Question: Please help me answer this question Question 10 (23 marks) Refer to the below limit order book for the stock BBQ. BID ASK Price Time

Please help me answer this question

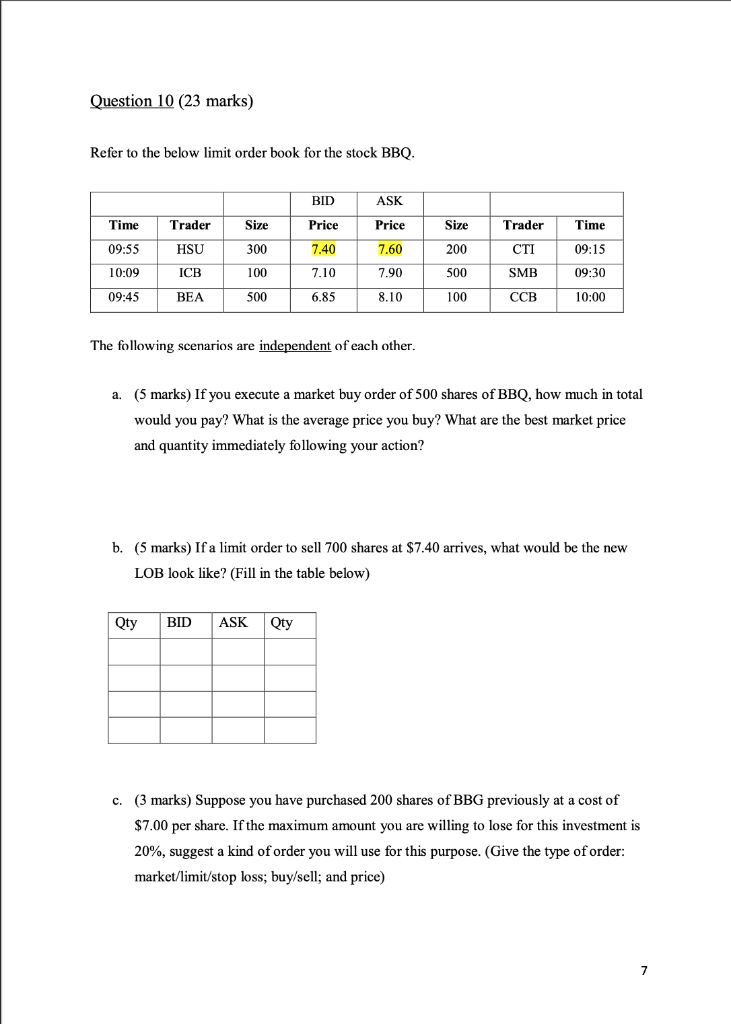

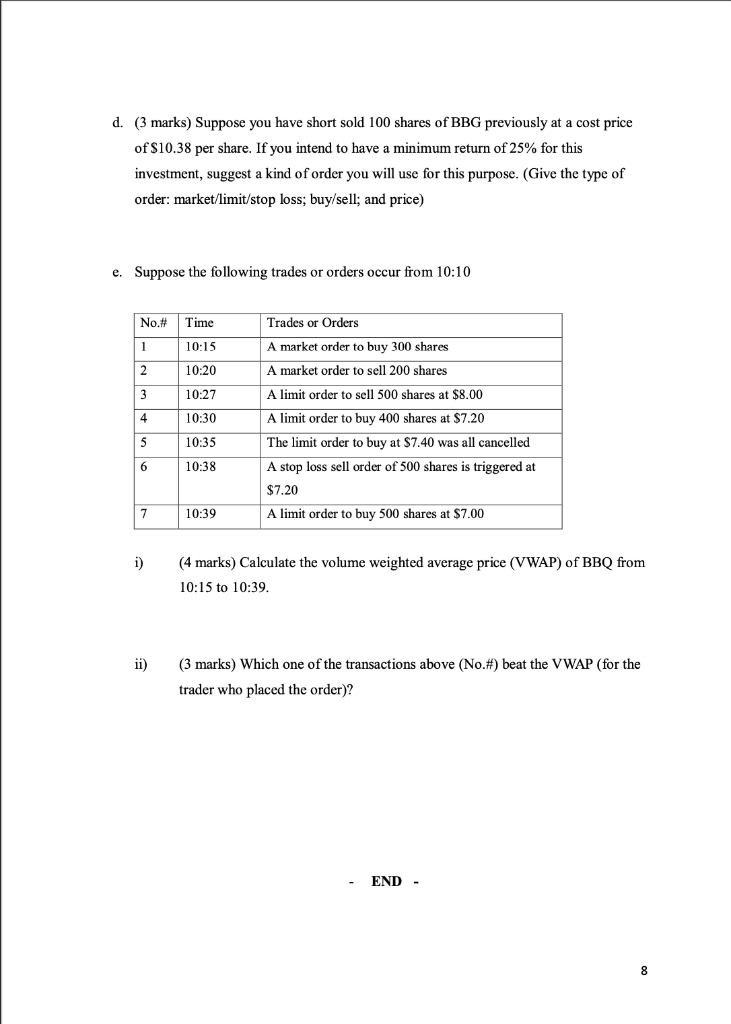

Question 10 (23 marks) Refer to the below limit order book for the stock BBQ. BID ASK Price Time Trader Size Price Size Trader Time 09:55 HSU 300 7.40 7.60 200 09:15 10:09 ICB 100 7.10 7.90 500 SMB 09:30 09:45 BEA 500 6.85 8.10 100 CCB 10:00 The following scenarios are independent of each other. a. (5 marks) If you execute a market buy order of 500 shares of BBQ, how much in total would you pay? What is the average price you buy? What are the best market price and quantity immediately following your action? b. (5 marks) If a limit order to sell 700 shares at $7.40 arrives, what would be the new LOB look like? (Fill in the table below) Qty BID ASK Qty c. (3 marks) Suppose you have purchased 200 shares of BBG previously at a cost of $7.00 per share. If the maximum amount you are willing to lose for this investment is 20%, suggest a kind of order you will use for this purpose. (Give the type of order: market/limit/stop loss; buy/sell; and price) 7 d. (3 marks) Suppose you have short sold 100 shares of BBG previously at a cost price of $10.38 per share. If you intend to have a minimum return of 25% for this investment, suggest a kind of order you will use for this purpose. (Give the type of order: market/limit/stop loss; buy/sell; and price) e. Suppose the following trades or orders occur from 10:10 No.# Time Trades or Orders 1 10:15 2 10:20 3 10:27 4 10:30 A market order to buy 300 shares A market order to sell 200 shares A limit order to sell 500 shares at $8.00 A limit order to buy 400 shares at $7.20 The limit order to buy at $7.40 was all cancelled A stop loss sell order of 500 shares is triggered at $7.20 A limit order to buy 500 shares at $7.00 S 10:35 10:38 6 7 10:39 i) (4 marks) Calculate the volume weighted average price (VWAP) of BBQ from 10:15 to 10:39. ii) (3 marks) Which one of the transactions above (No.#) beat the VWAP (for the trader who placed the order)? END 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts