Question: Please help me answer this question fast. Thank you very much Question 6 (16 marks) Terry Forest Corporation operates two divisions, the Timber Division and

Please help me answer this question fast. Thank you very much

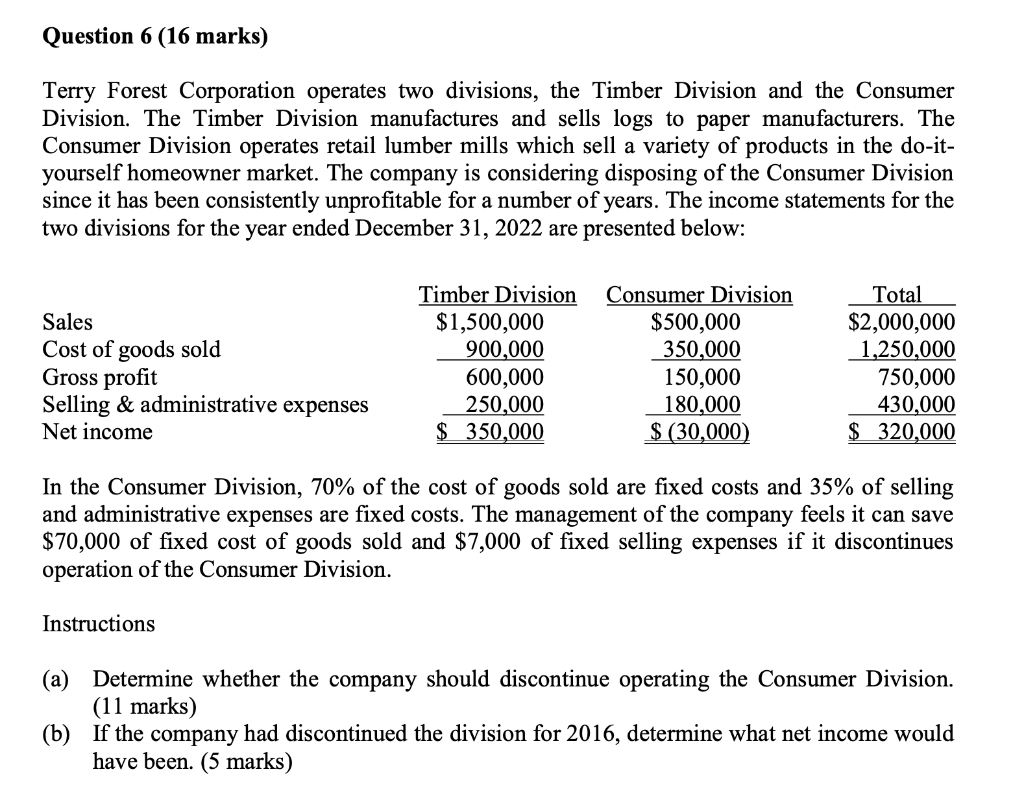

Question 6 (16 marks) Terry Forest Corporation operates two divisions, the Timber Division and the Consumer Division. The Timber Division manufactures and sells logs to paper manufacturers. The Consumer Division operates retail lumber mills which sell a variety of products in the do-it- yourself homeowner market. The company is considering disposing of the Consumer Division since it has been consistently unprofitable for a number of years. The income statements for the two divisions for the year ended December 31, 2022 are presented below: Timber Division Consumer Division Total $2,000,000 Sales $500,000 $1,500,000 900,000 Cost of goods sold 350,000 1,250,000 Gross profit 600,000 150,000 750,000 250,000 180,000 430,000 Selling & administrative expenses Net income $ 350,000 $ (30,000) $ 320,000 In the Consumer Division, 70% of the cost of goods sold are fixed costs and 35% of selling and administrative expenses are fixed costs. The management of the company feels it can save $70,000 of fixed cost of goods sold and $7,000 of fixed selling expenses if it discontinues operation of the Consumer Division. Instructions (a) Determine whether the company should discontinue operating the Consumer Division. (11 marks) (b) If the company had discontinued the division for 2016, determine what net income would have been

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts