Question: Please help me answer this question by giving a full answer and calculation path. As a Finance Manager of MAHAR Berhad, you are required to

Please help me answer this question by giving a full answer and calculation path.

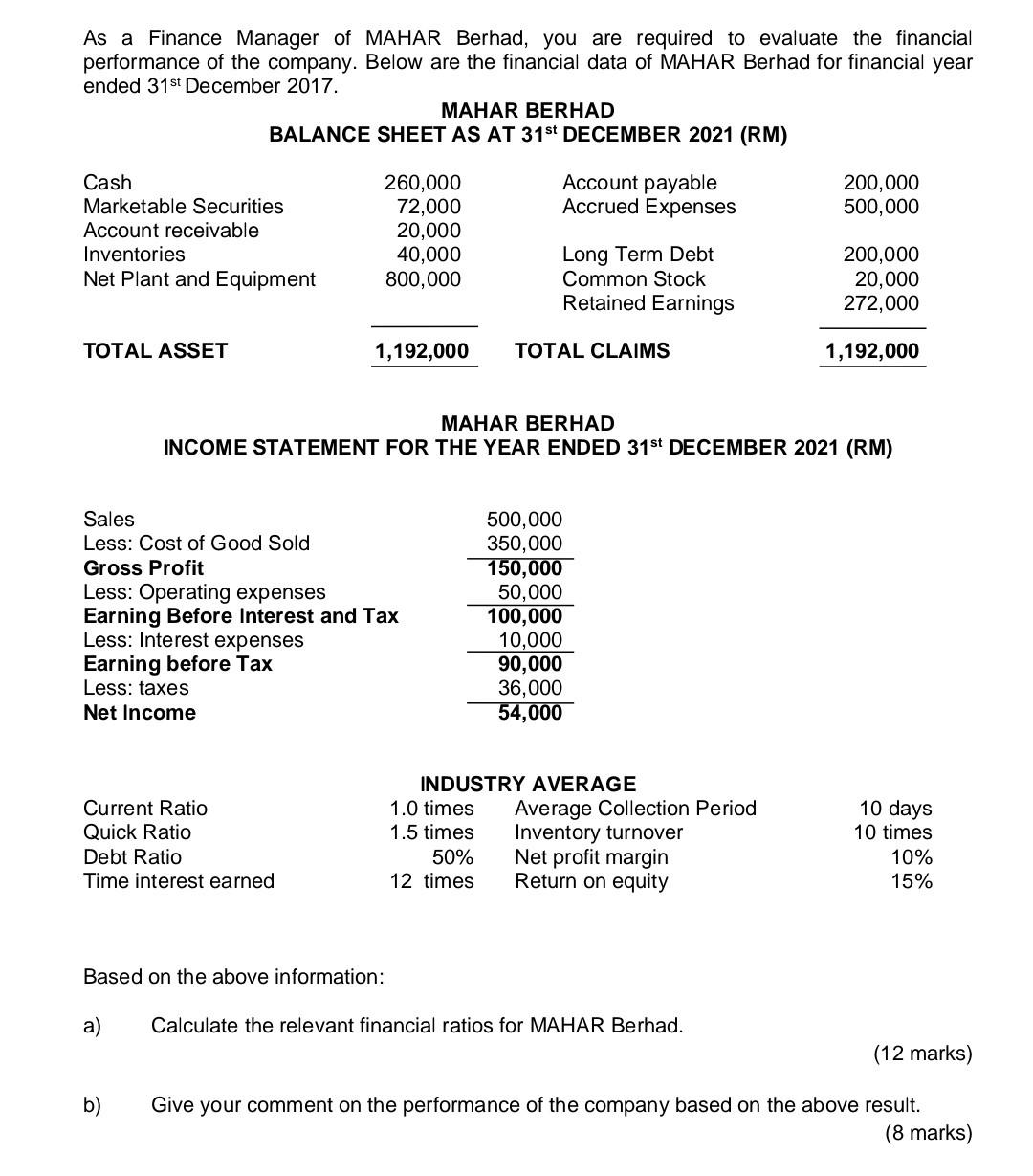

As a Finance Manager of MAHAR Berhad, you are required to evaluate the financial performance of the company. Below are the financial data of MAHAR Berhad for financial year ended 31st December 2017. MAHAR BERHAD BALANCE SHEET AS AT 31st DECEMBER 2021 (RM) Cash 260,000 Account payable 200,000 500,000 Marketable Securities 72,000 Accrued Expenses Account receivable 20,000 Inventories 40,000 Long Term Debt 200,000 Net Plant and Equipment 800,000 Common Stock 20,000 Retained Earnings 272,000 TOTAL ASSET 1,192,000 TOTAL CLAIMS 1,192,000 MAHAR BERHAD INCOME STATEMENT FOR THE YEAR ENDED 31st DECEMBER 2021 (RM) Sales 500,000 Less: Cost of Good Sold 350,000 Gross Profit 150,000 Less: Operating expenses 50,000 Earning Before Interest and Tax 100,000 10,000 Less: Interest expenses Earning before Tax 90,000 Less: taxes 36,000 Net Income 54,000 INDUSTRY AVERAGE Current Ratio 10 days 1.0 times 1.5 times Quick Ratio 10 times Average Collection Period Inventory turnover Net profit margin Return on equity Debt Ratio 50% 10% 15% Time interest earned 12 times Based on the above information: a) Calculate the relevant financial ratios for MAHAR Berhad. (12 marks) b) Give your comment on the performance of the company based on the above result. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts