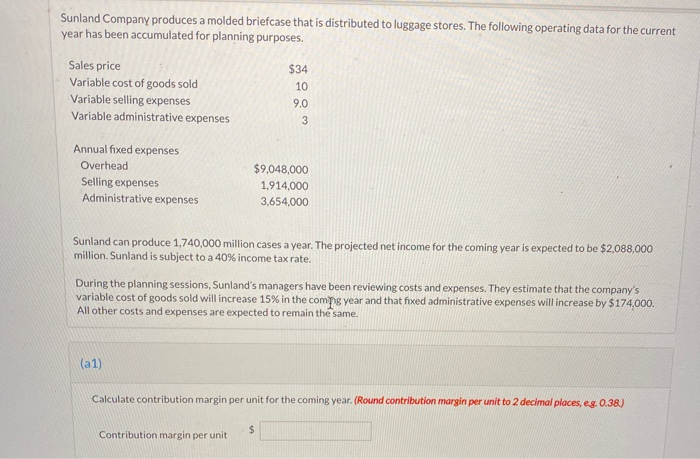

Sunland Company produces a molded briefcase that is distributed to luggage stores. The following operating data for the current year has been accumulated for planning purposes. Sales price $34 Variable cost of goods sold 10 Variable selling expenses 9.0 Variable administrative expenses 3 Annual fixed expenses Overhead Selling expenses Administrative expenses $9,048,000 1,914,000 3,654,000 Sunland can produce 1,740,000 million cases a year. The projected net income for the coming year is expected to be $2,088,000 million, Sunland is subject to a 40% income tax rate. During the planning sessions, Sunland's managers have been reviewing costs and expenses. They estimate that the company's variable cost of goods sold will increase 15% in the coming year and that fixed administrative expenses will increase by $174,000. All other costs and expenses are expected to remain the same. (a 1) Calculate contribution margin per unit for the coming year. (Round contribution margin per unit to 2 decimal places, eg. 0.38.) $ Contribution margin per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts