Question: Please help me answer this question for FINANCE ASAP Please follow the following additional instructions when completing the assignment: Assume that cash flows arrive continuously

Please help me answer this question for FINANCE

Please help me answer this question for FINANCE

ASAP

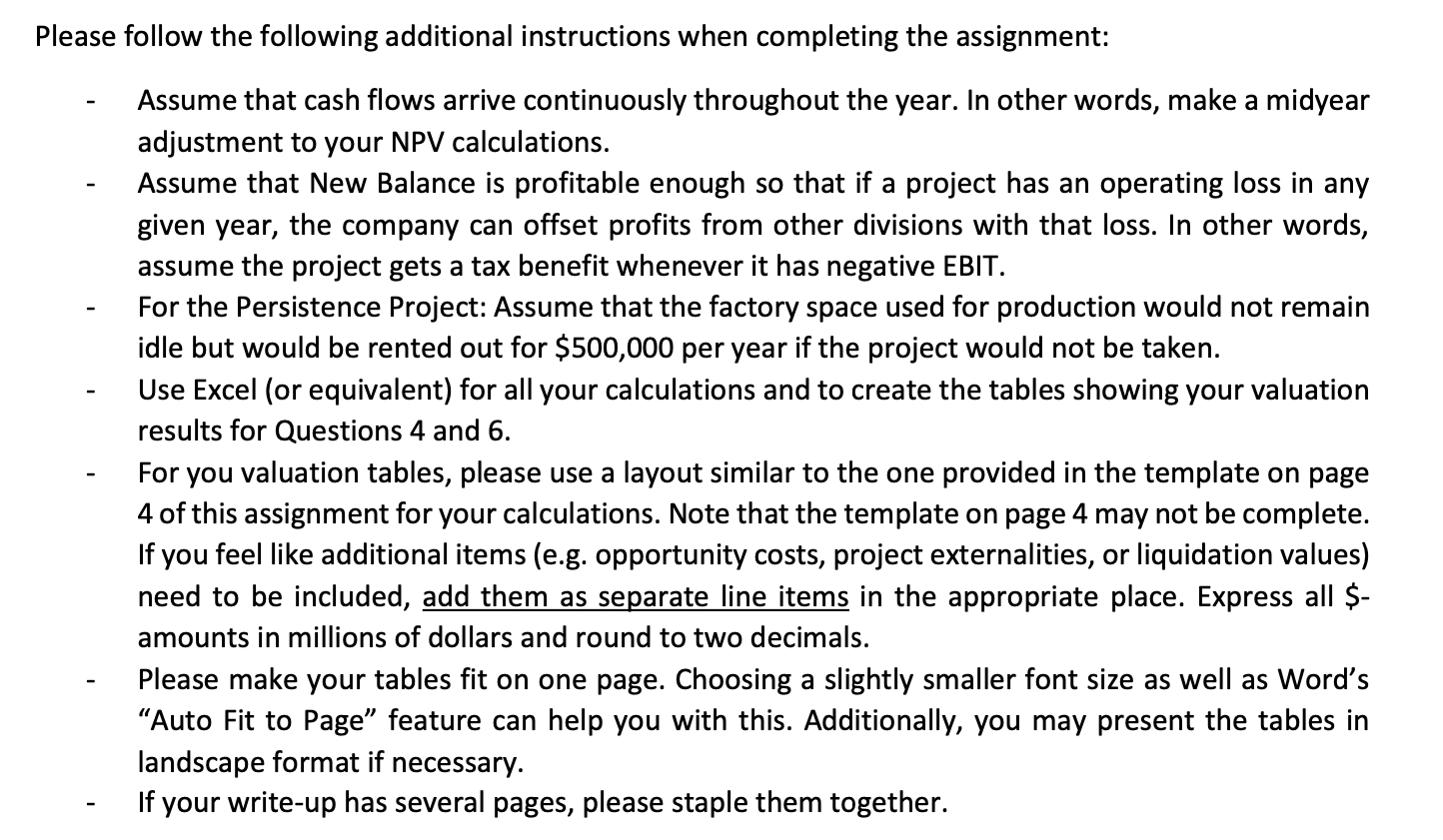

Please follow the following additional instructions when completing the assignment: Assume that cash flows arrive continuously throughout the year. In other words, make a midyear adjustment to your NPV calculations. Assume that New Balance is profitable enough so that if a project has an operating loss in any given year, the company can offset profits from other divisions with that loss. In other words, assume the project gets a tax benefit whenever it has negative EBIT. For the Persistence Project: Assume that the factory space used for production would not remain idle but would be rented out for $500,000 per year if the project would not be taken. Use Excel (or equivalent) for all your calculations and to create the tables showing your valuation results for Questions 4 and 6. For you valuation tables, please use a layout similar to the one provided in the template on page 4 of this assignment for your calculations. Note that the template on page 4 may not be complete. If you feel like additional items (e.g. opportunity costs, project externalities, or liquidation values) need to be included, add them as separate line items in the appropriate place. Express all $- amounts in millions of dollars and round to two decimals. Please make your tables fit on one page. Choosing a slightly smaller font size as well as Word's Auto Fit to Page feature can help you with this. Additionally, you may present the tables in landscape format if necessary. If your write-up has several pages, please staple them together. Question 7 (5 points) Assume that New Balance can only choose one of the two projects. Based on your calculations from Questions 4 and 6, which project should New Balance take? Briefly explain why. Please follow the following additional instructions when completing the assignment: Assume that cash flows arrive continuously throughout the year. In other words, make a midyear adjustment to your NPV calculations. Assume that New Balance is profitable enough so that if a project has an operating loss in any given year, the company can offset profits from other divisions with that loss. In other words, assume the project gets a tax benefit whenever it has negative EBIT. For the Persistence Project: Assume that the factory space used for production would not remain idle but would be rented out for $500,000 per year if the project would not be taken. Use Excel (or equivalent) for all your calculations and to create the tables showing your valuation results for Questions 4 and 6. For you valuation tables, please use a layout similar to the one provided in the template on page 4 of this assignment for your calculations. Note that the template on page 4 may not be complete. If you feel like additional items (e.g. opportunity costs, project externalities, or liquidation values) need to be included, add them as separate line items in the appropriate place. Express all $- amounts in millions of dollars and round to two decimals. Please make your tables fit on one page. Choosing a slightly smaller font size as well as Word's Auto Fit to Page feature can help you with this. Additionally, you may present the tables in landscape format if necessary. If your write-up has several pages, please staple them together. Question 7 (5 points) Assume that New Balance can only choose one of the two projects. Based on your calculations from Questions 4 and 6, which project should New Balance take? Briefly explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts