Question: Please help me as fast as you can Mr. Cauzone decided to wind-up his Company on 12/31/22. After selling all assets and settling all liabilities,

Please help me as fast as you can

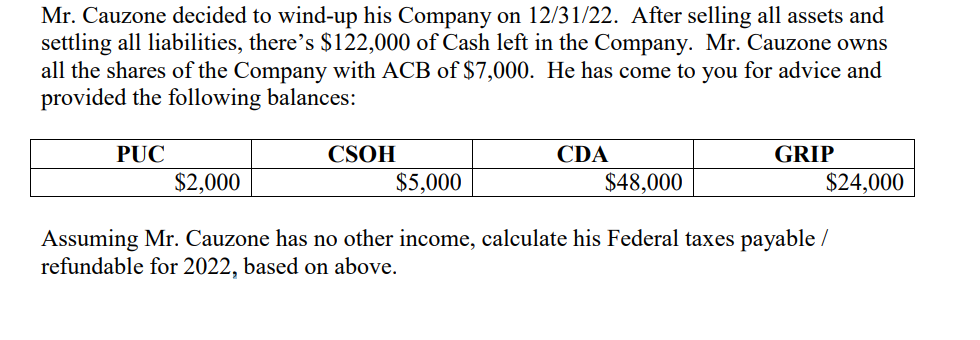

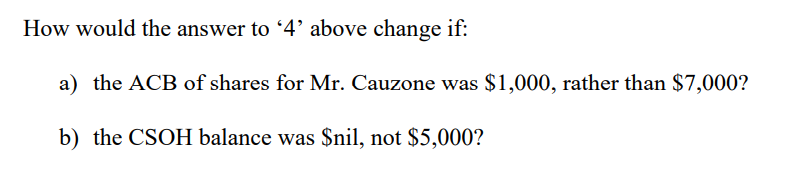

Mr. Cauzone decided to wind-up his Company on 12/31/22. After selling all assets and settling all liabilities, there's $122,000 of Cash left in the Company. Mr. Cauzone owns all the shares of the Company with ACB of $7,000. He has come to you for advice and provided the following balances: Assuming Mr. Cauzone has no other income, calculate his Federal taxes payable / refundable for 2022, based on above. How would the answer to ' 4 ' above change if: a) the ACB of shares for Mr. Cauzone was $1,000, rather than $7,000 ? b) the CSOH balance was $ nil, not $5,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock