Question: PLEASE HELP ME ANSWERING THIS, I REALLY HAVE A HIRD TIME DOING THIS. Use the following information for numbers 17 to 20: A domestic corporation

PLEASE HELP ME ANSWERING THIS, I REALLY HAVE A HIRD TIME DOING THIS.

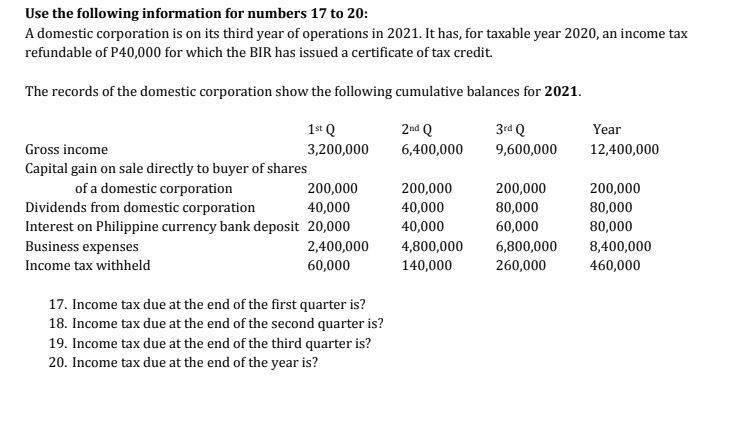

Use the following information for numbers 17 to 20: A domestic corporation is on its third year of operations in 2021. It has, for taxable year 2020, an income tax refundable of P40,000 for which the BIR has issued a certificate of tax credit. The records of the domestic corporation show the following cumulative balances for 2021. 1 st Q) 2nd Q 3rd Q) Year Gross income 3,200,000 6,400,000 9,600,000 12,400,000 Capital gain on sale directly to buyer of shares of a domestic corporation 200,000 200,000 200,000 200,000 Dividends from domestic corporation 40,000 40,000 80,000 80,000 Interest on Philippine currency bank deposit 20,000 40,000 60,000 80,000 Business expenses 2,400,000 4,800,000 6,800,000 8,400,000 Income tax withheld 60,000 140,000 260,000 460,000 17. Income tax due at the end of the first quarter is? 18. Income tax due at the end of the second quarter is? 19. Income tax due at the end of the third quarter is? 20. Income tax due at the end of the year is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts