Question: please help me answerr this before 10pm thank you Case Study 2 due June 1 Mesa Railroad (MRR) is a small railroad operating in rural

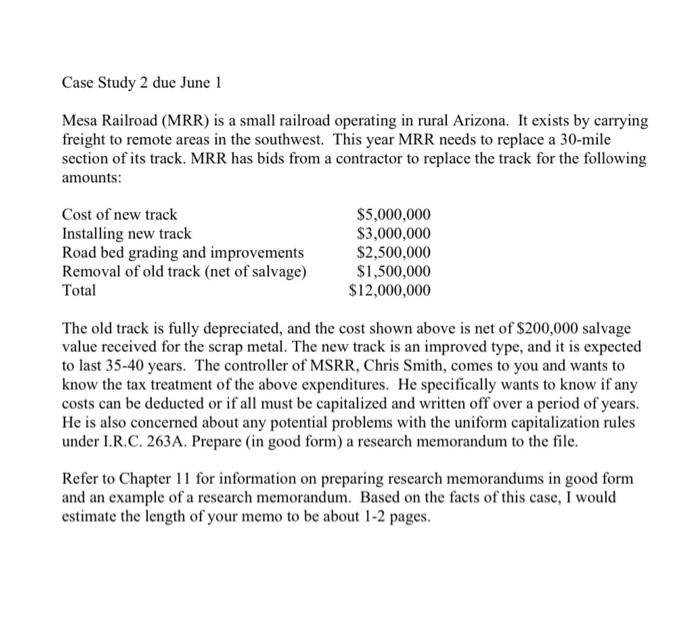

Case Study 2 due June 1 Mesa Railroad (MRR) is a small railroad operating in rural Arizona. It exists by carrying freight to remote areas in the southwest. This year MRR needs to replace a 30-mile section of its track. MRR has bids from a contractor to replace the track for the following amounts: Cost of new track Installing new track Road bed grading and improvements Removal of old track (net of salvage) Total $5,000,000 $3,000,000 $2,500,000 $1,500,000 $12,000,000 The old track is fully depreciated, and the cost shown above is net of $200,000 salvage value received for the scrap metal. The new track is an improved type, and it is expected to last 35-40 years. The controller of MSRR, Chris Smith, comes to you and wants to know the tax treatment of the above expenditures. He specifically wants to know if any costs can be deducted or if all must be capitalized and written off over a period of years. He is also concerned about any potential problems with the uniform capitalization rules under I.R.C. 263A. Prepare (in good form) a research memorandum to the file. Refer to Chapter 11 for information on preparing research memorandums in good form and an example of a research memorandum. Based on the facts of this case, I would estimate the length of your memo to be about 1-2 pages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts